Japan Markets ViewIRJHD’s Stock Price Worth Watching as Shareholder Meetings in Full Swing

Jun 14, 2023

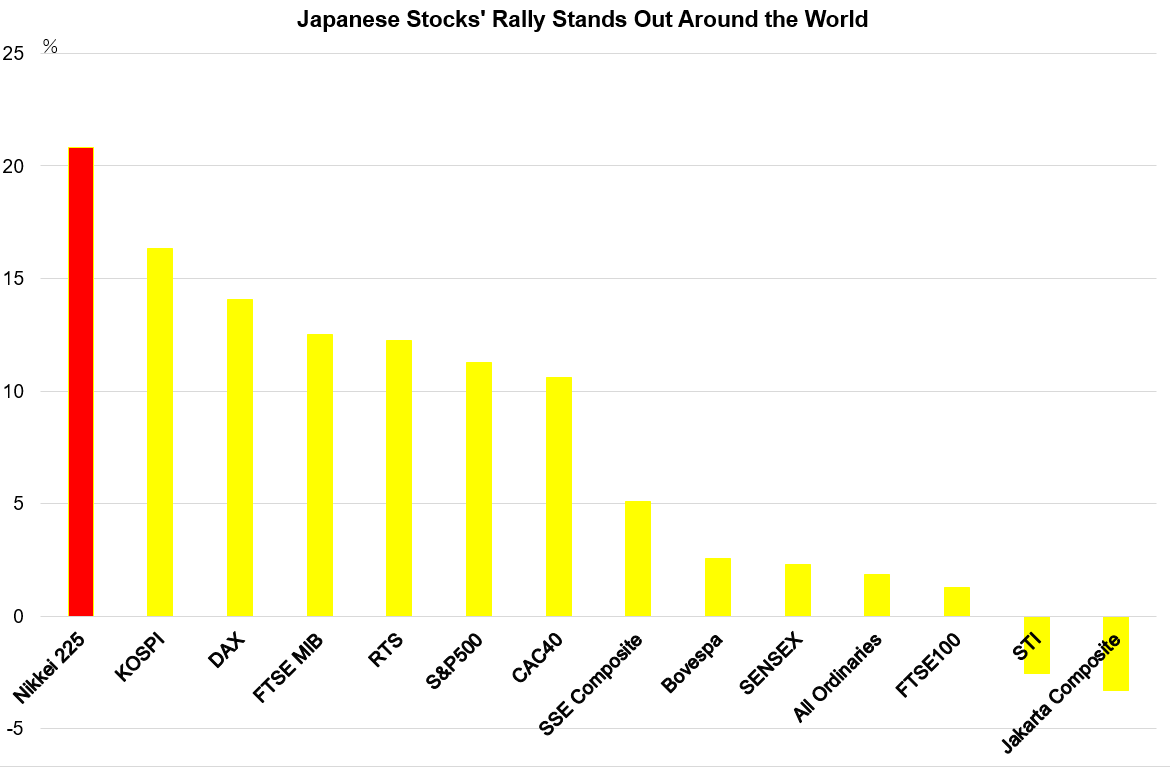

[QUICK Market Eyes] The Nikkei 225 has hit a new post-bubble high, and the inflow of funds into Japanese stocks has been booming. Ranking the stock price indices of major countries since the beginning of this year, the index of Japanese stocks stands out in terms of the increase rate.

*For consistency, the fluctuation rates of stock indices were calculated from the closing price on December 29, 2022 through June 2, 2023; June 1 for STI, and May 31 for Jakarta Composite.

Overseas investors are driving Japan’s stock market rally. According to the QUICK Monthly Survey (Equity) in June, 94% of respondents chose “Foreign Investors” as the investor category to watch, up 5 points from the previous month. The index, which indicates the degree of the impact (the closer the index is to 100, the greater the positive impact), was 66.2, up 6.3 points from the previous month. Expectations are rising for purchases of Japanese stocks by foreign investors.

