ESG研究所Interview with the Access to Medicine Foundation: Access to Medicine as material ESG issue for pharmaceutical sector

2019年02月06日

※Article available in Japanese → こちら

Access to medicine remains a global issue: 2 billion people lack access to medicine worldwide. The majority of these vulnerable population live in low-and middle-income countries. The Sustainable Development Goals address access to medicine as one dimension of universal health coverage (SDGs 3.8).

To tackle this issue, the Access to Medicine Foundation initiates a multi-stakeholder engagement involving the pharmaceutical industry and investors and researches how pharmaceutical companies address the accessibility and availability of medicines, vaccines, diagnostics and other health products in low- and middle-income countries.

In November, the Foundation has published the 2018 Access to Medicine Index. The 6th Index finds that the industry overall has progressed in access to medicine despite some gaps. Among 4 Japanese companies, Takeda Pharmaceutical Co. Ltd. ranked in 5th, moving 10 places. Eisai Co. Ltd., Daiichi Sankyo Co. Ltd., and Astellas Pharma Inc. are also in the ranking. Investors are increasingly focusing on access to medicine: as of 20 November 2018, 84 investors, collectively managing more than USD 11 trillion, have signed the Access to Medicine Index Investor Statement. The signatory investors commit to reflect the analysis of the Index, as appropriate, in their investment analysis and engagement with pharmaceutical companies.

We have conducted an interview with Bowen Gu, Investor Engagement Manager at the Access to Medicine Foundation. She has shared key findings of the 2018 Index, the Foundation’s engagement with investors, and insights and expectations on Japanese investors and pharmaceutical companies.

(Q) What is the aim of the Foundation?

(A) The Access to Medicine Foundation is an independent non-profit organization, and it started more than 10 years ago. This is the 6th time we are publishing the Index. Tracing back to the history, the founder of the organization had the idea to incentivize pharmaceutical companies to do more in providing access to medicine, especially in low- and middle-income countries. We thought that a ranking of top companies in the market could be a tool for companies to look at what their peers are doing and incentivizing them to do more in following the best practices.

We engage with different stakeholders including pharmaceutical companies themselves, investors who are shareholders of the companies, and governments. We are funded by the UK and Dutch governments as well as the Bill & Melinda Gates Foundation, who all support the global health agenda.

(Q) How does the Foundation engage with companies and investors?

(A) We have dedicated teams of analysts working on the Access to Medicine Index and the Antimicrobial Resistance Benchmark. There is also the Company Engagement Team, which speaks with the companies to support them in understanding our research findings and recommendations, and the Government Engagement Team, which speaks with government agencies (including the Japanese Ministry of Health, Labour and Welfare, Japanese Ministry of Foreign Affairs and the Japanese International Cooperation Agency) to inform their policy-making.

The Investor Engagement team engages with investors that have shareholdings in these pharmaceutical companies. We have a group of what we call signatory investors who sign up to the Investor Statement. The main principle they sign up to is that they support the work we do and they understand that access to medicine is a material issue for the pharmaceutical industry. The signatory investors can use our research in their own equity research and engagement with companies. Before engagement with pharmaceutical companies, the investors can reach out to us for our insights and research.

Our Index is not a financial instrument; it is a ranking published alongside a detailed and in-depth report, which includes many statistics and figures setting out our research findings in a broad range of topics. We have detailed company report cards that are publicly available on our website. It is like ESG profiles of companies focusing on access to medicine.

(Q) What is your impression on Japanese investors?

(A)We are glad to see that 3 Japanese investors signed up to the Access to Medicine Index Investor Statement this year. Since we are a team wholly based in the Netherlands, in the past we engaged most intensively with European investors and recently American investors. In Japan there is growing recognition from different stakeholders, including the Government Pension Investment Fund (GPIF), on the importance of ESG and stewardship engagement, so I think Japanese investors start to engage a lot more. At the 2018 Access to Medicine Index Tokyo Investor Launch Event held on December 11th 2018, a significant group of investors showed interest in our work and participated in the bilateral meetings with Japanese pharmaceutical companies at the event to discuss important issues on access to medicine.

