Japan Markets ViewKey Words Heading into the Shareholders’ Meeting – “Governance” and “Dialogue”

Apr 19, 2024

[QUICK Market Eyes] Despite the somewhat unstable performance of the Nikkei 225 since hitting its record high, some view that Japanese stocks still have room to improve their valuation in the medium to long term. The keywords are “governance” and “dialogue between companies and shareholders.” The importance of these two themes is expected to increase toward the announcement of corporate earnings results beginning in the second half of April for the fiscal year ending March 31, 2024 and the general shareholders’ meetings to be held intensively in June.

■ Governance in the Developing Phase

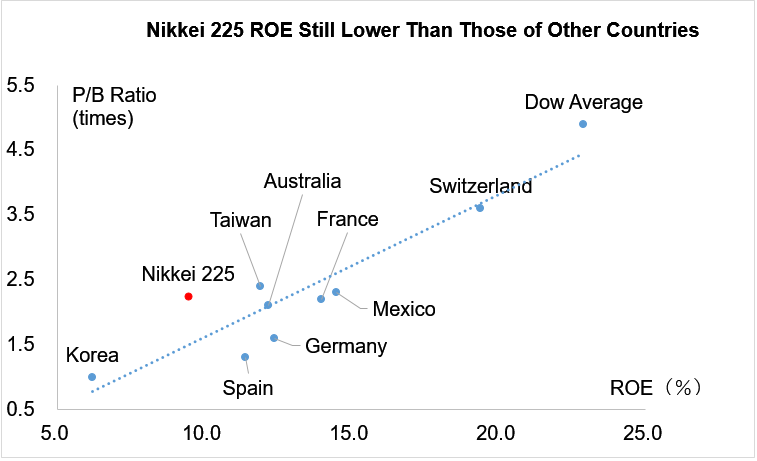

Japanese corporate governance has been slowly improving. Chisa Kobayashi, a strategist at UBS SuMi TRUST Wealth Management, points out, “Corporate governance improvements could accelerate on both the macro and micro levels.” She suggests that, over the long term, return on equity (ROE), an indicator of efficient earning, may improve, increasing the attractiveness of the Japanese market as a whole, which has been relatively low compared to overseas markets. Thus, there is room for many investors to evaluate Japanese companies more favorably.

On the macro level, Japan has overcome years of deflation and stands on the threshold of inflation accompanied by rising wages. In addition, the U.S. economy remains strong, and corporate earnings in Japan are growing due to the weaker yen. On the micro level, on the other hand, the Tokyo Stock Exchange (TSE) has been calling for companies to take “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” Pressure from institutional investors is also intensifying.

Until now, share buybacks have been the focus of attention as a measure to improve low P/B ratios in response to the TSE’s request. The next focus will be on structural reforms, including optimization of the companies’ business portfolios. Ms. Kobayashi notes, “Low ROE has clearly reduced the overall attractiveness of the Japanese market.” She expects that corporate efforts to reform itself will improve its ROE and naturally increase its reputation among investors.

*Compiled based on QUICK-FactSet data.

■ Over 100 Shareholder Proposals in 2023, with More Expected Going Forward

The other keyword, “dialogue between investors and companies,” is a theme for shareholders’ meetings of companies with fiscal year ending March 31. According to Daiwa Institute of Research (DIR), the number of companies receiving shareholder proposals had been only about 30 to 40 before 2014, but exceeded 100 in 2023.

Source: DIR

The Japanese Stewardship Code (Code of Conduct for Investors), formulated in 2014, has clarified that Japanese institutional investors emphasize corporate value. Hidenori Yoshikawa, a chief consultant at DIR, expects “the number of shareholder proposals to increase further going forward.”

On April 4, Oasis Management, a Hong Kong-based investment fund known as an activist, launched a campaign against Kao (4452). At a press conference on April 8, Oasis’ Chief Investment Officer (CIO) Seth Fischer explained the campaign in detail for 45 minutes, holding Kao products in his hands.

Mr. Fischer highly appreciated Kao’s skincare brands. At the same time, he passionately stated that Kao’s marketing capabilities were weak compared to those of its competitors and that strengthening these capabilities would improve Kao’s profitability. After his presentation, he politely answered questions from reporters. Kao’s general shareholders’ meeting for 2023 already ended in March. However, Oasis’ Fischer said, “We can make a proposal at next year’s or extraordinary shareholders’ meetings.”

Since the meeting with Kao’s management team has not yet taken place, Mr. Fischer of Oasis is upset that he has not yet been welcomed to the company. Still, he also said, “Japanese companies are changing, and we are increasing our investment in Japanese stocks.”

There are some indications in the market that “companies are gradually beginning to take a more positive attitude toward dialogue with investors,” according to a Japanese securities company. Many foreign investors, like Oasis, have high expectations for changes in Japanese companies. As expectations for corporate governance improvement and dialogue are fostered, the ability of each company to meet these expectations is being tested.

(Reported on April 10)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/