Japan Markets ViewApril Market with Unstable Supply-Demand Balance – Profit Taking at Early Period and Absence of Leading Buyers

Apr 11, 2024

[QUICK Market Eyes] At the end of March, one market participant said, “I am wary of the beginning of the fiscal year.” That is because financial institutions in Japan are likely to sell their shares in April, the beginning of the new fiscal year, to “take profits out.” Profit-taking sales could continue for a while, limiting the upside potential of Japanese stocks. In addition, especially in April, investors tightening supply-demand balance are often absent. Foreign investors tend to buy more Japanese stocks than sell them in April, but the market could easily turn upside or downside due to unstable supply-demand.

■ What Is “Profit-Taking Sales at the Beginning of the Period” ?

The phrase “profit-taking sales at the beginning of the period” has been frequently mentioned. This is carried out by financial institutions seeking to make profits from their existing holdings in order to secure enough time to meet their budgets for the fiscal year. A Japanese securities company trader said, “Financial institutions told me in late March that they wanted us to be ready for their profit-taking sales in April.”

The Nikkei 225 rose nearly 44% in FY 2023, facilitating profit-taking sales as financial institutions have accumulated holdings over a long period of time. On April 1, a Japanese securities trader said, “When the Nikkei 225 fell below 40,000 yen, profit-taking sales decreased. The profit-taking trend may differ depending on the market movement on that day. Although it is difficult to predict the scale and duration of profit-taking sales, a Japanese securities trader commented, “They will continue at least through the end of the week starting April 1.”

■ Declining Trend in Share Buybacks in April

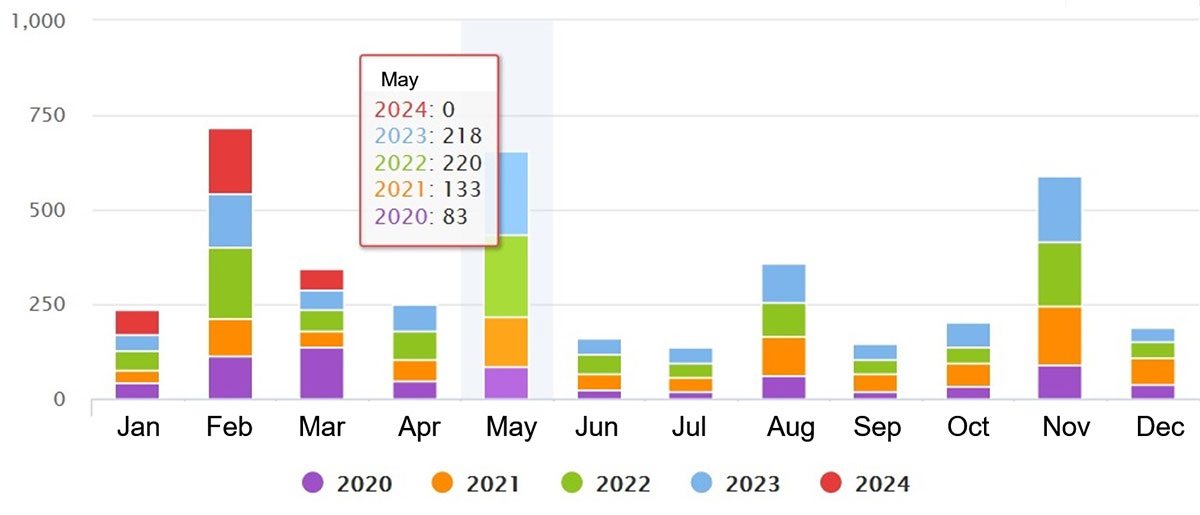

In April, companies tightening the supply-demand balance are also less likely to repurchase their own shares. According to Share Buybacks Data compiled by QUICK, the largest number of buybacks in the past few years took place in May by the companies with the fiscal year ending March 31. In 2022 and 2023, more than 200 companies announced their share buybacks. Some companies may end already-declared share buybacks before the end of March, leaving April as a gap month in which actual share buybacks are less frequent.

Source of data: QUICK Corp.

Makoto Sengoku, senior equity market analyst at Tokai Tokyo Intelligence Laboratory, pointed out, “It is often seen that the market is influenced by the movements of foreign investors, who have a large share of trading in Japanese stocks. However, from a long-term perspective, share buybacks greatly affect the supply-demand balance.” Since share buybacks reduce the number of shares in circulation, the ripple effect on the overall market is significant when many companies repurchase their shares.

