Japan Markets ViewEvaluation of Premium Charge Rate Score

Mar 23, 2023

The previous article examined the Premium Charge Rate incurrence for each sector in the Japanese stock market. This article features a case study on the accuracy of QUICK’s Premium Charge Rate Score, which was conducted by F-index, a data analysis consulting service provider in Japan.

Prediction Score for Premium Charge Rate Incurrence

Japan Securities Finance (JSF) discloses the companies that have incurred the Premium Charge Rate by “around noon JST on the business day following the trading day.”

Meanwhile, at “around 6:00 p.m. JST on the day of trading,” QUICK provides the Premium Charge Rate Score, which predicts whether the Premium Charge Rate will be incurred on the next business day, based on the stock exchange guidelines and past incurrence data.

The Premium Charge Rate Score takes the form similar to a probability value with a range of 0 to 1. In this study, the threshold was set at 0.6 to judge whether or not the Premium Charge Rate will be incurred on the next business day.

- The Premium Charge Rate Score of 0.6 or higher indicates that the Premium Charge Rate will be incurred on the next business day

- The Premium Charge Rate Score of less than 0.6 indicates that the Premium Charge Rate will not be incurred on the next business day

For investors considering margin trading, it is desirable to be able to predict the Premium Charge Rate incurrence as accurately as possible. Therefore, this study examined the accuracy of the Premium Charge Rate Score for the one-year validation period from January 4, 2022 to December 30, 2022 (hereinafter, the “validation period”).

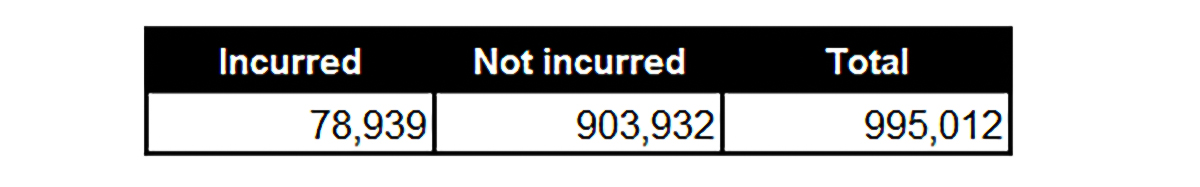

The total number of days Premium Charge Rates were incurred during the validation period was 78,939 (see total in Table 1). The total number of business days during the validation period, which aggregates the number of business days of all companies, was 995,012. Table 1 shows the number of days the Premium Charge Rates were generated during the validation period.

Table 1: Total Number of Days Premium Charge Rates Were/Were Not Incurred in 2022

The proportion of the number of days the Premium Charge Rates were incurred was 7.93% (the value obtained by dividing the number of days the Premium Charge Rates were incurred by the total number of business days). If we continue to predict throughout the validation period that the Premium Charge Rate will not be generated, the correct prediction rate would be 92.07%. This means we can ensure a correct prediction rate of more than 90%, even without considering anything.

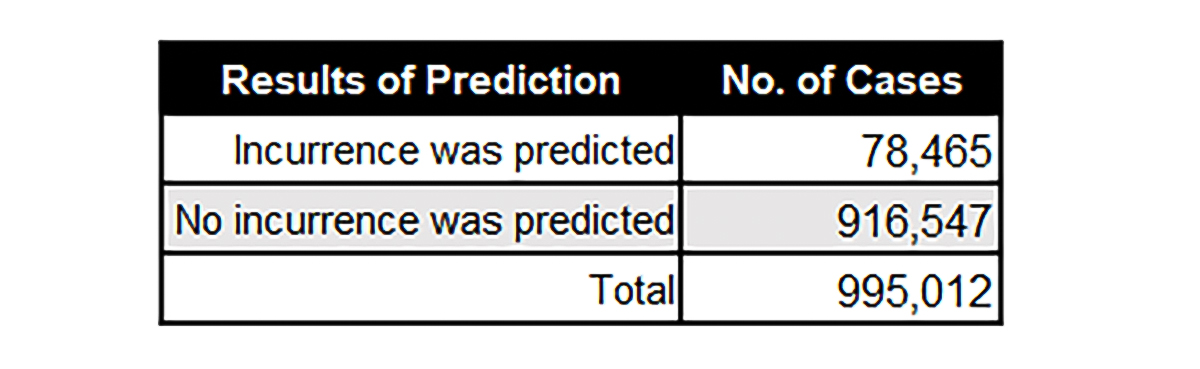

Let us take a look at the accuracy of the Premium Charge Rate Score. First, the Premium Charge Rate Score calculated using information up to the previous business day shall be used to predict whether or not the Premium Charge Rate will be incurred. Table 2 shows the breakdown of the prediction results.

