Japan Markets ViewNQN News Distribution Trends and Their Application to Stock Investment

Aug 30, 2023

Summary

- NQN Market News Provided by QUICK

QUICK provides data on news from Nikkei QUICK News (NQN), a company that distributes highly flash market news. - Application the News to Stock Investment

The timing when new news is distributed after a period of no distribution is considered as an investment opportunity. It can be used for better investment decisions by adding a judgment as to whether the news is positive or negative.

Introduction

F-index, a data analysis consulting service provider in Japan, examined the distribution trends of news provided by NQN (NQN News) and the use of the trends for stock investment.

Company News and Stock Prices

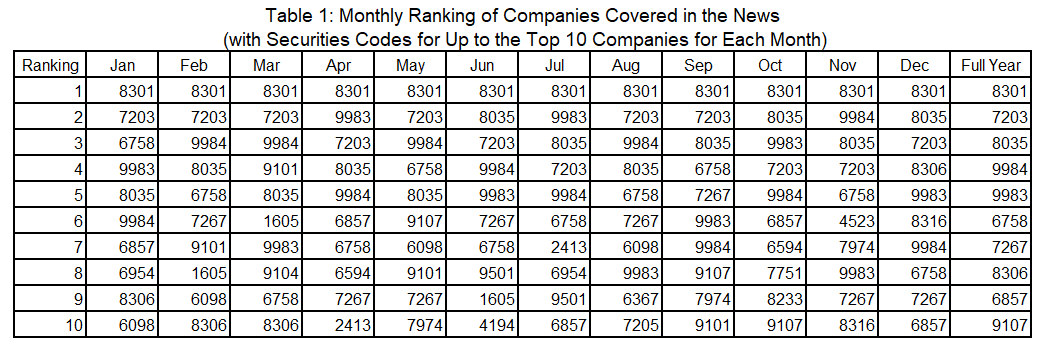

A total of 56,370 NQN news articles were distributed during the year from the beginning of January to the end of December 2022. Among them, news related to listed companies in Japan totaled 23,719, of which 17,452, or 73.58%, were distributed between 8 am and 3 pm. This indicates that corporate news distribution is concentrated during the order acceptance period and trading hours. Which companies were most frequently covered in the news? We ranked the listed companies that appeared in the news by month and summarized them in Table 1.

Excluding the Bank of Japan (BOJ, 8301), as the news related to the release of economic statistical indicators is tied to the BOJ, the top three companies for the year are Toyota Motor (7203), Tokyo Electron (8035), and SoftBank Group (9984). These three companies were ranked in the top 10 for all months and remained in the spotlight throughout the year.

Here, we hypothesize as follows: The news about a company that has not been covered for some time will have a stronger impact on stock prices than the news about a company that has been in the spotlight on a regular basis and whose news articles are consistently distributed.

Application the News to Stock Investment

The following rules are established to check the performance of each investment.

[Investment Rules]

Rule 1: We cover the news articles distributed during the trading hours.

Rule 2: We purchase a stock when its news is delivered after being undistributed for some time (or at least not on the same day).

Rule 3: We sell the stock at the closing price of the day.

