Japan Markets ViewPopular NISA Stocks Also Enjoy Strong Performance

May 26, 2023

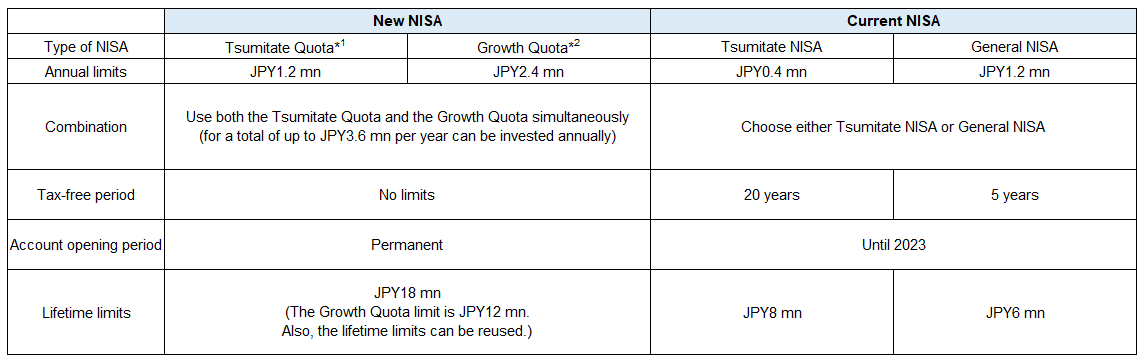

[QUICK Market Eyes] Nippon Individual Savings Account (NISA), a small investment tax exemption system, is popular among many novice investors. The “New NISA” (with changes from the current NISA described at the end of this article) to be launched in 2024 is expected to further boost the number of people who will begin to invest in this system. Among current NISA users, stocks with high dividend yields are popular. Such stocks have exhibited strong stock price performance as well.

“High Dividend Yield” Is a Keyword for Popular NISA Stocks

A strategist at a securities company says, “I know some fund managers who created funds focusing on popular NISA stocks, which have been performing well,” but did not name the funds in question.

“Popular NISA stocks continue to receive a long-lasting inflow of funds from individual investors, but there are many ‘unpopular’ stocks that not many institutional investors own. This makes it difficult to sell such stocks,” explains the strategist.

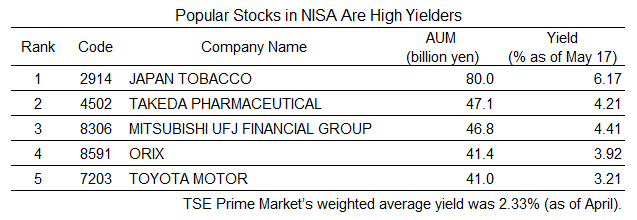

QUICK compiles a ranking of NISA accounts at online securities companies in terms of assets under management at the end of each month. As of the end of March, Japan Tobacco (JT, 2914) ranked first with JPY80 bn, followed by Takeda Pharmaceutical (Takeda, 4502) with JPY47.1 bn and Mitsubishi UFJ Financial Group (Mitsubishi UFJ FG, 8306) with JPY46.8 bn.

“High dividend yield” is a keyword common to these stocks. Compared to the TSE Prime Market’s weighted average yield of 2.33% (as of April), the yields of JT, Takeda, and Mitsubishi UFJ were far above the average, at 6.17%, 4.21%, and 4.41%, respectively, as of May 17.

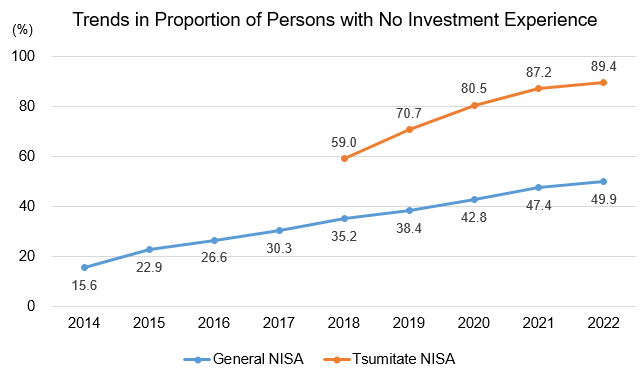

Launched in 2014, NISA is a system designed to encourage even novice investors to easily manage their assets. According to the Japan Securities Dealers Association (JSDA), 49.9% of those who have opened “General NISA” accounts, which allow investment in stocks, had no prior investment experience (as of the end of December 2022). With gradual growth in awareness of NISA, the proportion of novice investors among those who have opened accounts in recent years has been increasing.

*The graph is based on JSDA data

For such newcomers to the investment world, a high “dividend yield” would be an easy-to-understand indicator when selecting stocks. Furthermore, in recent years, “investment using points” has been on the rise. According to a securities company, “high-dividend stocks remain popular” as destinations for investment of the points earned in daily life.

Popular Stocks Outperform TOPIX

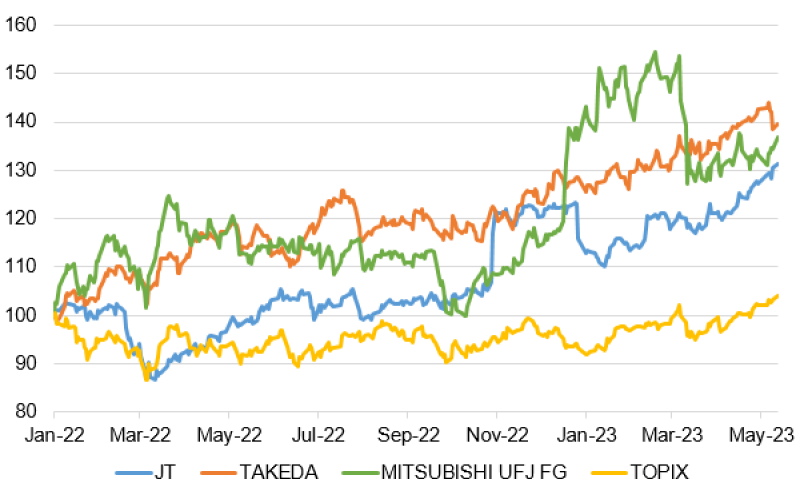

Popular NISA stocks have also shown a strong performance in terms of prices when viewed from a slightly longer perspective. A comparison of the Tokyo Stock Price Index (TOPIX) and the top three stocks from January 2022 shows that the latter performed better than the former.

As explained by the strategist earlier, it is difficult to sell stocks that are “unpopular” among institutional investors, even when their prices rise. On the other hand, novice investors and NISA users tend not to buy and sell stocks frequently, but to invest their money slowly and gradually. This is because their objective is to “receive dividends” rather than investment income.

Amidst this situation, Nippon Telegraph and Telephone (NTT, 9432) announced on May 12 that it would split one share into 25 shares, with a record date of June 30. The company stated that this was in anticipation of the New NISA, and CEO Akira Shimada said at the financial results meeting on the same day, “We need to lower the unit price in order to motivate young people to invest in our company.”

The launch of the New NISA is less than a year away. Although NTT’s stock split has its pros and cons, the company’s move will nevertheless attract attention as its investor base expands.

(Reported on May 18)

Key Points of the New NISA (Changes from the Current NISA)

*1 It depends on the financial institution, but usually the users are expected to make monthly contributions into their investment savings accounts.

*2 As with the General NISA, it allows investment in listed stocks and most equity investment trusts.

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/