Japan Markets ViewExploring Candidate Stocks for Buffett’s Additional Investments – Keywords Are “I” and “F”

Apr 14, 2023

[Nikkei QUICK News] Prominent U.S. investor Warren Buffett has announced he is considering additional investments in Japan. Which stocks will meet the eye of the “Omaha’s Wise Man?” Using as a clue the “Letter to Shareholders,” the annual report of Berkshire Hathaway, the investment company led by Mr. Buffett, we explore the stocks that might be candidates for his additional investments. The keywords are two “I”s and an “F.”

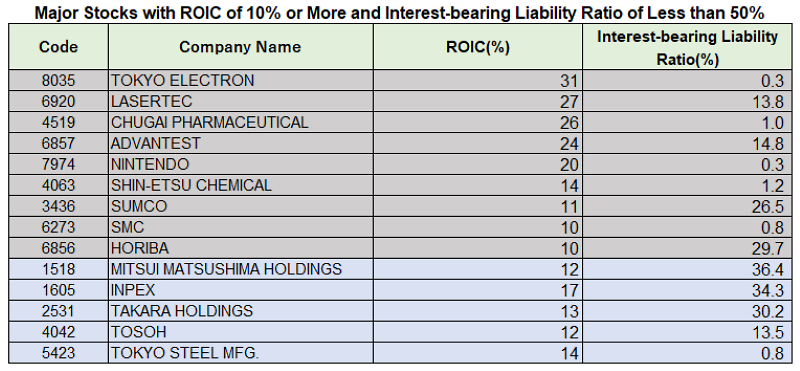

*Companies with blue background are those with P/B ratio below 1x.

(Source) QUICK Corp.

The first “I” stands for “inflation.” In Japan, the recent labor shortage and other factors have triggered widespread moves to raise wages, increasing the price inflation rate. Corporate earnings and stock prices are, needless to say, nominal values. It is not profitable for someone like Mr. Buffett, who lives in a country with rising prices (the U.S.), to invest in Japan, where prices are not rising. However, once prices rise, investing in Japanese stocks would become more attractive. Particularly, investments in companies with small interest-bearing liability would be desirable because interest rates are expected to rise.

The second “I” represents “invested capital.” In 1980, when inflation was as high as it is today, Berkshire’s portfolio included the auto insurer GEICO, which later became the core of its business, as well as companies in a wide range of other industries, such as steel, security, power tools, and tobacco.

Berkshire has more than doubled its holdings since two years ago to diversify its investments. The company diversified into companies with a high return on invested capital (ROIC) based on its judgment that promising companies are those with high market shares, easy price pass-through, and the ability to increase profits with little additional investment.

The “F” refers to “fiscal deficit.” In his letter to shareholders published in February 2023, Buffett wrote, “Huge and entrenched budget deficits would have consequences,” and sounded alarm bells about government debt. In March, when a U.S. regional bank failed and Swiss financial giant Credit Suisse Group suffered a series of financial crises, he invested additionally in shale oil-related Occidental Petroleum (Oxy) but not in banks. This is probably because he views financial and fiscal crises as two sides of the same coin. Companies with strong financial fundamentals are preferable for investments.

Given this context, 82 stocks, including Shin-Etsu Chemical (4063), SUMCO (3436), and Nintendo (7974), were extracted from the Nikkei 500 Index based on the assumption that Buffett would make new investments in Japanese companies with (1) ROIC of 10% or more and (2) interest-bearing liability ratio of less than 50%.

Adding a P/B ratio of less than 1x to the criteria further narrows the list down to six stocks, including INPEX (1605), Tosoh (4042), and Tokyo Steel (5423).

The five major trading company stocks, including Itochu Corporation (8001), in which Buffett began investing in 2020 and has recently increased his stake, have resource-related interests and a broad business portfolio. This makes them function as a good “antenna (to look for trends)” for investing in Japanese stocks based on an inflation scenario. It would not be surprising to see a foreign investor following in Mr. Buffett’s footsteps.

(Reported on April 11)

NQN News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data017/