Japan Markets ViewPremium Charge Rate Incurrence and Equity Investment

Apr 19, 2023

QUICK provides scores for the probability of incurring the Premium Charge Rates. F-index, a data analysis consulting service provider in Japan, has conducted a verification study on the Premium Charge Rates.

Introduction

This article discusses the development of equity investment strategies taking into account the incurrence of the Premium Charge Rate, which is a cost that cannot be assumed in advance and is borne by those selling stocks on margin. The verification period is one year, from January 4 to December 30, 2022.

Premium Charge Rate Incurrence and Equity Investment

The following are two well-known proverbs about the Premium Charge Rates in the Japanese stock market.

- “No selling when the Premium Charge Rate is incurred”:

When the shares of a specific stock are in short supply, the demand for the stock is high. Therefore, the stock price is expected to rise, and investors should buy the stock. - “No buying when the Premium Charge Rate is incurred”:

As the stock shortage is resolved, selling momentum is expected to increase and the stock price will fall. Therefore, it is advisable to refrain from buying the stock.

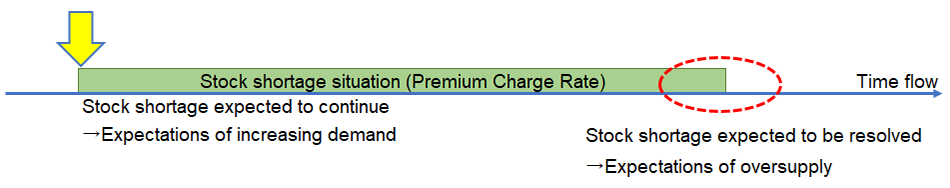

Which proverb should we follow? Before answering this question, let us look more closely at the conditions where shares are in short supply. Figure 1 illustrates an image of the Premium Charge Rate incurrence.

Figure 1: Image of Time Flow and the Premium Charge Rate Incurrence

As shown in Figure 1, rather than focusing on which proverb is more accurate, we consider that in the initial stage, when the Premium Charge Rate is incurred, the stock is “recommended to buy” as the proverb (1) says, while in the final stage, when the Premium Charge Rate is eliminated, the stock is “recommended to sell” following the proverb (2).

Then, does the situation as shown in Figure 1 actually take place? The following are examples of stocks for which the Premium Charge Rate incurrence has actually continued.

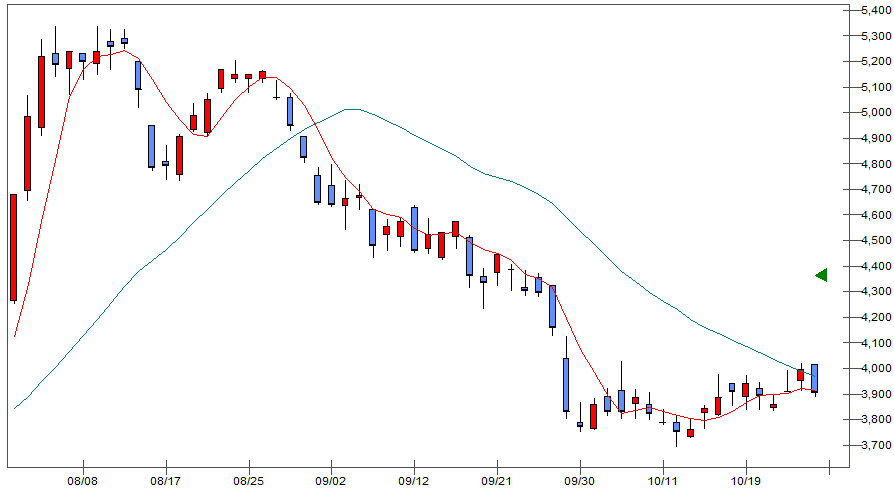

Figure 2: Candlestick Chart of NS United Kaiun Kaisha

(From August 1, 2022, through October 26, 2022)

