Japan Markets ViewThe market is focusing on the trend of the NT ratio due to Nikkei 225 already weakening

Mar 25, 2021

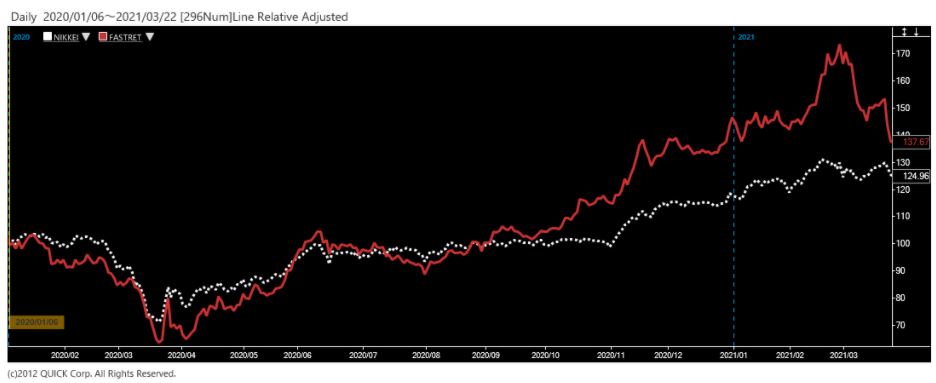

On March 19, the Bank of Japan decided to exclude the Nikkei 225-linked ETFs and the JPX-Nikkei 400-linked ETFs from its ETFs purchase program and to purchase the only TOPIX-linked ETFs. Fast Retailing (9983), the top-weighted stock on the Nikkei 225, fell 6.1% on the day, pushing down the Nikkei 225 by 212.83 points. On the first trading day the week of March 22, the decline ratio of the Nikkei 225 was still much higher than that of the TOPIX.

Relative chart of Fast Retailing (9983) and Nikkei 225

(Indexed to 100 at the beginning of 2020)

“It was not the market consensus.”

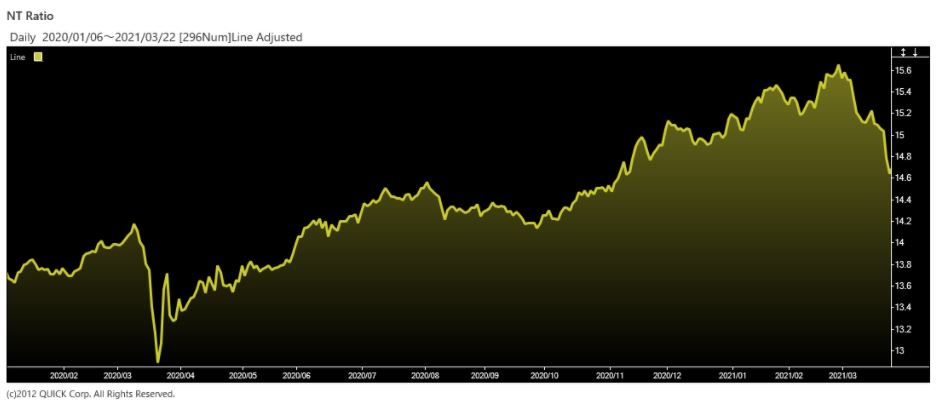

In a report dated March 19, Nomura Securities said, “The shift to purchase only TOPIX-linked ETFs was in line with our forecast but not with the market consensus,” and added, “The NT ratio has already been on a downward trend since the end of February as the expectation of COVID-19 infection convergence spreads, and the BOJ has provided additional factors. Besides, for stocks that have a large weighting in the Nikkei 225, this “transition” will have an impact on supply and demand.”

“It is too early to judge that the NT ratio, which fell to 14.8 as of the close on March 19, has reached its lower limit,” Mizuho Securities said in a report on March 19, adding that “There is a high probability that the impact on performance will continue over the long term between the Nikkei 225 and JPX-Nikkei 400, which will lose their effects, and TOPIX, which will be strengthened.”

Passive demand associated with the dividend payment at the end of March will contribute to the reduction of the NT ratio, as buying demand for TOPIX may be greater than that for the Nikkei 225. The key point will be whether the Nikkei 225 can stop falling relatively.

The US stock market, on March 19, saw the major stock indices all turn negative compared to the previous day as the FRB announced that it would cease easing conditions for the supplementary leverage ratio (SLR) at the end of March as planned.

However, the Nasdaq Composite Index and the Philadelphia Semiconductor Stock Index regained positive territory and finished higher.It will be interesting to see if buying continues in Tokyo Electron (8035) and Advantest (6857), which are also price-sensitive stocks included in the Nikkei 225.

In a report dated March 19, Daiwa Securities said that the NT ratio is expected to decline temporarily due to the BOJ’s decision to stop the purchase of Nikkei 225-linked ETFs. However, the firm pointed out that “The BOJ has reduced the proportion of Nikkei 225-linked ETFs in its ETFs purchase program twice in the past. But the long-term upward trend of the NT ratio has not changed.” The firm, therefore, forecasted that “The decline in the NT ratio will only be temporary and the long-term uptrend of the NT ratio will remain unchanged.”