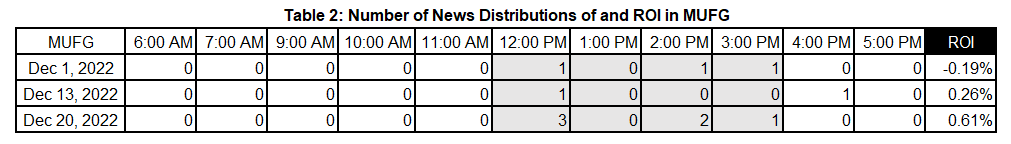

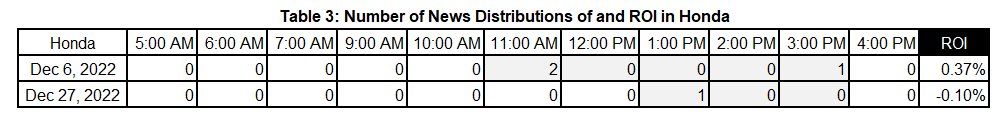

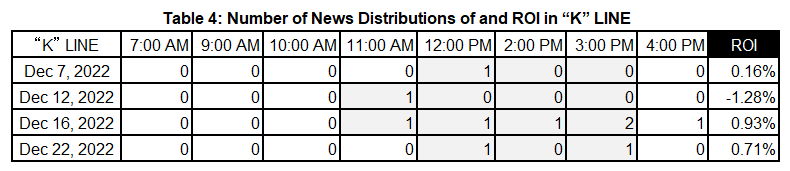

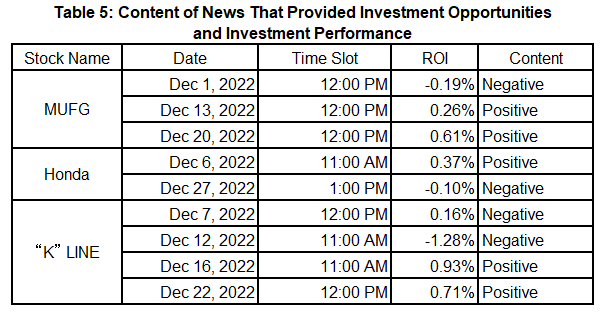

Tables 2, 3, and 4 summarize the results of the investment in Mitsubishi UFJ Financial Group (MUFG, 8306), Honda Motor (Honda, 7267), and Kawasaki Kisen (“K” LINE, 9107) for the month of December 2022, respectively, based on the above investment rules. The dates of the investment opportunities are taken in the row direction, and the number of news distributions by time period is noted in the column direction. Note that the tables show only the dates and time periods when news distribution was made in December 2022. For example, in the case of MUFG on December 1, the first news was delivered during the time slot from 12 pm to 1 pm. The stock was purchased at 749.4 yen, the opening price of the following time slot from 1 pm to 2 pm, and sold at the closing price of 748 yen, resulting in a return on investment (ROI) of -0.19%.

MUFG has recorded a negative return on one out of three investment opportunities, Honda on one out of two, and “K” LINE on one out of four investment opportunities. The above investments were made based solely on the timing of news distribution; hereafter, investment decisions are made after considering the content of the news stories that generated investment opportunities.

If the news that provided an investment opportunity for each of the stocks shown in Tables 2, 3, and 4 is favorable to the stock, it is judged as “positive”; otherwise, “negative.” For the news that only describes the stock price trend immediately prior to the news distribution, if the news describes a stock price increase, it is judged as positive, and otherwise, as negative.

For MUFG and Honda, negative news resulted in negative investment performance and positive news produced positive investment performance. In other words, considering news content helps improve overall investment performance. Honda shows a similar trend.

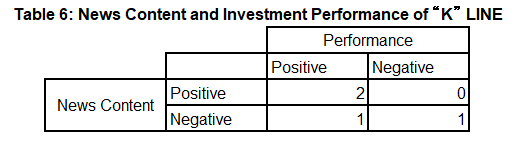

Table 6 summarizes the relationship between the news content and investment performance of “K” LINE.

In December 2022, “K” LINE had four investment opportunities. Two of them were provided by positive news, both resulting in positive investment performance. On the other hand, the remaining two investment opportunities were generated by the negative news, resulting in positive and negative investment performance, respectively. However, the performance following the investment opportunity generated by the negative news on December 7 was not very high, at +0.16%. This performance was lower than the +0.93% on December 16 and +0.71% on December 22 following the investment opportunities provided by positive news. On the other hand, following the investment opportunity with negative news on December 12, a large negative performance of -1.28% was observed. In not all investment opportunities, positive or negative judgments of news content are tied to positive or negative rates of return. However, if the overall performance is evaluated in light of the magnitude of the rate of return, better performance can be achieved by making investment decisions taking into account the news content.

Conclusion

This article examined the NQN news distribution trend and discussed the application to stock investment. We focused only on the news about companies. In addition, we considered the timing of news distribution after a period of no distribution as an investment opportunity since news is not constantly distributed. Accordingly, we narrowed down the target news. This study confirmed that investment based on news content would yield stable and high performance.

NQN News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data017/