Japan Markets ViewJapanese Stocks Rely on a Weak Yen; Which Stocks Are More Resilient to Market Volatility?

Jul 26, 2022

The results of the QUICK Monthly Survey (Equity) in July 2022 represented the lackluster market for the time being. Market participants forecast that the Nikkei 225 (simple average) will remain at the 26,000 yen level until the end of September 2022, and is not expected to reach 28,000 yen even at the end of the year.

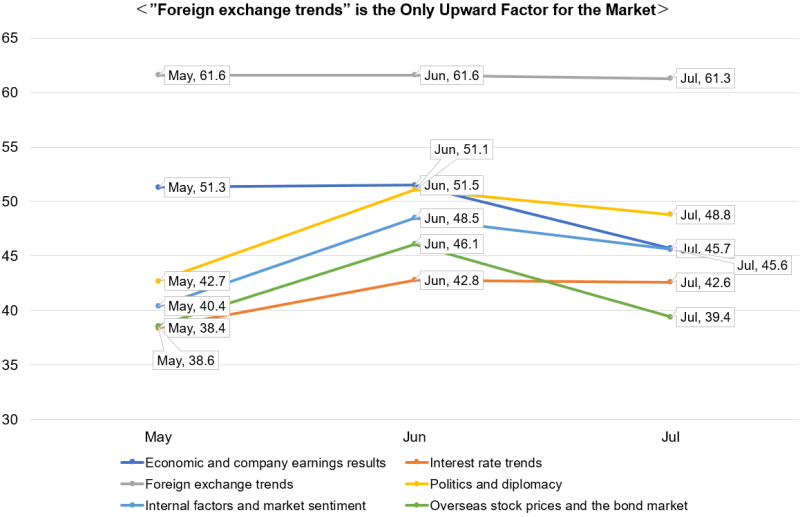

Among the price fluctuation factors, “Foreign exchange trends” is the only upward factor when the degree of impact is converted into an index.

* The value becomes zero when concerns about downward factors are the strongest and 100 when expectations of upward factors are the highest.

In fact, however, no market participants cited “Foreign exchange trends” as a factor to watch, suggesting their little interest in this area. With the announcement of financial results for the April-June period beginning at the end of the month, while “Economic and company earnings results” was at 60%, up 9 points from the previous month, the index was 45.7. This indicates that many investors are concerned this could be a downward factor.

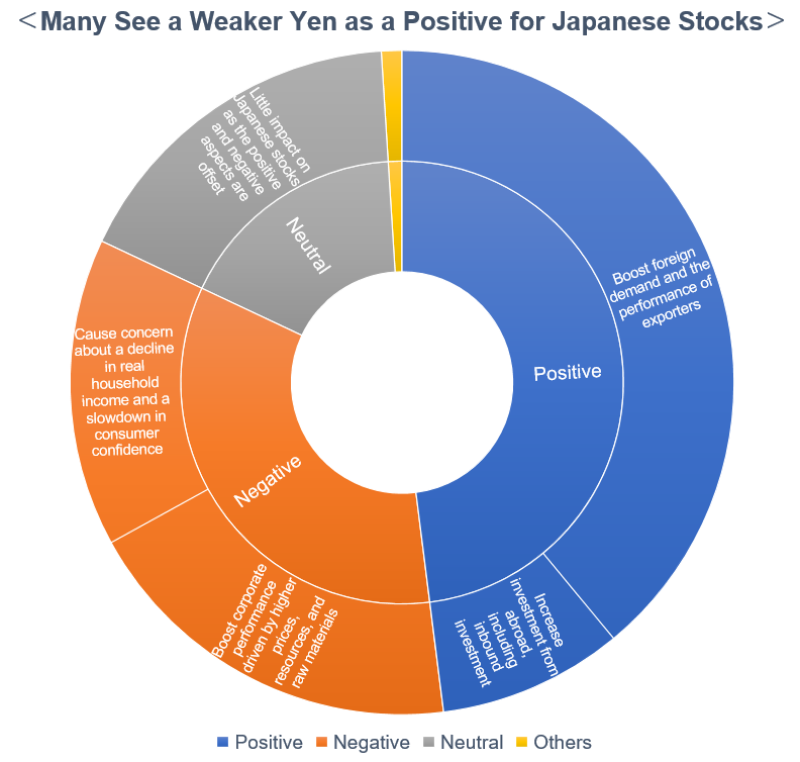

The July survey once again asked a question about the impact of the yen’s rapid depreciation against the dollar on the market.

Despite some concerns about the negative impact of soaring prices of imported raw materials, 48% of the respondents expected a positive effect on the economy as a whole, more than the negative (34%), due to the boost in earnings of exporting firms. Respondents who answered “little or no impact” as a result of offsetting the positive and negative impacts accounted for 17% of the total. The yen’s depreciation may have a positive impact on corporate earnings in the near term. However, it cannot be entirely welcomed since it is largely a reaction to the tightening of the U.S. monetary policy. The situation is back-to-back with the U.S. economic slowdown. While the boost from a weaker yen will offset this to some extent, the effect will diminish if volume declines significantly. Particular attention should be paid to trends in U.S. consumer spending, which will be cut by rising prices and monetary tightening.

