Tokyo Term Risk Free RateTORF

Summary of Transition

from LIBOR

LIBOR is the abbreviation for the London Interbank Offered Rate and is widely used as the benchmark interest rate for loans and bonds. Major global banks calculate the interest rate to borrow funds in the London short-term financial market and report to an organization. The average interest rate is then calculated and published in five currencies including the U.S. dollar, the Euro, the British pound, the Japanese yen, and the Swiss franc.

In 2012, several banks were found manipulating the rate by fraudulently reporting the interest rate in their own bank’s favor, thereby causing its reliability to erode significantly. In July 2017, the British Financial Conduct Authority (FCA) announced that the publishing of LIBOR would not be guaranteed after the end of 2021.

In March 2021, FCA finally announced that it would cease publishing LIBOR based on the current methodology immediately after the end of 2021 except for some US dollar LIBOR settings.

If the publishing of LIBOR is suspended, calculations of payment amounts for loan interest and derivative transactions may not be able to take place and could cause confusion in the financial markets. Consequently, financial institutions and companies must halt all new transactions that refer to LIBOR while at the same time switching existing transactions to an alternative benchmark.

* The “panel bank” LIBOR publication ceased at the end of 2021, except for some US dollar settings.

What is TORF

Summary

In Japan, there are several candidates for alternative benchmarks to replace LIBOR but the benchmark that was most supported by public consultations conducted on November 2019 by the Cross-Industry Committee on Japanese Yen Interest Rate Benchmarks, for which the Bank of Japan serves as the Secretariat, was the Tokyo Term Risk Free Rate (TORF) calculated and published by QUICK. TORF is a benchmark based on the uncollateralized overnight call rate which involves almost no credit risk of financial institutions. It calculates the interest rate from derivative transaction data for a period of one month or three months. Similar to existing interest rate benchmarks such as LIBOR, the rate is fixed as of the start of the interest rate calculation period, making the system and administrative burden associated with the switch, relatively small.

In February 2020, QUICK was designated as a Calculating and Publishing Entity of prototype rates. Rate publication is divided into two phases: the publication of prototype rates used by market participants and interest rate benchmark users for developing their administrative frameworks etc. (Phase 1); and the publication of production rates that will be used in actual transactions (Phase 2). Prototype rates had been published on a weekly basis since May 2020 and daily basis since October.

In January 2021, TORF administration company “QUICK Benchmarks Inc.” (QBS) was established. QBS has been publishing TORF production rate since April 2021 and TORF was designated as “Specified Financial Benchmark”. In October 2021, under the Financial Instruments and Exchange Act, QBS received approval from the Prime Minister for its Operational Rules, as well as relevant rules such as the Code of Conduct and the Calculation Guidelines.

Features

- Term interest rate

based onrisk free rate

of Japanese yen - ”Fixing in advance”

method where applied

interest rate is fixed at

the beginning of the

period - Interest rate reference

period and calculation

period are the same

Burden of switching from

LIBOR is small

Name

| Official Name | Tokyo Term Risk Free Rate |

|---|---|

| Abbreviation | TORF |

Data

| Tenor | 1M, 3M, 6M |

|---|---|

| Calculation Time | 15:00 JST on a Tokyo business day |

| Publication Time | around 17:00 JST on the same day |

*For the publication date, please refer to the TORF calendar.

Calculation

methodology

Data Source

| Spot-starting outright OIS transaction in Japanese yen |

| Executed transactions on a Tokyo business day |

| Executed transactions :execution rates, notional amounts, execution date and time |

| Indicative Quote Data :best bids and offers and other data, date and time of submission |

