Japan Markets ViewInvestors Eye Socionext (6526), an Advanced Semiconductor Company with Continued High Growth

Jun 06, 2023

[QUICK Market Eyes] Movements in the semiconductor industry are picking up. Amid increasing U.S. restrictions on semiconductors against China and rising tensions between China and Taiwan, governments of major countries and semiconductor-related companies are increasingly diversifying their manufacturing bases. Under such circumstances, the Japanese government has been aggressively attracting foreign companies to Japan in an effort to regain its footing in the semiconductor sector. This trend is also evident in the fact that U.S.-based Micron Technology has announced an investment of up to JPY500 bn in Hiroshima as the world’s semiconductor leaders gathered in Japan ahead of the G7 Summit. In addition, the Ministry of Economy, Trade and Industry (METI) released a revised draft of its “Strategy for Semiconductors and the Digital Industry.” This is likely to expand business opportunities for Socionext (6526), which is involved in advanced semiconductors.

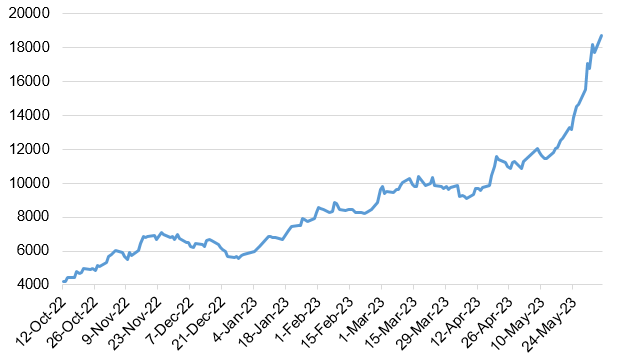

Socionext’s Stock Price Trend since Listing

Tailwind

METI released a revised draft of the “Strategy for Semiconductors and the Digital Industry,” which outlines the direction of industrial policy, at the 9th Semiconductor and Digital Industry Strategy Review Conference held on May 30. The strategy is scheduled to be finalized, and reflected in the Basic Policy on Economic and Fiscal Management and Reform by the end of June. METI presented its basic approach, which includes creating new leading cases by attracting investment and human resources in Japan and abroad. Furthermore, the ministry set a goal of achieving Japanese semiconductor manufacturers’ sales of over JPY15 tn in total by 2030 (about three times the sales in 2020).

As for generative AI, METI has added an industrial strategy to promote its utilization, and has proposed a policy to develop guidelines for businesses, deploy best practices across the board, and consider measures to train human resources. This is expected to be a tailwind for Socionext, which has “edge computing technology” that performs advanced information processing with low power consumption.

Socionext is a fabless semiconductor manufacturer that was formed by integrating the semiconductor divisions of Fujitsu and Panasonic. The company designs and develops system-on-chips (SoC) tailored to specific customers and products. SoC is a semiconductor product that integrates CPU, memory, and other functions into a single chip, and is widely used in mobile devices such as smartphones and tablets, as well as IoT devices. The company pioneered its unique “Solution SoC” business model based on the technology and experience it has cultivated over many years. This model is used in advanced technology fields such as automobiles, data centers, networking, and smart devices.

Strong Performance

Prior to the integration, Fujitsu and Panasonic’s semiconductor divisions had struggled to fully leverage their strengths in semiconductor design and development mainly because they had their own factories and focused on the domestic market. However, with the shift to a fabless structure after the integration, efforts have been made to transform the business model from System LSI business, which had become a heavy burden, into solution SoC business.This produced positive results. Overseas sales ratio has exceeded 50%. Moreover, by establishing a new branch in Taiwan to take on global supply chain management, the company has been able to supply products to customers in a timely manner and reduce costs by shortening lead times, etc. Additionally, with the expansion of the semiconductor ecosystem, companies such as Apple and Tesla are increasingly manufacturing advanced SoC in-house in order to differentiate their products and services. This trend is also likely to be a tailwind for Socionext.

The company’s current performance has been strong. In the consolidated financial results for the fiscal year ending March 31, 2023, announced at the end of April, net sales increased 64.7% YoY to JPY192.7 bn and operating income increased 2.6 times to JPY21.7 bn. Both results exceeded the company’s forecasts (net sales of JPY190 bn and operating income of JPY19.5 bn), which were revised upward when the 3Q results were announced.

The company’s net sales are composed of NRE revenue received in stages based on the costs incurred during the design and development process as well as product sales, which are received at the mass production stage. In the fields of data centers and networking, Socionext made progress in securing production quotas from contract manufacturers in response to the startup of new product mass production. This resulted in a significant increase in product sales. Additionally, the weaker-than-expected exchange rate of the yen against the U.S. dollar contributed to higher sales. For the fiscal year ending March 31, 2024, the company anticipates a modest increase in both sales and profit, with net sales of JPY200 bn, up 3.8% YoY, and operating income of JPY22.5 bn, up 3.6% YoY. Many semiconductor companies expect a decrease in profits due to the sluggish semiconductor market. Given this situation, Socionext’s custom products, which are less susceptible to market conditions, will give it a relative advantage.

Socionext’s stock was initially listed on the Prime Market in October 2022. Because it was a large deal with a market capitalization of over JPY100 bn, the initial price was only JPY3,835, 5% above the initial public offering price (JPY3,650). Since then, however, the stock price has continued to rise due to strong performance and expectations for a recovery in the semiconductor market. In semiconductor stocks in general, the situation of increasing pressure for profit-taking sales should be a good opportunity for bargain buying.

(Reported on June 1)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/