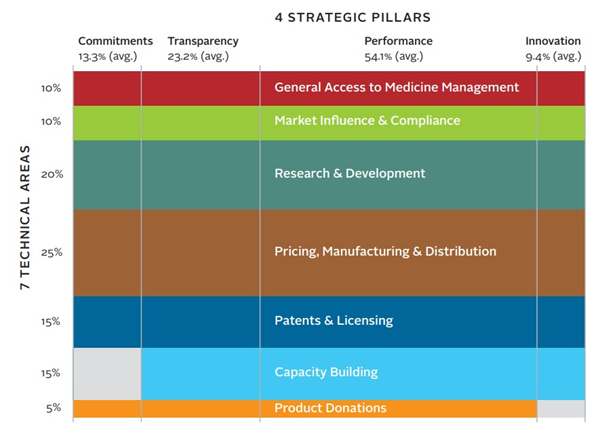

(Q) How is the framework of the ATM Index assessment formed?

(Source: Access to Medicine Foundation)

(A)The Index is based on the framework of 7 Technical Areas. These are 7 areas that we have agreed based on consultations with different stakeholders including global health experts and investors. Our Expert Review Committee reviews this framework every 2 years.

General Access to Medicine Management looks at how companies govern, plan for and manage their access to medicine objectives. Investors are interested in whether there is a board-level oversight or long-term incentives for employees, including senior executives.

Market Influence & Compliance looks at the interaction between companies and other organisations and how these may affect access to medicine, as well as the risk management of the company, and whether companies have compliance frameworks regarding issues such as ethical marketing and anti-corruption.

Research & Development(R&D)is the core of pharmaceutical business. This area reviews whether companies respond to the priority medicine needs of low-and middle-income countries and more importantly, whether companies put plans in place for providing access to medicine. Sometimes companies have R&D in place, but they do not plan for marketing authorization application in developing markets, for example. Then these medicines will not be available nor affordable to local population in those markets. This area also investigates policies governing clinical trial conduct to ensure it is transparent and ethical.

Pricing, Manufacturing & Distribution looks at the supply chain aspect. This includes whether companies take public health needs into account when making commitments to file for marketing approval and whether companies take affordability into account when they set prices. For example, best practices in this area include developing equitable pricing strategies that set different prices per population segment, depending on a range of socio-economic factors. These practices cover countries like Brazil where there are significant income gaps between different population.

Patents & Licensing looks at the transparency of patents and licensing practices, whether companies practice voluntary licensing for generic manufacturers in developing countries to support the supply and affordability of pharmaceuticals for the local population.

Capacity Building reviews how companies strengthen the local health and pharmaceutical systems. Pharmaceutical companies have a responsibility for access to medicine, but they cannot function without the strong and supportive local ecosystem of low-and middle-income countries. Capacity building is particularly important in the areas of R&D, local manufacturing capacity, supply chain management, pharmacovigilance systems, and health system strengthening.

Product Donation is about the scale of donation programs and how companies work with partner organisations to ensure the programs are of high quality, sustainable and respond to need.

Behind the 7 Technical Areas listed above, there are 69 quantitative and qualitative indicators that together measure pharmaceutical companies’ policies and practices.

(Q)What were the key findings of the 2018 Index?

(A)This is the first year we included cancer in our research. An inclusion of cancer is the reflection of the global health community’s insight. By statistics, cancer is an increasing burden for emerging markets. From our analysis, although more companies accelerate their R&D and manufacturing of cancer or oncology drugs, we see very few of them considering planning for access, for example by planning to seek marketing authorization in low- and middle-income countries. Only 4.7% of oncology R&D projects have access plans. This is very low in comparison to R&D for communicable diseases. In terms of governance, we see more companies have board level oversight and long-term employee incentives, but still not the majority. Another key issue is ethical marketing. For example, we try to make sure companies decouple sales incentives from sales targets. Only 9 out of 20 companies have stepped away from rewarding the sales agents based on their sales targets.

(Q)Any thoughts on Japanese companies’ performance?

(A)Amongst the Japanese companies that we cover we see progress over the years. Takeda, in particular, jumped 10 places from 15th to 5th. The company been actively implementing the access to medicine strategy developed and noted in 2016. For example, Takeda has newly assigned responsibility for access to its CEO and has deepened its approach to equitable pricing and to capacity building. There are still opportunities to improve, such as expanding its price segmentation approach and establishing project-specific access plans for late-stage projects, which we have mentioned in the Opportunities section of the company report card.

Rising 3 places to 8th, Eisai has also been making improvement over the years and demonstrates particular strength in R&D, engaging in partnership to develop a comparatively high number of projects that address R&D priorities, and in donations. We see opportunities for Eisai to play a stronger role in areas such as expanding the process to establish access plans for R&D projects during development and expanding the registration for epilepsy medicines to more low- and middle-income countries.

