Japan Markets ViewDiamonds and Fine Art Attracting Attention for Inflation Hedging Purposes

Sep 14, 2023

[QUICK Market Eyes] The global inflation wave is sweeping over Japan. Amid such a situation, jewelry and fine art are selling well. Investment money aimed at hedging against inflation is also flowing into high-end goods.

Looking at the sales mix of department stores nationwide in July, the Japan Department Stores Association reported that sales of “fine art, jewelry, and precious metals” increased for the 30th consecutive month, up 2% YoY. Although sales of confectioneries, delicatessen food, and sundries also exceeded the previous year’s level, they fell short of the record for consecutive positive sales in fine art, jewelry, and precious metals.

Isetan Mitsukoshi Holdings (3099) announced that domestic department store sales in July were up 14% YoY (fixed figures). Sales of fine art, jewelry, and precious metals were up 11%, and for Ginza Mitsukoshi, sales were up 43%. Among these high-value items, there are strong inquiries for jewelry, according to Isetan Mitsukoshi Holdings. This pace has not slowed down in August.

Fine art auctioneer Shinwa Wise Holdings (Shinwa Wise, 2437, Standard) also sells diamonds and has seen a rapid increase in sales. Sales for the fiscal year ending May 2023 were up 55% from the previous fiscal year due to increasing demand to protect assets from inflation. Diamonds have a dollar-denominated market worldwide. According to Shinwa Wise, diamond prices have been on a steady upward trend for the past 30 years.

Fine art auctions, Shinwa Wise’s core business, have also been strong. Consolidated sales for the last fiscal year were up 39%. A growing number of art buyers boosted transaction volume, and increased handling of high-value goods also contributed to the strong performance. The company expects to maintain sales growth this fiscal year, though the growth rate will decline to 14% YoY.

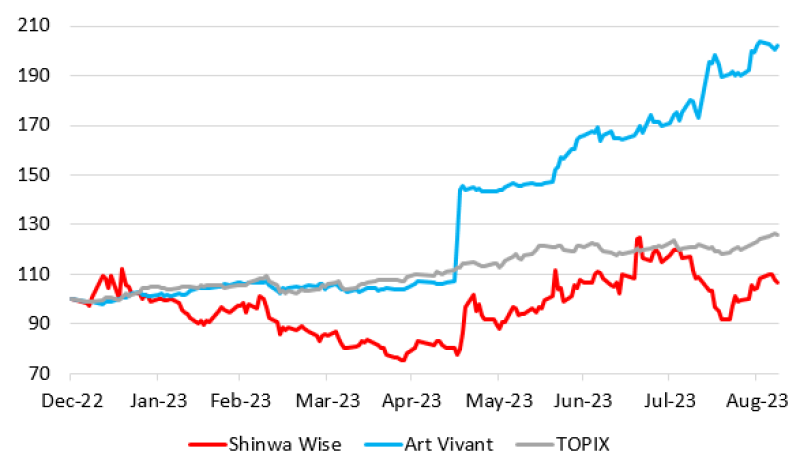

On the other hand, the company’s stock price has been weak since the beginning of the year, underperforming the TOPIX. The factors, such as the capital reduction announced in late July, have been weighing heavily on the stock price. Art Vivant (7523, Standard), in the same industry, has seen its stock price nearly double since the beginning of the year, but its performance in the current fiscal year has been lackluster.

Other players involved in fine art auctions include SBI Art Auction, a group of SBI Holdings (8473), and Mainichi Auction, a group of a major job placement information company, Mynavi Corporation. Department stores are also significant in the sale of works of art.

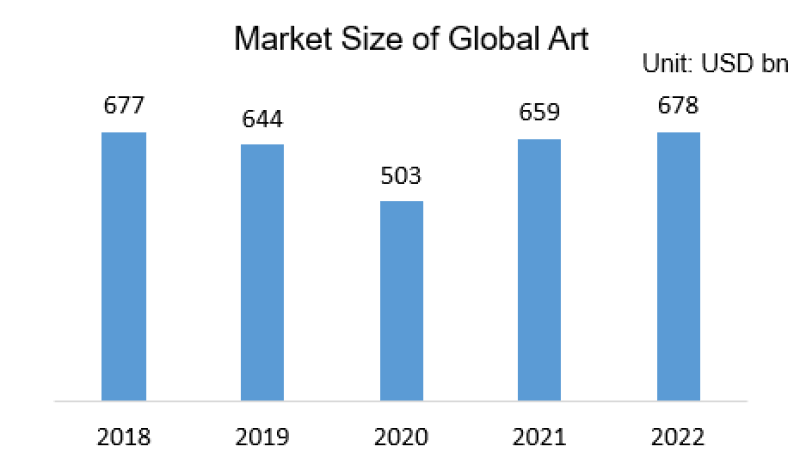

According to a report compiled by Art Basel and UBS, global art sales in 2022 were estimated at USD67.8 bn, up 3% from the previous year. It was driven by the U.S., the U.K., and China. Sales in the U.S., the world’s largest market, reached a record high of USD30.2 bn. The auction market declined 2% from the previous year to USD30.6 bn, but remained at a high level.*Compiled based on the data in

“The Art Market 2023” issued by The Art Basel and UBS

The size of the Japanese market is in the JPY200 bn range (in 2021), which is still small compared to overseas markets. However, with Japan’s aging population, the number of works coming to the auction market may increase due to inheritance. There are also expectations that high value-added works will come to the market. In addition to the demand to hedge against inflation, Japan’s unique environment is likely to be a tailwind for the jewelry and fine art market.

(Reported on September 8)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/