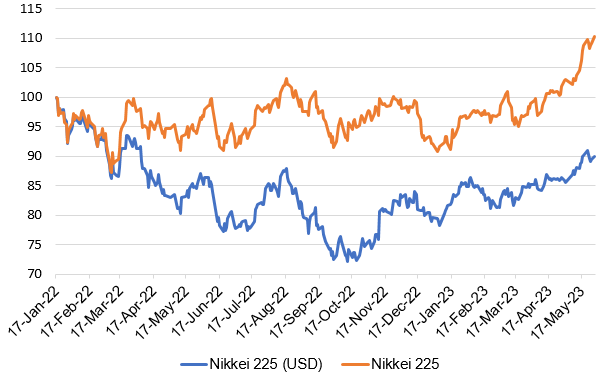

The Nikkei 225 in USD terms, a benchmark for many foreign investors, remains at April 2022 levels, just under 230 dollars.

It could expect more purchases of Japanese stocks by foreign investors, who are looking at the market as undervalued.

Having said that, Japanese stocks have long been considered “undervalued.” In order to dispel the skepticism toward foreign Investors buying Japanese stocks, there must be growing confidence that the “undervaluation” will eventually begin to dissipate. If Japanese stocks remain “undervalued” all the time, their attractiveness will not increase.

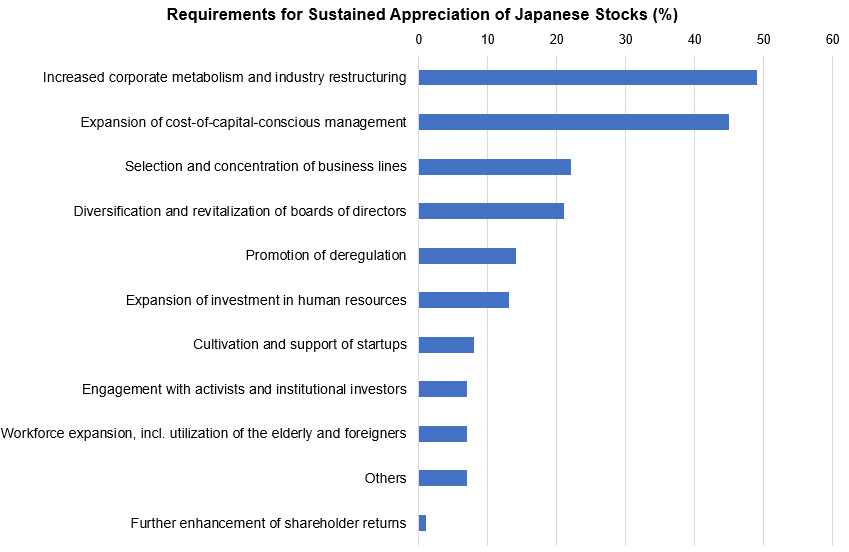

The QUICK Monthly Survey also asked respondents about the requirements for sustained appreciation of Japanese stocks. The top response, at 49%, was “increased corporate metabolism and industry restructuring,” followed closely by “expansion of cost-of-capital-conscious management” at 45%.

Although both of these issues have long remained untouched, the atmosphere is changing dramatically, as evidenced by the Tokyo Stock Exchange’s request to redress a P/B ratio of less than one.

June is the time for companies with a fiscal year ending March 31 to hold their general shareholders’ meetings, providing an opportunity for engagement between investors and the companies. According to Mitsubishi UFJ Trust and Banking, 82 companies with a fiscal year ending March 31 disclosed receipt of shareholder proposals as of May 31. This is the largest number ever, surpassing the 77 companies in 2022. Investors are certainly beginning to have engagement with Japanese companies more seriously. The issue is the attitude of companies that receive proposals, but adverse reactions of Japanese companies to activist proposals are much weaker than in the past. Careful management strategies designed to persuade investors also enhance a company’s growth potential. The Yokohama Rubber (5101), for example, has sold off subsidiaries and government-owned shares and allocated the proceeds to the costs for acquiring an overseas tire manufacturer for agricultural machinery. The market has generally reacted positively to this move. It will be critical to see whether Japanese companies can enhance their corporate value through aggressive investor activities.

