Japan Markets ViewJapanese Domestic Demand Stocks Successfully Passing Through Costs to Continue Holding the Upper Hand?

Apr 28, 2023

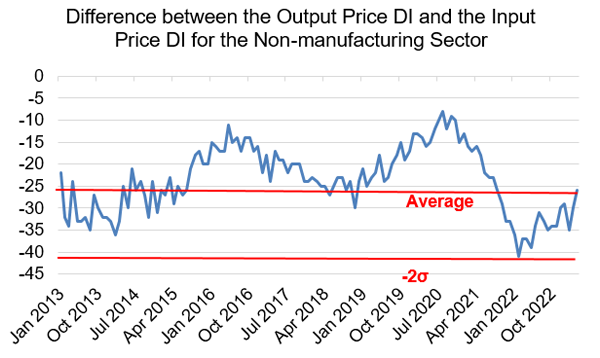

[QUICK Market Eyes] Higher raw material cost pass-throughs are progressing in the non-manufacturing sector. “QUICK Short-Term Economic Survey (QUICK Tankan)” for April conducted by QUICK showed that the difference between the Output Price Diffusion Index (DI) and the Input Price DI for the non-manufacturing sector improved by 4 points to minus 26 from the previous month’s survey. This was the third consecutive month of improvement. In February 2022, the difference deteriorated to -41, 2σ below the average since the survey began. It, however, has improved to the average level (-26) over the following one year and two months.

The DI for non-manufacturing sector improved by 1 point from the previous month’s survey to +29, marking the third consecutive month of improvement. On the other hand, the DI for manufacturing sector deteriorated by 3 points, with the non-manufacturing sector underpinning all industries (unchanged from the previous month).

The earnings announcement season kicks into gear next week for companies with fiscal year ending in March. Ahead of this, both manufacturing and non-manufacturing companies with fiscal year ending in February reported double-digit growth in ordinary profit for the fiscal year ended February 2023. According to estimates by Mitsubishi UFJ Morgan Stanley Securities, the manufacturing and non-manufacturing sectors increased their ordinary profits by 22.9% and 20.0% YoY, respectively. On an all-industry basis, sales increased by 11.8% and ordinary profit rose by 20.3%. Looking at the contribution of individual companies to the increase in ordinary profits, Seven & i Holdings (3382) and AEON (8267) accounted for more than half of the increase, with the former gaining 9.5 points and the latter 3.0 points, respectively.

Mitsubishi UFJ Morgan Stanley Securities forecasted a slight profit increase for the companies with the fiscal year ending February 2024, with sales for all industries rising 0.8%, ordinary profit up 2.9%, and net income increasing 1.1% YoY, respectively. In the report, the company expressed its view that “the focus will be on how much more profits can be accumulated as a result of the shift from Class 2 equivalent to Class 5 for COVID-19 and the recovery of inbound demand.”

Many have pointed out that Japanese domestic demand stocks, many of which are in the non-manufacturing sector, are promising. JPMorgan Securities noted in its April 11 report that if the base salary increases agreed in the spring wage negotiations this year exceed market expectations and inflation subsides in the second half of 2023 as forecast by the Bank of Japan, “real wages are expected to turn from negative to positive growth, supporting consumer spending and domestic demand stocks.” In addition, “China’s reopening is also expected to provide additional support for consumer spending and domestic demand stocks in Japan due to growing inbound demand driven by an increase in the number of visitors to Japan this summer and beyond,” JPMorgan Securities pointed out. The company’s equity investment strategy for Japanese equities focuses on Japanese domestic demand stocks as its core portfolio.

According to a fund manager, “We are concerned about the impact of increased labor costs triggered by labor shortages and rising energy resources. However, we may be able to cope with the price hike without adversely affecting customer numbers and volume considering the improved consumer sentiment due to wage hikes with the progress of reopening.”

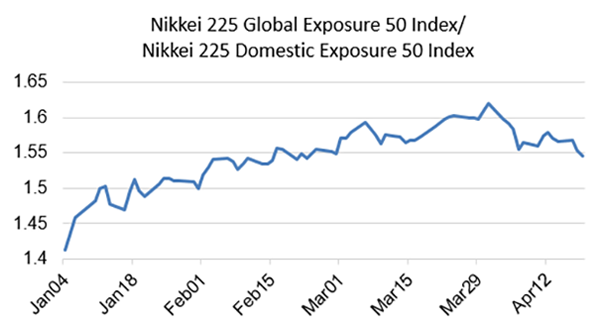

The Nikkei 225 Domestic Exposure 50 Index continued to rise for nine days through April 20, outperforming the Nikkei 225 Global Exposure 50 Index since April 1.

Inbound demand, one of the supporting factors for domestic stocks, is on a steady recovery track. The Japan National Tourism Organization (JNTO) announced on April 19 that the number of inbound visitors to Japan was 1,817,000 in March, recovering to 66% of the pre-Covid levels in March 2019. The Japan Tourism Agency reported on the same day that travel spending per visitor to Japan for the January-March 2023 period totaled JPY212,000, a 30% increase from the full-year results of 2019 (approximately JPY158,000). Behind this trend is an increase in the number of tourists, especially among the wealthy. By country/region, the number of Chinese visitors to Japan doubled from the previous month to 75,000, but 89% fewer than that in March 2019. Credit Suisse noted in its April 20 report that “the focus is on the middle-income segment by income group, and on the full-fledged recovery of Chinese visitors to Japan by country/region. The timing of lifting the China’s group travel ban is likely to be key to further recovery.

(Reported on April 21)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/