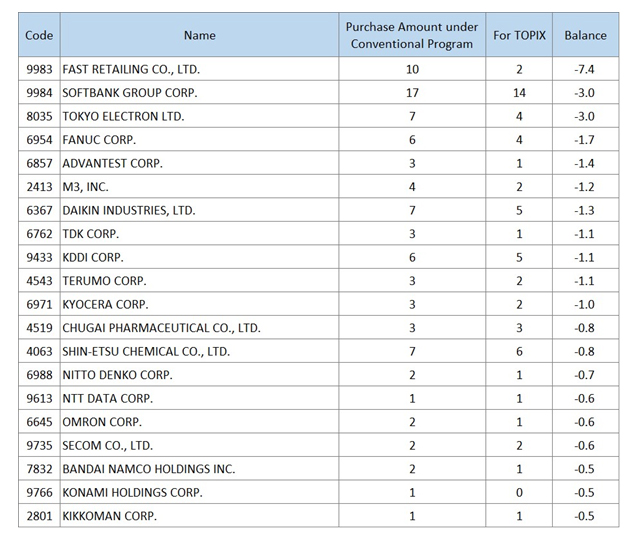

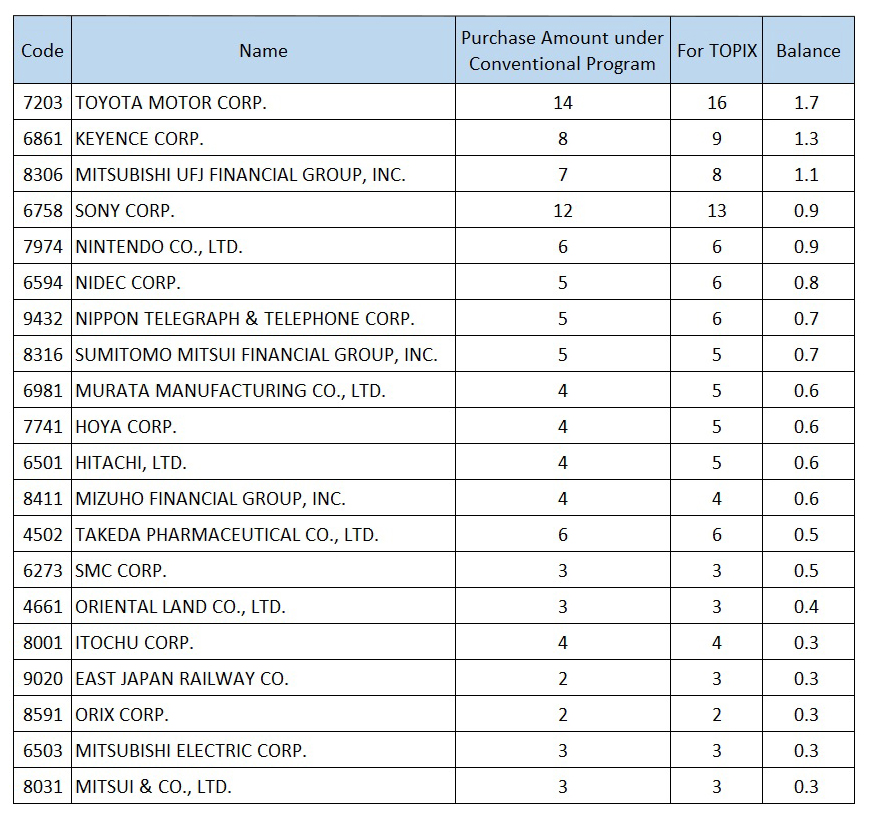

List of Stocks Affected by Purchase Amount

According to a report dated December 21, 2020, by Nomura Securities, the BOJ has been purchasing ETFs for each index with the following allocations: TOPIX: 84%, Nikkei 225: 14%, and JPX400: 2%.

For the BOJ’s ETFs purchasing to be concentrated on the TOPIX ETFs, the following stocks are estimated to be significantly different from the previous purchases in terms of the amount purchased for individual stocks.

Stocks with reduced purchase amount per purchase due to concentration on TOPIX-linked ETFs

(Unit: billion yen, at the time of purchase of 50 billion yen)

Stocks with increased purchase amount per purchase due to concentration on TOPIX-linked ETFs

(Unit: billion yen, at the time of purchase of 50 billion yen)

What’s NT ratio?

The NT ratio is the Nikkei Stock Average (Nikkei 225) divided by TOPIX (Tokyo Stock Price Index). The initial letters of both indices are called NT ratio, which indicates the relative strength between the two indices. The Nikkei 225 is the average price of 225 leading Japanese stocks selected by Nikkei Inc. from among the stocks listed on the First Section of the Tokyo Stock Exchange (TSE First Section), adjusted by a divisor. TOPIX, on the other hand, is calculated as a weighted average of the market capitalization of all stocks listed on the First Section of the Tokyo Stock Exchange and is, therefore, more likely to be influenced by stocks with large market capitalizations (such as those in the domestic demand sector). Therefore, if the share price of the high-tech sector rises more than that of the domestic demand sector, the NT ratio will rise, and if the share price of the domestic demand sector rises more than that of the high-tech sector, the NT ratio will fall. The ST ratio, which is calculated by dividing the S&P 500 index by TOPIX, is another index that measures the divergence in stock prices between Japan and the US.