First, the Premium Charge Rate for NS United Kaiun Kaisha (9110) was incurred on August 1, 2022 and had been observed for 58 consecutive business days until October 25, 2022. The daily candlestick chart in Figure 2 shows that the stock price was on the rise from August 1, when the Premium Charge Rate was incurred, to August 12. This is considered to be the initial stage in Figure 1. It then turned downward and bottomed out on September 30. The downward trend resumed on October 26, when the Premium Charge Rate was eliminated. With the information disclosed by the Japan Securities Finance (JSF), we can find out the timing of the Premium Charge Rate incurrence. While it is possible to recognize that “the stock has subsequently fallen into a shortage situation,” it is considered difficult to determine when the stock shortage will be resolved. Based on the information released by the JSF, it is possible to find out that the Premium Charge Rate has been eliminated. However, until the announcement is made, market participants are likely to begin selling the stock under the assumption that “the stock shortage will be resolved” resulting in a continuing downward trend in stock prices.

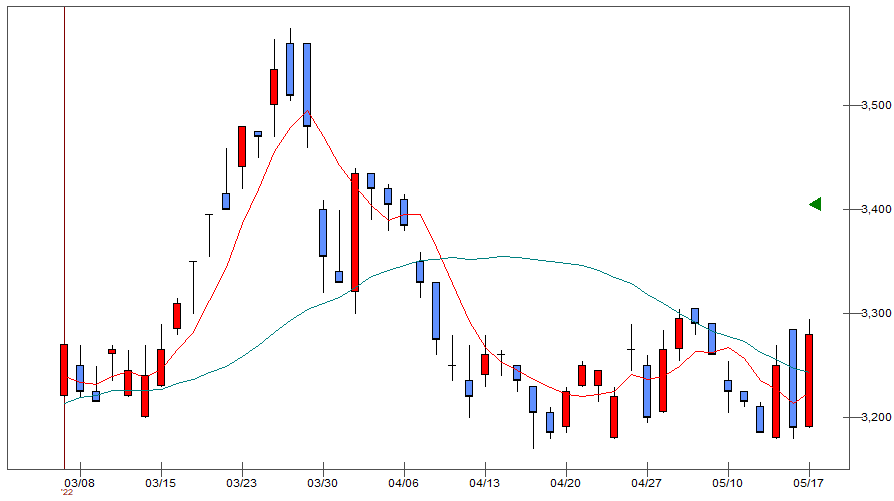

A similar phenomenon was observed in Kyokuyo (1301), where the Premium Charge Rate was incurred on March 7, 2022, and was eliminated on May 16, 2022.

Figure 3: Candlestick Chart of Kyokuyo

(From March 7, 2022, through May 17, 2022)

Following the Premium Charge Rate incurrence, the stock price showed an upward trend and peaked on March 25. After that, it was on a downward trend and hit the bottom on April 19. The stock price then temporarily picked up, but then began to decline before the Premium Charge Rate was eliminated on May 16. An upward trend was observed in the initial stage after the Premium Charge Rate was incurred. However, the stock price declines were seen without a clear prediction as to when the Premium Charge Rate would be eliminated.

Conclusion

This article discussed equity investment methods using the information on the Premium Charge Rates. There exist investment proverbs recommending buying/selling positions respectively, taking into account the Premium Charge Rates. The verification study revealed that these proverbs recommend buying in the initial stage when a stock shortage occurs or selling in the final stage when the stock shortage is resolved, taking into account the Premium Charge Rate incurrence process in accordance with each stage.

[Related Topic]

- Premium Charge Rate Incurrence in the Japanese Stock Market

https://corporate.quick.co.jp/en/japanmarketsview/equity/premium-charge-rate-incurrence-in-the-japanese-stock-market/ - Evaluation of Premium Charge Rate Score

https://corporate.quick.co.jp/en/japanmarketsview/equity/evaluation-of-premium-charge-rate-score/

Margin Trading Restriction on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data020/