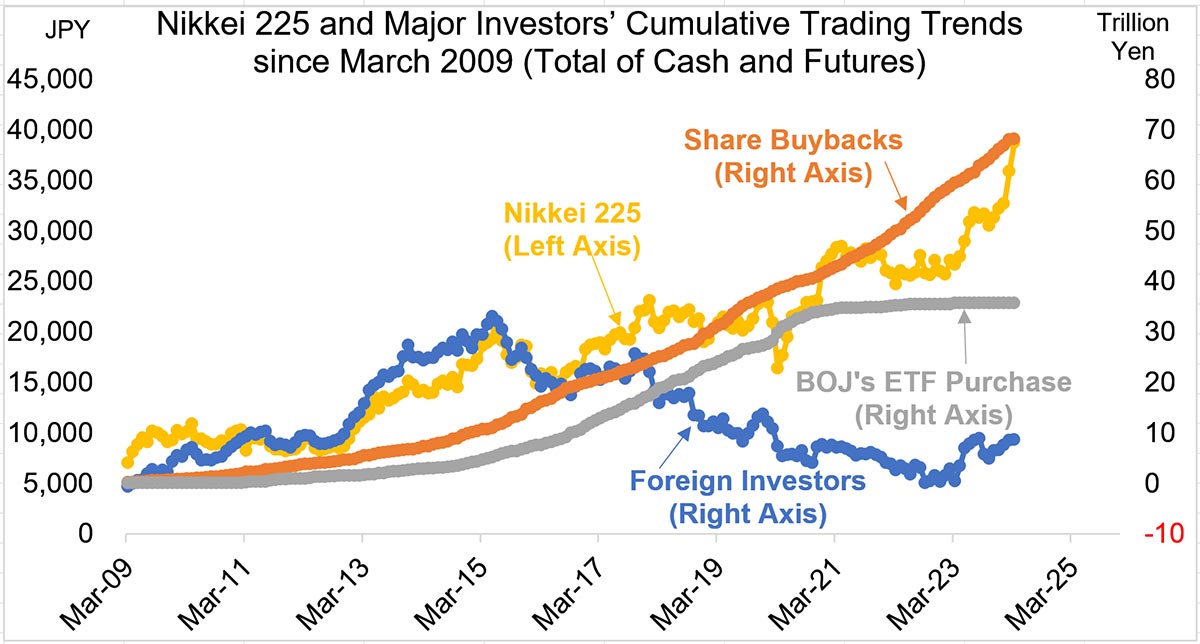

The effect of share buybacks is easy to see when analyzing investors’ cumulative trading trends since March 2009, when the Nikkei 225 hit a post-bubble low of 7054 yen. Until around 2015-2016, foreign investors had been net buyers of Japanese stocks (cash + futures), and the Nikkei 225 followed the trend. After that, the Nikkei 225 has been rising even when foreign investors have been cumulatively overselling.

Source of data: Tokai Tokyo Intelligence Laboratory

Since March 2009, net purchases by foreign investors have amounted to only about JPY8.7 tn. On the other hand, the amount of share buybacks is larger, totaling more than JPY68 tn. Even with JPY38 tn in cash stock sales as a result of unwinding cross-shareholdings, this still amounts to a net purchase amount of JPY30 tn. In addition, the Bank of Japan’s purchases of Exchange Traded Funds (ETFs), which suspended new purchases in March, posted a net buying amount of over JPY37 tn.

■ Focus of Attention on Shareholder Returns in Full-Year Earnings Results

Companies with fiscal years ending March 31 begin to announce their full-year financial results in the second half of April to peak in mid-May. The focus will be on the outlook for the current fiscal year (ending March 31, 2025) as well as on the companies’ approach to shareholder returns.

One strategist sees that “TSE’s request for ‘Management Conscious of Cost of Capital and Stock Price’ has increased pressure on companies, especially those with high equity capital, to return profits to shareholders, for example by buying back their own shares. The supply-demand balance is particularly unstable in the first half of April. However, it is interesting to see whether companies will take a stronger stance on share buybacks, further boosting the outlook for Japanese stocks.

(Reported on April 4)

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/