Table 2: Results of Prediction Using the Premium Charge Rate Score

The number of cases subject to prediction was 995,012, which is equal to the number of business days in the validation period. Of these, 78,465 cases were predicted that the Premium Charge Rate would be incurred on the next business day, and no incurrence was predicted for the remaining 916,547 cases.

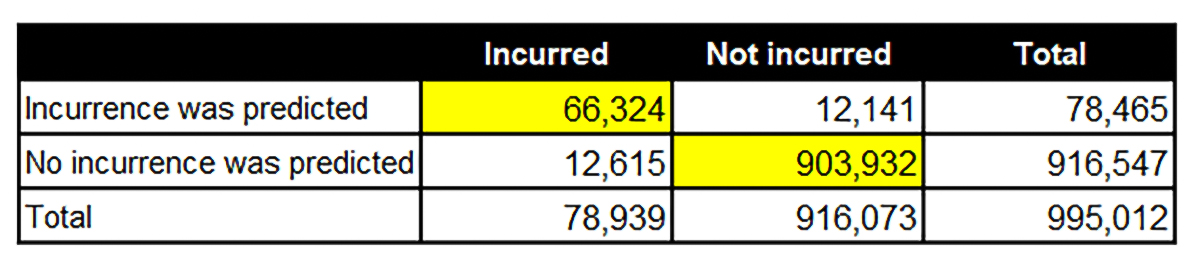

Next, let us check whether the predictions using the Premium Charge Rate Score in Table 2 were correct or not. Table 3 is a contingency table (confusion matrix) that compares the results of prediction using the Premium Charge Score (Table 2) and the correct prediction data (Table 1). The predictions are summarized in rows and the actual incurrence in columns.

Table 3: Correct/Incorrect Predictions Using the Premium Charge Rate Score

In Table 3, the correct predictions using the Premium Charge Rate Score are for the following two cases shown in the yellow background color: (i) 66,324 days for which the Premium Charge Rate Score predicted that the Premium Charge Rate would be incurred on the next business day and were actually incurred; and (ii) 903,932 days for which the score predicted that the Premium Charge Rate would not be incurred on the next business day and were not actually incurred. In other words, the total number of days correct predictions were made using the Premium Charge Rate Score was 970,256, which is the sum of (i) and (ii). In addition, the correct prediction rate was 97.51%, which was calculated by dividing the number of days correct predictions were made by 995,012 business days during the validation period. This rate exceeds 92.07%, which was obtained without considering anything on the assumption that the Premium Charge Rate would never be generated.

Furthermore, the correct prediction rates were calculated for the cases of (i) and (ii) above respectively.

(i) The rate of correct prediction that the Premium Charge Rate would be incurred on the next business day was 84.53%.

This represents the ratio of 66,324 correct predictions to 78,465 predictions using the Premium Charge Rate Score that the Premium Charge Rate would be incurred on the next business day

(ii) The rate of correct prediction that the Premium Charge Rate would not be incurred on the next business day was 98.62%.

This represents the ratio of 903,932 correct predictions to 916,547 predictions using the Premium Charge Rate Score that the Premium Charge Rate would not be incurred on the next business day

The Premium Charge Rate Score is considered to have high predictive accuracy for both positions.

This case study found that highly accurate predictions could be made by using the Premium Charge Rate Score on the business day before the exact announcement by JSF. In particular, JSF discloses the information a few hours after the market opens on the day, and after the morning session is over. On the other hand, the Premium Charge Rate Score is available on the business day before the JSF’s announcement, allowing investors to make investment decisions before the market opening of the day.

Margin Trading Restriction on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data020/