Japan Markets ViewExploring Factors Turning Investor Sentiment Positive Based on Nikkei 225 Performance

Jun 01, 2023

[QUICK Market Eyes] With financial results announcements by listed companies now over, the forecasts of companies with a fiscal year ending in March have shifted from “estimated results for the fiscal year ending March 2023” to “forecast for the fiscal year ending March 2024.” Companies with a fiscal year ending in December also updated their forecasts for the current fiscal year, giving a “clear view” of their performance in the previous year and guidance for the current fiscal year.

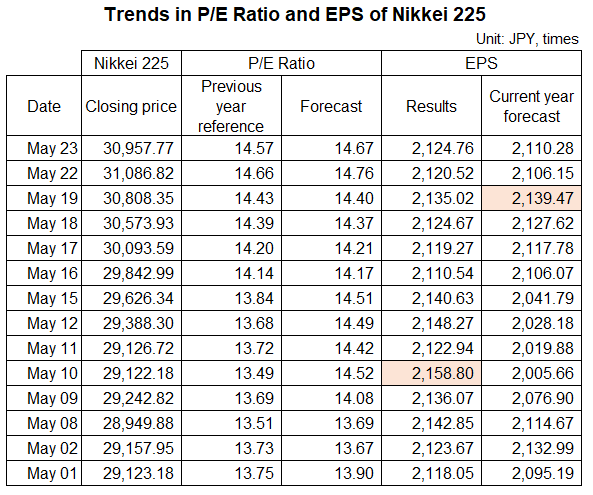

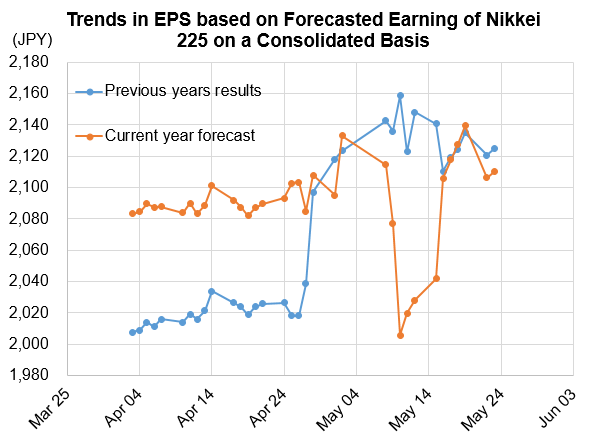

The following table shows the changes in the price-to-earnings ratios (P/E ratios based on actual and forecasted earnings, both on a consolidated basis) for the month of May. Calculations was made assuming that the data were for a single company based on the constituents of Nikkei 225, which is published daily by the Nikkei Inc. Changes in earnings per share (EPS) were also estimated based on the closing prices of the Nikkei 225.

As of the end of consecutive holidays in May, the forecast for the current fiscal year looked inferior to the strong performance of the previous fiscal year. This was likely one of the reasons for investors’ uneasiness. EPS for the previous fiscal year was the highest at 2,158.80 yen on May 10. However, it was at a time when the outlook for this year’s earnings was still uncertain, as major steel companies were forecasting lower profits. Later, with the progress of earnings announcements, a difference between EPS based on the previous year’s actual results and the one based on this year’s forecast became smaller. Investor sentiment may have turned more positive, assuming that corporate earnings for the current fiscal year will not decline as much as previously expected.

EPS based on forecasted earnings rose to 2,139.47 yen on May 19. When simply compared to the previous year’s results, it may be natural to view this negatively as sluggish growth or a plateau. However, a positive reaction that earnings for the current fiscal year will not decline as much as expected could be a driver to the post-bubble economy high of the Nikkei 225.

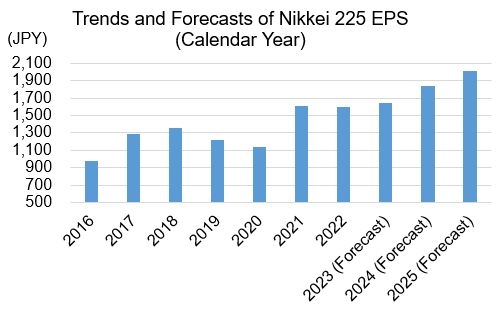

Let’s look at EPS on a forecasted basis for the Nikkei 225 using QUICK Factset Workstation. By drawing a chart showing the actual results for 2016-2022 and the forecast for 2023-2025, the improvement in corporate performance can be visually grasped. Some semiconductor-related companies have explained to investors their scenario of “earnings bottoming out during this fiscal year and profit recovery in two to three years,” and their stock prices appear to have responded to this scenario. Strong fundamentals of major companies could be seen as supporting the current rally in stock prices.

(Reported on May 25)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/