Japan Markets ViewContinued Strengthening of Shareholder Returns – What about Trend of Dividend Increase Forecasts?

Apr 24, 2024

[QUICK Market Eyes] Amid the ongoing correction phase in Japanese equities, expectations for enhanced shareholder returns continue to underpin the supply-demand balance. According to Nikkei Online Edition, dated March 25, the total of shareholder returns of listed companies, including dividends and share buybacks, for the fiscal year ending March 2024 is expected to reach about JPY25 tn, a record high for the second consecutive year.

Share buybacks are projected to be up 9% to JPY9.3 tn. According to Share Buybacks Data provided by QUICK, 508 listed companies have announced share buybacks since the beginning of 2024. This is about 60% of the 885 announcements made in 2023, indicating that companies are announcing share buybacks earlier than last year.

Looking at the average over the past five years, May usually has the second largest number of companies announcing share buybacks after February. In May 2023, 218 companies announced share buybacks.

With Japanese stock prices rising, the expected dividend yield on the weighted average of the Tokyo Stock Exchange (TSE) Prime Market has been on a downtrend to 1.95%, from 2.5% in June 2022.

The dividend payout ratio, calculated based on Nikkei’s forecasted price-to-earnings ratio (“P/E ratio”) and expected dividend yield, is still below 30% at 28%, indicating continued expectations for dividend increases.

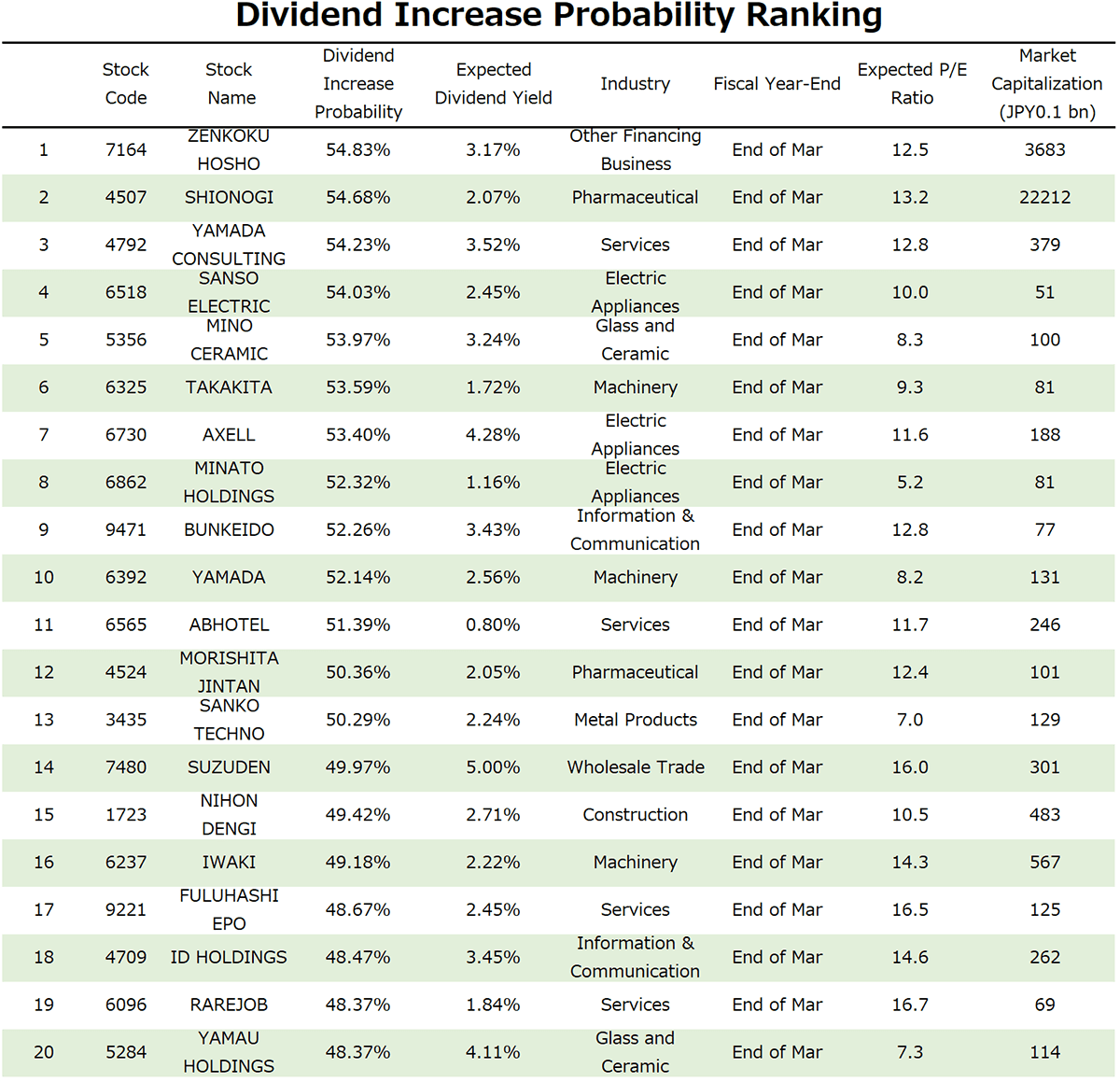

To examine the trend of stocks with high expectations for dividend increases, we ranked the top 20 stocks* in terms of the probability of dividend increase. QUICK’s “Prediction of Dividend Forecast Revision,” an analytical tool, was used to compile this ranking for the stocks that updated their forecast data in the past three months.

* Companies that have already announced dividend increases are excluded.

“Prediction of Dividend Forecast Revision” is an ML-based analytical tool to predict the probability of a year-end dividend revision based on quarterly financial results and dividend revisions over the past ten years or so. It models and calculates how various variables, such as actual financial results, cash flow, quarterly progress rate, and other financial results of individual stocks, tend to be before dividend increases (or decreases) are actually made. It predicts the probability of a dividend forecast revision up to the next quarterly financial results announcement date.

Looking at the ranking of projected dividend increase probabilities, most of them are small- and mid-cap stocks with a market capitalization of less than JPY100 bn, except for Zenkoku Hosho (7164), which ranked first, and Shionogi (4507), which ranked second. In addition, all of these stocks have an expected P/E ratio less than 20.

With pressure from the TSE’s request for listed companies to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price,” expectations for shareholder returns and improved capital costs, including dividend increases, are likely to continue, especially for undervalued small- and mid-cap stocks.

In a report dated April 1, titled “Shareholder Returns of Japanese Companies in FY2023,” Naoya Fuji, a strategist at Nomura Securities, noted that share buybacks conducted by all listed companies in 2023 totaled JPY9.4 tn, down 3% from the previous year. He cited the declining undervaluation of stock prices due to rising stock prices as the reason for this. For 2024, he projects an 18% increase in share buybacks to JPY11.1 tn. Mr. Fuji pointed out that share buybacks would increase due to higher profits and abundant cash reserves as a source of returns.

He also indicated that total dividends would increase 13% YoY to JPY33.1 tn in FY2024 due to the continued increase in the total payout ratio and higher earnings.

(Reported on April 19)

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/