Japan Markets ViewWith New NISA to Launch Soon, Major Securities Companies Compete Against “Zero-Commission Trading” by Maximizing CS

Sep 07, 2023

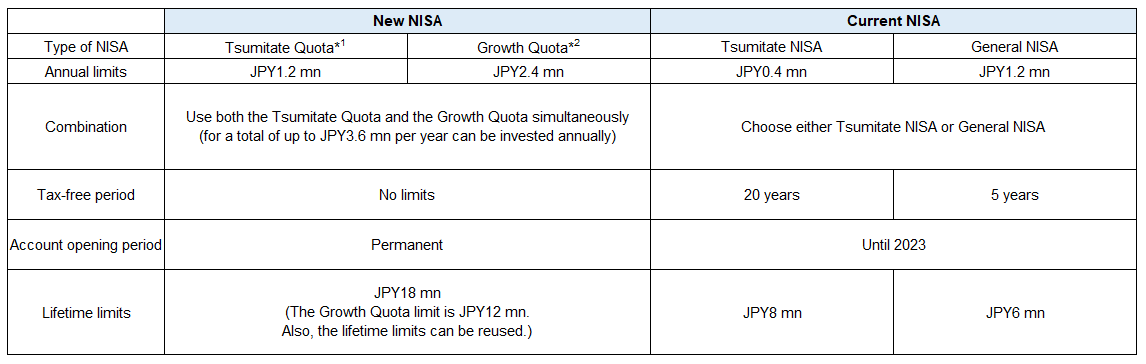

[Nikkei QUICK News] With the soon-to-launch New Nippon Individual Savings Account (New NISA, with changes from the current NISA described at the end of this article) in 2024, the differences in strategies among securities companies are becoming more evident. While online securities companies offer commission-free trading, major securities companies are taking advantage of face-to-face sales to maximize customer satisfaction (CS). The Nikkei 225 has doubled since the launch of the current NISA in 2014. This favorable market environment is also supporting the efforts of the securities industry as a whole. All eyes will be on which will be the winner in the race to acquire new clients for the New NISA.

SBI Securities, a subsidiary of SBI Holdings (8473), and Rakuten Securities, a subsidiary of Rakuten Group (4755), announced on August 31 that they would waive trading commissions for Japanese stocks. These companies will charge no commissions for cash and margin transactions. They aim to accelerate their efforts to attract younger investors who have yet to allocate their funds to investments.

Online securities companies have kept commissions low and attracted a large number of customers, mainly individual investors. According to the Financial Services Agency (FSA), the number of online securities’ customers holding investment trusts increased from approx. 2.8 million in FY 2020 to 5.6 million in the first half of FY 2022. This growth is remarkable compared to the counterpart of major securities companies that remained at a little over 3 million over the same period.

The New NISA is to be launched in January 2024. Each person is allowed to open only one NISA account at a single financial institution. A consulting firm in Japan says, “If the launch of zero-commission trading offers an incentive to create a NISA account, online securities companies will be able to capture the investment funds of individual investors.”

On the other hand, there is little sign at this time that the major securities companies will follow suit by waiving commissions. Nomura Securities, a subsidiary of Nomura Holdings (8604), told Nikkei Quick News that it would not immediately follow suit, saying, “The business models of online brokerages and major brokerages providing face-to-face services are different.”

Major securities companies are shifting its focus to a strategy of increasing customer satisfaction rather than pursuing short-term profits. Symbolic of this is the handling of so-called “sales quotas.” Mizuho Securities, a subsidiary of Mizuho Financial Group (8411), has revised its sales management system. While the company continued to use the increase in assets under management as an evaluation item, it eliminated the revenue item from its sales branch and individual targets in FY 2023. Regarding the evaluation of sales amount, the company no longer considers the type of assets, such as investment trusts and stocks. Shin Ito, general manager of Retail and Business Banking Division in Mizuho Securities, comments, “We have also discontinued checks by the head office on the progress rate of revenue targets of branch offices. We need to change the mindset to the one that the sales representatives’ job is not to sell products to customers, but to provide them with consulting services.”

SMBC Nikko Securities, a subsidiary of Sumitomo Mitsui Financial Group (8316), has introduced an evaluation system since FY 2022. Under this system, earnings are excluded from the scope of evaluation, and emphasis is placed on performance converted into points based on the amount of assets acquired, the net increase in investment trusts under management, and inheritance and business succession cases. Masahiro Yamaguchi, Senior General Manager, General Manager, Sales Planning at SMBC Nikko Securities, says, “In some cases, new employees focus on acquiring assets rather than selling products.” This is a far cry from the days of securities sales, which used to focus so much on profits that terms like “turnover trading” were coined.

Behind this change in the approach of major securities companies is the growing recognition that the sale of financial products in pursuit of short-term profits undermines the sustainability of their businesses. Mitsubishi UFJ Morgan Stanley Securities, which abolished revenue targets in FY 2019, considers that “revenue will naturally follow if we can increase customer satisfaction.” The company gathers information on clients’ asset conditions and life stages through meticulous consulting sales based on the policy that “the mission of the sales representatives is to provide solutions to the issues and demands that have been identified.”

Under these circumstances, the balance of assets under management by “fund wraps,” in which investors entrust financial institutions with the management of their assets in investment trusts, has been increasing. According to the FSA, the amount of assets under management by major securities companies increased from approx. JPY6.1 tn in FY 2017 to JPY7.8 tn in the first half of FY 2022.

Takahide Kiuchi, Executive Economist at Nomura Research Institute (NRI), notes, “Online securities companies charge low commissions, but their services are limited. On the other hand, major securities companies charge commissions but offer more detailed services, such as explanations by sales representatives. They offer a wider range of products, including investment trusts.” In addition, he expects that many of those who will open NISA accounts are beginner investors and may go to major securities companies that offer detailed product explanations and other services.

Mr. Ito of Mizuho Securities says, “Currently, the market environment is also favorable to the securities industry.” The year high price of the Nikkei 225 in 2013, just before the launch of the current NISA, was 16,291, while that in 2023 is more than double that, at 33,753. Takahide Kiuchi of NRI points out, “The government is strongly promoting the New NISA and strengthening financial education under the government’s “Doubling Asset-based Income Plan,” making it much easier for financial institutions to solicit customers.

Will major securities companies continue to maximize CS rather than short-term profits? The true test of these efforts will come when the stock market enters a turbulent phase triggered by the Bank of Japan’s major monetary policy revisions and downward pressure from overseas economies.

(Reported on September 1)

Key Points of the New NISA (Changes from the Current NISA)

*1 It depends on the financial institution, but usually the users are expected to make monthly contributions into their investment savings accounts.

*2 As with the General NISA, it allows investment in listed stocks and most equity investment trusts.

NQN News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data017/