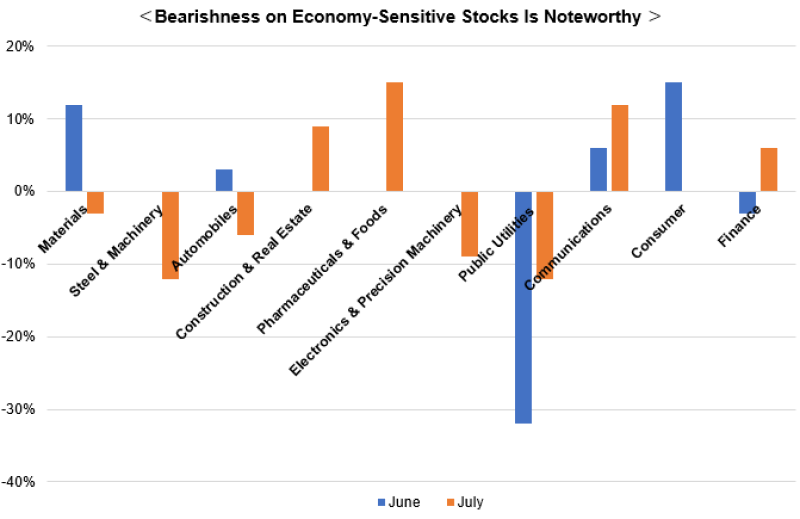

The weak yen does not simply encourage stock purchases, which is reflected in the trend of selective buying.

In terms of the subtraction of “underweight” from “overweight” in the question asking about investment stance by sector, the sectors where the orange line turned negative in July (i.e., sectors where more investors plan to underweight) are “Materials,” “Steel and Machinery,” “Automobiles,” and “Electronics & Precision Machinery”; all of which represent economically sensitive stocks. While “Automobiles” is one of the sectors most likely to benefit from a weaker yen, there are also concerns about a change in the auto market, which has been booming in the U.S. amid rising interest rates on auto loans. Parts supply, which has been slower than expected, and the delayed recovery of production, are also likely to be a cause for concern in the April-June earnings. This could lead to an ironic situation where production cannot keep up when demand is strong, and the market is experiencing a downturn when production finally gets back on track.

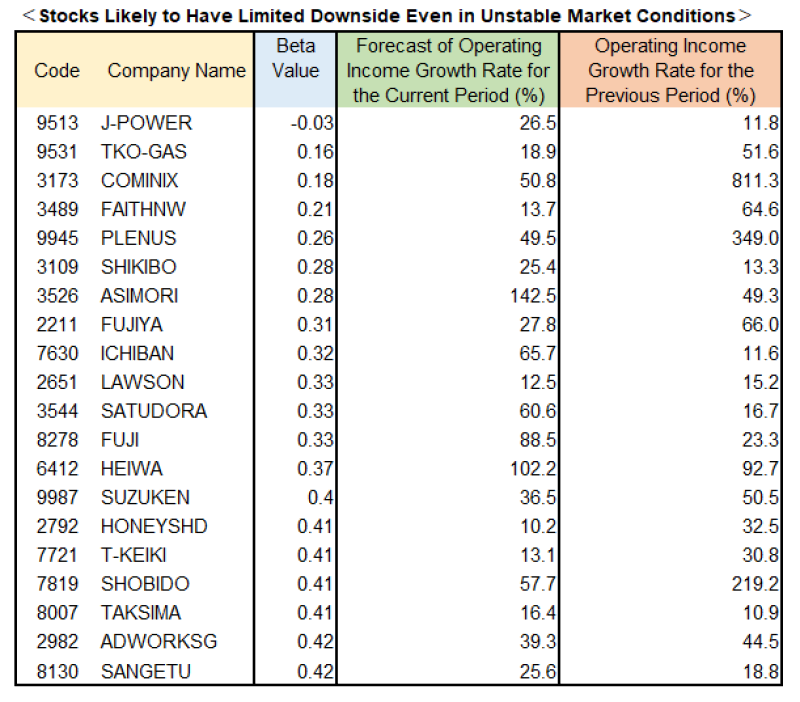

In the immediate future, strong economic indicators may trigger concerns about the risk of monetary tightening, while weak economic indicators may raise awareness of the deterioration of the real economy, both of which pose a difficult situation for stock prices. It may be worth taking an investment stance that avoids stock price volatility risk as much as possible by investing in stocks that are less sensitive to the overall market trend and that seem to be backed by stable current business conditions.

Among the TSE Prime Market, we picked out stocks that are less linked to the Nikkei 225 and expect to see an increase in operating income in the previous and current periods. Looking at the top 20 companies with low beta, domestic-demand and defensive stocks stand out.

* Low-beta stocks of the TSE Prime-listed companies with double-digit operating income growth rate for the previous period and double-digit operating income growth rate expected for the current period (Nikkei forecast). Beta values are indexed against the Nikkei 225, 180 days.

Top-ranked companies such as Electric Power Development (9513, J-Power) and Tokyo Gas (9531) are attracting attention amid the tight power supply and demand during the summer months.

J-Power is involved in sales and purchases on the Japan Electric Power Exchange (JEPX), and sales seem to make a larger contribution to earnings. Tokyo Gas is engaged in new power generation, but it appears to be relatively unaffected by procurement prices at JEPX. If the company acquires more subscribers and increases the amount of electricity it procures from JEPX, soaring market prices for electricity may put pressure on earnings. However, many believe that Tokyo Gas will enjoy the benefits of being a survivor as new power companies with less corporate strength continue to withdraw from the market or close their businesses.

With the April-June financial results, we should get through a tumultuous summer while once again inspecting the footing of domestic- demand and defensive stocks.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/