Japan Markets ViewStrong sentiment on Japanese stocks. Survey shows Nikkei 225 the highest point since the poll started. — QUICK Monthly Survey (Equity) in February 2021

Feb 09, 2021

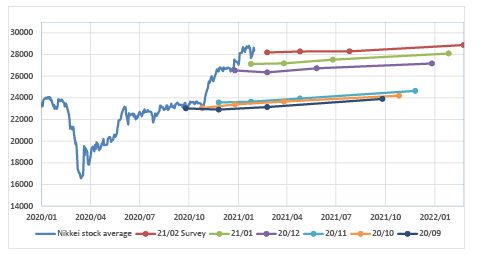

Market participants are turning bullish on the outlook for Japanese stocks, with the average forecast for the Nikkei 225 at 28,190 at the end of February, according to the QUICK Monthly Survey (Equity) for February. As for the end-of-month forecast, it was the highest since the survey started in April 1994 and the seventh consecutive month of rises. Expectations are rising for vaccinations against the new coronavirus and additional economic measures in the U.S.

The survey was conducted from 2nd to 4th February, and the Nikkei 225 closed at 28,341 as of 4th February. At the end of the week on 8th February, the Nikkei 225 rose 609 to 29,388, recovering to the 29,000 level for the first time in 30 years and six months, beyond the bullish market expectation.

The most important factor for stock price fluctuations was the “Economy and corporate earnings” at 52%, followed by “Interest rate trends” and “Overseas stock and bond markets” at 15% each. Many respondents said that a variety of factors would lead to higher stock prices, including “Progress in vaccinations for the new coronavirus and the normalization of behaviour are important” and “Expectations of U.S. fiscal expansion are a strong tailwind for Japanese stocks” (Investment trust advisor). On the other hand, some bankers said that the rise was driven by expectations and that the stock market would be in a “Strong adjustment phase in the near future” due to caution about a rapid rise in stock prices.

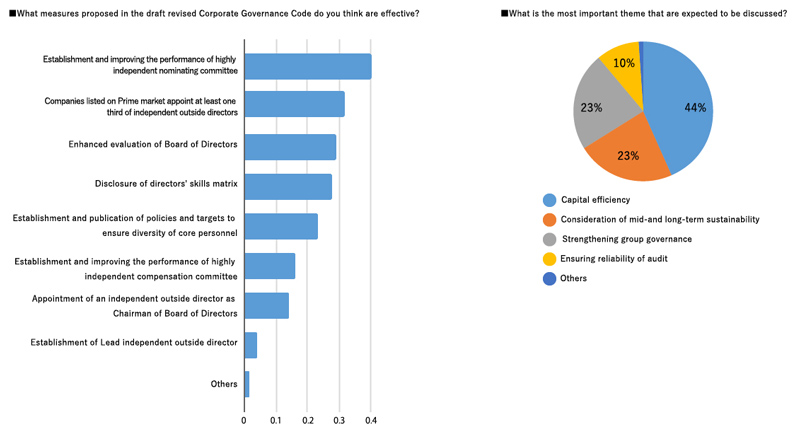

TSE and the Financial Services Agency plan to revise the Corporate Governance Code this spring. The revised draft proposes measures to ensure the functioning of the board of directors and the diversity of core personnel. When asked what measures you thought would be effective in the survey, the most common answer at 40% was to “Establishment and improving the performance of highly independent nominating committees (statutory and voluntary)”, followed by “Appoint at least one-third independent outside directors” at 32%.

The most important theme for future discussions, at 44%, was “Capital efficiency” including a review of business portfolios and Policy-holding shares. “Strengthening group governance” and “Consideration of mid-and long-term sustainability” were answered by 23% of respondents each.

Some respondents pointed out that “I think the ESG trend is a bigger theme than the CG Code for asset owners (Institutional investors as trustees).” (Securities company) and that “Professional managers will not be grown unless we start by reforming the strange sense of equality, such as uniform treatment when hiring new employees” (Bank).

The survey was conducted among 214 people, including investment managers of domestic institutional investors, and the number of respondents is130. The survey was conducted between 2nd to 4th February.

QUICK Data Factory(QUICK Monthly Survey)

https://corporate.quick.co.jp/data-factory/en/product/data012/