Japan Markets ViewListing Approval for Actively Managed ETFs – Emergence of Japanese Version of ARKK?

Aug 24, 2023

[QUICK Market Eyes] On August 21, the Tokyo Stock Exchange (TSE) approved the listing of six actively managed exchange-traded funds (ETFs). All of them are set to be listed on September 7. In the overseas markets, 2,000 actively managed ETFs are already listed. One of them is ARK Innovation ETF (ARKK), which is managed by ARK Investment Management led by Cathy Wood and popular also in Japan. Although the initial listing has just been announced, some in the market have already begun to anticipate the emergence of a Japanese version of ARKK.

Listing Approval for Actively Managed ETFs – Emergence of Japanese Version of ARKK?

The actively managed ETFs approved for listing by the TSE are managed by three companies, including Nomura Asset Management. These ETFs are the funds to invest in growth stocks or high-dividend stocks or are theme-based funds.

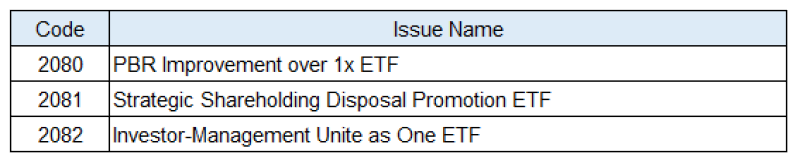

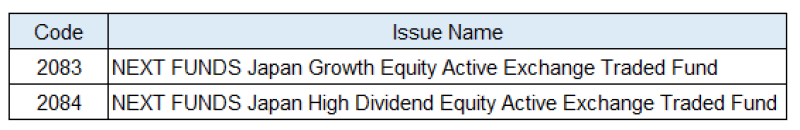

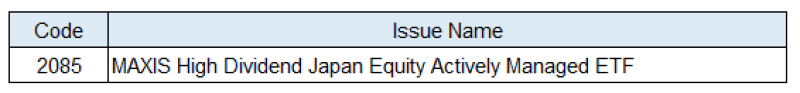

Actively Managed ETFs Approved for Initial Listing

– Simplex Asset Management

– Nomura Asset Management

– Mitsubishi UFJ Kokusai Asset Management

In the market, there are expectations for actively managed ETFs as well as concerns about them. One expectation is an expansion of actively managed ETFs in Japan, which lags behind the rest of the world. Tomoichiro Kubota, senior market analyst at Matsui Securities, notes, “For better or worse, the emergence of a prominent manager such as ARK Investment Management is likely to raise awareness and attract recognition of actively managed ETFs.”

The issue will be liquidity in intraday trading. Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute, points out, “Market makers need adequate liquidity to prevent abnormal prices during intraday trading.” Mr. Kubota of Matsui Securities also notes, “There have been theme-based ETFs in the past, but some of them have not taken root among investors due to a lack of liquidity.”

Both growth and high-dividend ETFs are expected to attract a certain level of popularity. Of particular note are the three ETFs managed by Simplex Asset Management. For example, “PBR Improvement over 1x ETF” is an ETF that invests in a diversified universe of companies with P/B ratios below one and encourages executives to improve the management quality of undervalued companies through the exercise of their voting rights. A domestic securities firm comments, “Even from the name, you can tell this ETF rides on the current trend.”

In the case of actively managed ETFs, it is possible to confirm on a daily basis what stocks they are holding using the Indicative NAV and PCF information published daily by the TSE. A local securities dealer comments, “Stocks held by PBR Improvement over 1x are likely to come under pressure, while the final selection of stocks needs to be confirmed.” A domestic securities firm also notes, “It depends on the ETF’s popularity, but capital inflows into value stocks are anticipated.”

Actively managed ETFs are already listed on 33 exchanges in 25 countries around the world. Assets under management are increasing at an accelerating pace, and are estimated to be worth JPY80 tn. Japan lags behind in actively managed ETFs. However, they are likely to gradually attract market expectations driven by the growing momentum to shift from savings to investment.

Nomura Asset Management Held a Briefing on August 21

On the evening of August 21, Nomura Asset Management held a media briefing regarding the listing approval of actively managed ETFs. Masafumi Watanabe, head of the ETF Business Strategy Department, and Yushun Mizusaki, senior manager of the same department, expressed their expectations that this would increase investors’ options and expand the market size over the medium to long term. The following is a summary of the Q&A session with the media.

-

The document says that the PCF information will be disclosed. Is it possible to check it from September 7?

-

Starting September 7, the stocks in which the ETFs invest, etc. will be posted on the TSE’s PCF information.

-

What criteria did you use to determine the amount of trust fees?

-

The decision was made comprehensively, taking into account the amount of trust fees of overseas actively managed ETFs.

-

What is the outlook for the actively manged ETF market size?

-

We expect the market for actively managed ETFs will continue to grow, and a wide range of investors will gradually put their money into actively managed ETFs.

In the U.S., actively managed ETFs account for about 5-6% of all ETFs. In Japan, the total balance of ETFs is JPY60 tn. If excluding central bank holdings, etc., the balance is generally around JPY10 tn. In the mid- to-long-term, we can expect the ETF market size in Japan to be in the range of JPY500 to 600 bn. We are eager to establish our presence in this market.

-

Where do you find the significance of listing actively managed ETFs amidst a global market dominated by passively managed ETFs?

-

Indeed, passively managed ETFs are the mainstay of the global market. In the U.S., this type of ETFs account for more than 90% of all ETFs. Meanwhile, actively managed ETFs increase investment options. We have a system in place for corporate research, etc., and we would like to deliver added value of active investment management.

-

What challenges do you see in expanding actively managed ETFs to individual investors?

-

This is a never-ending theme in Japan, not only for actively managed ETFs. We expect ETF holdings by individual investors to grow. We intend to take various approaches, including marketing. We will provide products that individual investors would like to trade. The actively managed ETFs to be listed this time allow investors to start with as little as 2,000 yen per unit, and we expect that they will be used for accumulating investments.

-

Can we expect institutional investors to invest in these ETFs?

-

Institutional investors are also increasingly investing in index-tracking and theme-based ETFs. We anticipate that high-dividend ETFs will be used more by institutional investors. At the same time, we assume these investors will invest in growth ETFs to a certain extent.

-

Could you be more specific about the daily disclosure of the portfolio and its constituents?

-

Constituents will be disclosed on a daily basis. Regarding market liquidity, it is necessary to provide liquidity also during intraday trading hours as a unique feature of ETFs. We are planning to make changes to the constituents at the close of trading, not during intraday trading hours. We will manage the ETFs without making any major changes to the components.

(Reported on August 23)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/