Astellas and Daiichi Sankyo have also made their own improvements, though these are less visible in material ranking changes. Daiichi Sankyo made progress in the R&D and Patents & Licensing Technical Areas. Astellas has strengthened its R&D commitments and compliance system. However, these two companies still lack an overarching access-to-medicine strategy that is aligned with corporate strategy. We encourage companies to have an overall strategy on access to medicine and recognition by CEO and the board level, in addition to improving their efforts in specific areas such as establishing access plans for R&D projects during development and for key products.

(Q)How do investors use the Access to Medicine Index?

(A)There are multiple ways. One way is to reach out to our analysts and receive company level insights and industry level trends. We have been monitoring the companies’ performance for over 10 years, so we have the general trend of pharmaceutical companies and the industry. This can be helpful for macro-level analysis.

Also, there is quantitative information including the ranking, overall score and individual scores by Technical Areas for each company. Investors may use the quantitative data to screen top performing companies versus bottom ones. Some investors screen out bottom ones based on their clients’ requests and exercise best performing selection.

Another is company engagement – this is the key approach that investors may use. We support investors with bilateral engagement with companies. At the 2018 Access to Medicine Index Tokyo Investor Launch Event, we organized one-on-one meetings for investors to meet with all four Japanese companies included in the Index as well as Shionogi & Co., Ltd., which is evaluated on the Antimicrobial Resistance Benchmark. Our company report cards function as a tool to understand how pharmaceutical companies perform, compare with competitors and raise questions upon engagement. Investors can use our data as a tool for impact measurement on companies’ contribution to SDGs on health care.

(Q)Do European investors use the Index beyond engagement and apply it to integration and positive/negative screen?

(A)Some investors have a mandate to screen best in class approach depending on the client’s request. Some ethical investors look at which company has the best approach on access-to-medicine, selecting top 10 pharmaceutical companies and including them in the portfolio. They may set thresholds for certain issues they are most concerned about, such as R&D and pricing issues and screening the companies out for scoring under the thresholds. We also see more pharmaceutical analysts using our research in addition to general ESG research.

(Q)What is your expectation for Japanese investors and pharmaceutical companies?

(A)We have seen increasing interests from Japanese investors. Signing up to the Investor Statement is the first step, but the next step is using the Index in engagements substantively. At the 2018 Access to Medicine Index Tokyo Investor Launch Event where we hosted one-on-one meetings between investors and pharmaceutical companies, there was such progress, and we got positive feedback from investors that the Index is helpful for having a conversation with companies. Further on, we hope to see more in-depth conversation dealing with specific issues. For instance, investors can raise questions about the company’s governance on access to medicine like board-level oversight. We are happy to support both investors in understanding the companies’ issues and the companies in improving the areas in need of progress.

(Q)Any message for investors and the pharmaceutical industry?

(A)As a non-profit organisation, our research scope is limited to 20 companies. However, the Access to Medicine Index framework (i.e., what the Index measures) can be applied to more companies. We always encourage investors to use the framework and apply it to their own investment universe. Same for companies, we hope they can use our framework for their internal policy-making strategy such as pricing strategy, R&D, and patents & licensing.

Investor’s role is crucial. Responsible stewardship activity is the key. Our company report cards specify changes from the 2016 Index and the opportunities for each company. They are very transparent messages for the companies and investors, which can be transformed into engagement questions.

(From left: Kazunori Nakatsuka, QUICK Corp. ESG Research Center, Etsuya Hirose, QUICK Corp. ESG Research Center, Bowen Gu, Access to Medicine Foundation)

◆Access to Medicine Foundation

https://accesstomedicinefoundation.org/

The Access to Medicine Foundation is a non-profit organisation based in the Netherlands. It conducts research to stimulate and guide pharmaceutical companies to improve access to medicine for people living in low- and middle-income countries. The Access to Medicine Index ranks 20 of the world’s largest research-based pharmaceutical companies with products for high-burden diseases in low-and middle-income countries. The ranking is updated every 2 years.

◆Bowen Gu, Investor Engagement Manager, The Access to Medicine Foundation

https://accesstomedicinefoundation.org/our-team/bowen-gu

◆2018 Access to Medicine Index

https://accesstomedicinefoundation.org/publications/2018-access-to-medicine-index

QUICK ESG研究所 平井采花