Japan Markets ViewExploring Why Plant Demolition Company BESTERRA (1433) Is in Spotlight

Jul 25, 2023

[QUICK Market Eyes] The Japanese government has set a goal of reducing GHG emissions by 46% by FY2030 (compared to FY2013) and achieving carbon neutrality by FY2050 as a countermeasure against global warming. Infrastructure business companies such as those in the steel and electric power industries, which are major greenhouse gas emitters, are called on to conduct their businesses focusing on the SDGs. Accordingly, these companies have successively announced CO2 emission reduction targets. In the medium to long term, demolition projects are expected to increase due to the aging of plants built during the high economic growth period. Given this situation, business opportunities are anticipated to expand for BESTERRA (1433), which specializes in plant demolition, bringing it into the spotlight.

Plant Demolition Demand Grows Driven by Decarbonization

BESTERRA is a one-of-a-kind company specializing in plant demolition, and is involved in demolition work for all types of plants, including steel, electric power and gas, and petroleum plants. The company has developed unique, patented demolition methods that realize world-leading decarbonized demolition, represented by the “apple peeling method” and the “method for pushing down a stack structure using the base.” In addition, the company has extensive know-how and experience in the removal of hazardous materials such as polychlorinated biphenyls (PCBs), asbestos, and dioxins. BESTERRA offers a wide variety of plant demolition with excellent cost, work period, and safety, while giving full consideration to the reuse and recycling of scrap and other resources, as well as environmental measures. With the trend toward decarbonization, the steel and electric power industries, which are BESTERRA’s customers, have announced CO2 emission reduction targets. In this context, the demand is increasing for demolishing aging plants that were built during the high economic growth period.

BESTERRA released in early June its consolidated financial results for the February-April 2023 (Q1) period, with net sales down 8.6% YoY to JPY1.537 bn and an operating loss of JPY35 mn (vs. an operating profit of JPY196 mn in Q1 of the previous year). While orders and inquiries for new large-scale projects were strong, the start of demolition work already ordered is concentrated in Q2 and later. In addition, low-margin demolition projects ordered in the previous period pushed down profits. However, the amount of orders received, which have been the focus of much attention in terms of prospects, surged 4.4 times over the previous year to JPY7.427 bn, led mainly by the steel industry, exceeding the amounts on an annual basis in the past. Furthermore, the backlog of orders received also reached a record high of JPY9.303 bn, a 5.5-times increase over the previous fiscal year. The company is enthusiastic about taking advantage of the growing demand for demolition and steadily receiving orders for demolition projects, and is expected to expand its business performance over the medium to long term.

The company has formulated a medium-term management plan, “Decarbonization Action Plan 2025” covering the next three years. Under the plan, the company intends to improve profitability by taking business environment changes as opportunities, promoting decarbonization management, and transforming its corporate culture. For the fiscal year ending January 31, 2026, the final year of the plan, the company has set the targets for consolidated sales of JPY12 bn, operating profit of JPY1.2 bn, and return on equity (ROE) of 13%. The company intends to make every effort to achieve these targets as soon as possible.

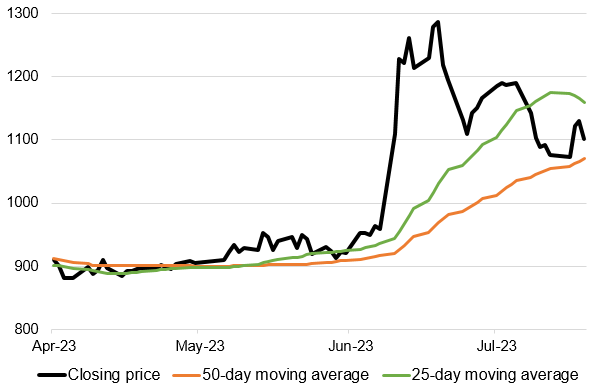

<BESTERRA Daily Chart>

Although BESTERRA’s stock price fell due to selling for profit taking after the sharp rise following the earnings announcement, the stock price stopped falling around the 50-day moving average. Thus, there is an emerging sense that the correction phase is almost over. Once the company hits the 25-day moving average (1159 yen at the market closing of July 21), which is just ahead, the stock price is likely to soar again. We need to take a closer look at BESTERRA’s stock.

(Reported on July 21)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/