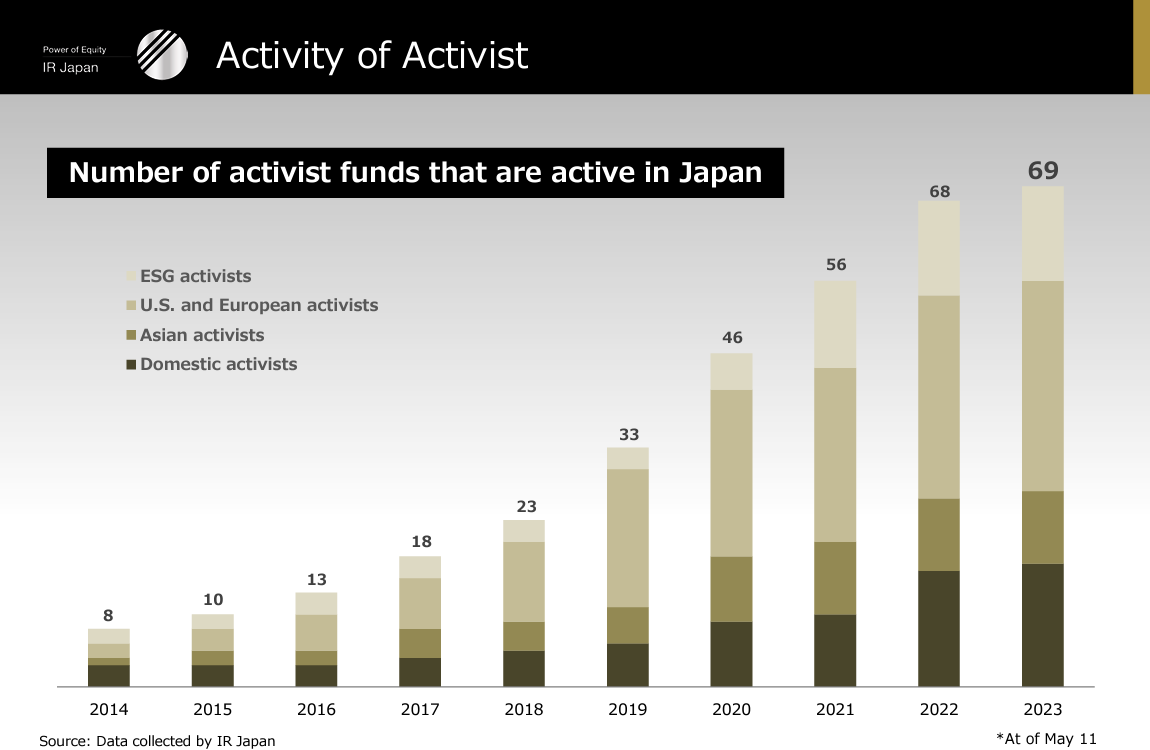

IR Japan Holdings (IRJHD, 6035), a company conducting shareholder identification surveys, has attracted attention every year around this time. However, the company’s stock price has sunk to a year-low range. Last year, the suspected involvement of the former vice president in an insider trading scandal and an alleged conflict of interest were uncovered, and the company’s performance has been sluggish partly due to the cancellation of contracts triggered by the scandals uncovered. IRJHD had been enjoying high revenue growth and profit margins by leveraging the strengths it had developed as an independent company. However, the company’s popularity has backfired, and the current stock price is 90% below the record high. The company’s consolidated net income for the fiscal year ending March 2023 fell 72% from the previous fiscal year to JPY671 mn. On top of that, the company has decided not to disclose its forecast for the fiscal year ending March 2024 due to a number of uncertain factors. As transparency and fairness are called for, the impact of the scandals could be long-lasting. Nevertheless, the company’s expertise in researching the identification of substantial shareholders and knowing their characteristics and being able to instruct companies on how to deal with shareholders poses a high barrier for other companies to enter this segment. Activist funds have been picking up recently. As a result, the company continues to receive orders, mainly for projects related to proxy advisors (PAs) and financial advisors (FAs) who deal with activists. In the second half of the previous fiscal year (October 2022 to March 2023), the company saw a recovery in receiving orders for large projects with unit prices of JPY50 mn or more.

Given the inevitable improvement in corporate governance after the scandals, it is time to be aware of the possibility that IRJHD’s business conditions may soon bottom out.

* Excerpts from IRJHD’s financial results presentation materials

(Reported on June 7)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/