Calculation Methodology

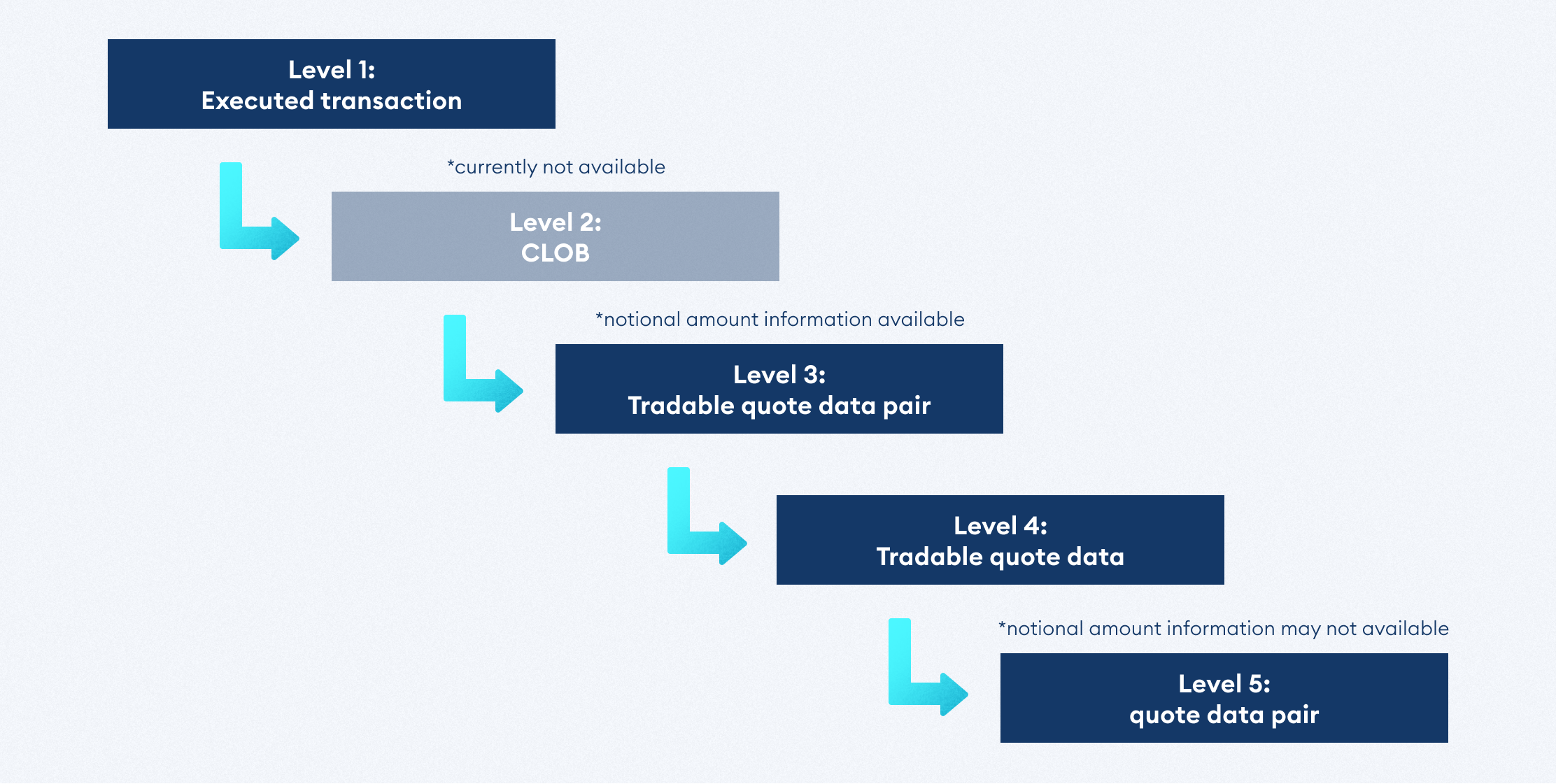

Waterfall methodology is adopted where executed transactions data is used first, but if there is no applicable data, the next level data is used. For details of each level of data, please refer the PDF document (downloadable from the button below).

Schedule

2020 |

February 26 | Selected as Calculating and Publishing Entity for Term Risk Free Rates (prototype rates) |

PHASE |

||

| May 26 | Begin weekly publication of prototype rates | ||||

| July 28 | Finalized name to Tokyo Term Risk Free Rate | ||||

| October 9 | Begin daily publication of prototype rates | ||||

2021 |

January 18 | Establish TORF administration company “QUICK Benchmarks” | |||

| April 26 | Begin the publication of production rates |

PHASE |

|||

| April 27 | Designated as “Specified Financial Benchmark” | ||||

| October 26 | Receive approval for relevant rules under the Financial Instruments and Exchange Act | ||||

| December 31 | Cease the publication of Japanese yen LIBOR |

2020 |

PHASE |

||

| February 26 | Selected as Calculating and Publishing Entity for Term Risk Free Rates (prototype rates) | ||

| May 26 | Begin weekly publication of prototype rates | ||

| July 28 | Finalized name to Tokyo Term Risk Free Rate | ||

| October 9 | Begin daily publication of prototype rates | ||

2021 |

|||

| January 18 | Establish TORF administration company “QUICK Benchmarks” | ||

| April 26 | Begin the publication of production rates |

PHASE |

|

| April 27 | Designated as “Specified Financial Benchmark” | ||

| October 26 | Receive approval for relevant rules under the Financial Instruments and Exchange Act | ||

| December 31 | Cease the publication of Japanese yen LIBOR |

How to access TORF

Access via QUICK Services

| Applicable products |

QUICK Workstation, Qr1, QUICK Asset Design PRO, QUICK APIs, QUICK Feed, etc. |

|---|---|

| For Inquiries | <Real Time> Quote Code: MJPY#TORF.n/QBS *n=1,3,6 Screen Code: TORF@ <24H Delayed> Quote Code: MJPY#TORF.n/QBSD *n=1,3,6 Screen Code: TORF@D |

| QUICK Money World (24H Delayed) |

https://moneyworld.jp/page/torf.html |

Other Publication Sources

| Morning edition of the Nikkei Newspaper, Nikkei NEEDS service Refinitiv (Tile: <JPYTRR=QCKJ>, RIC Code: <JPYTRR1M=QCKJ>, <JPYTRR3M=QCKJ>, <JPYTRR6M=QCKJ>) Bloomberg (TORF<Go>) |

Information regarding use of TORF

License Agreement

To using TORF, a license agreement with QUICK is required.

Please refer to the agreement sample and the price list, then click the button below to contact us for your application or inquiries.

You can also refer to the application form sample.

For the details of TORF license, please see the “TORF License Guide”.

Contact

In addition, please confirm the content of the document on the following QBS website.

https://www.torf.co.jp/en/document/

redistribution license

To redistribute TORF, a license agreement with QUICK is also required.

Please refer to the price list, then click the button below to contact us for your application or inquiries.

Contact

In addition, please confirm the content of the document on the following QBS website.