Japan Markets ViewA Series of IPOs Taking Place in Japan – Fund Turnover to Spur Rally in Japanese Stock Market?

Apr 06, 2023

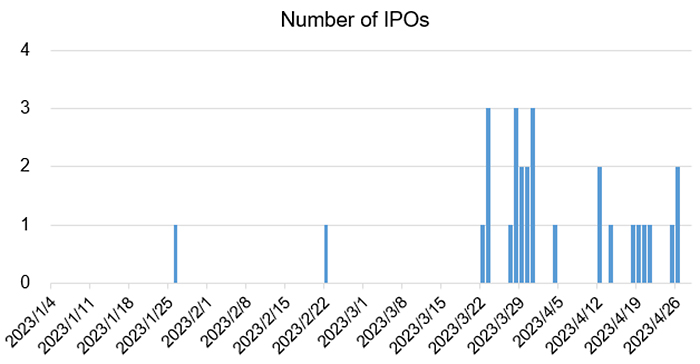

[QUICK Market Eyes] Toward the end of April, a series of initial public offerings (IPOs) are taking place in Japan. Despite concerns about the U.S. financial system instability, IPO market sentiment is not dampening. A brisk turnover of funds is likely to spur a rally in the Japanese stock market. The IPO market, which mirrors individual investors’ appetite for investment, should also be closely watched to read the outlook for the Japanese stock market.

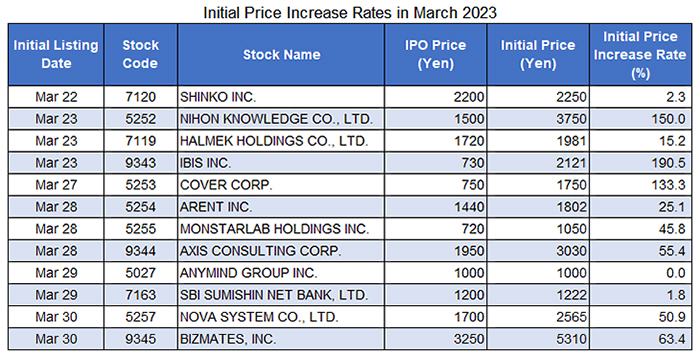

Ten companies completed initial listing in March (as of March 30), and none of the initial stock prices fell below their IPO prices. Stocks of companies operating in the hot topic areas attracted investors anticipating the future potential. In addition, stocks with small fund absorption facilitated selective buying due to the supply-demand balance.

ibis (9343) enjoyed popularity, nearly tripling its IPO price of 730 yen. The company offers ibisPaint, a painting app that allows users to easily draw pictures on their smartphones. The number of monthly active users in December 2022 totaled 40 million. The app supports 19 major languages, and thus, overseas users accounted for more than 90% of downloads. The company has a proven track record overseas, and is expected to capture global demand.

ibis projects non-consolidated sales of JPY3.5 bn, up 6% YoY, and after-tax profit of JPY202 mn, up 20% YoY for the fiscal year ending December 31, 2023. The app’s functions are available mostly free of charge, and its revenue source is advertising revenue. However, the company also plans to expand its business performance by focusing on subscription-based services.

COVER (5253), which was newly listed on the Growth Market on March 27, also attracted many investors, with the initial price more than double the IPO price. The company operates “hololive production,” which manages VTubers (virtual YouTubers). COVER expects non-consolidated sales to increase 32% YoY to JPY18 bn and after-tax profit to grow 15% YoY to JPY1.4 bn for the fiscal year ending March 31, 2023.

The company’s large number of shares offered for sale had raised concerns that the stock price would lack buoyancy. Despite such circumstances, the initial price jumped up. However, the company’s shares are currently being sold for profit-taking. The stock price rose to more than 1.5 times its IPO price. This may have had some impact on the lifting of the selling restriction (lock-up) by the venture capital (VC) shareholders. Still, the stock is holding up without falling below its IPO price.

Investors’ sentiment toward IPOs does not seem to have been dampened. It is represented by the initial listing on March 29 of an Internet bank, SBI Sumishin Net Bank (7163). Although the company’s listing took place amid the uncertainty surrounding the U.S. financial system, the initial price exceeded its IPO price. The listing was accompanied by many uncertainties, including the fact that it was only a secondary offering by existing shareholders, which is not always popular in the stock market, and the relatively large number of shares offered (41.46 million shares). However, two major shareholders, Sumitomo Mitsui Trust Bank and SBI Holdings, each holding a 50% stake in the company, will continue to hold a substantial percentage of the company’s shares after the listing, which appears to have contributed to a sense of assurance among investors.

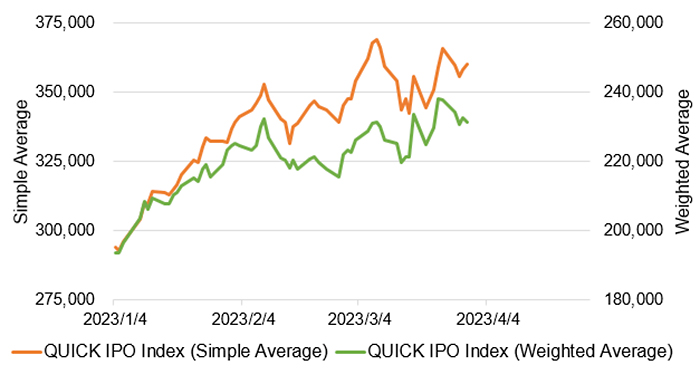

The QUICK IPO Index (weighted average), which shows the price movements of stocks completed IPO over the past year, rose by 4% during March (as of March 30), outperforming the Tokyo Stock Price Index (TOPIX, -0.5%). The Japanese stock market as a whole is likely to stay steady as concerns over the U.S. financial system ease and the turnover of funds from retail investors involved in IPOs becomes more active toward the end of April.

(Reported on March 31)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/