Japan Markets ViewSumitomo Forestry (1911) Stock to Enter a New Upswing Phase Following U.S. Housing Market Upturn?

Jul 31, 2023

[QUICK Market Eyes] Sumitomo Forestry (1911) is attracting investment money amid signs of recovery in the U.S. housing market. Among Japanese homebuilders, Sumitomo Forestry has a relatively high ratio of sales to the U.S. market. In June, the company’s stock price hit a record high on the assumption that it would benefit from improved U.S. market conditions. If the bottoming out of earnings is confirmed, the stock price is likely to enter a new phase of appreciation.

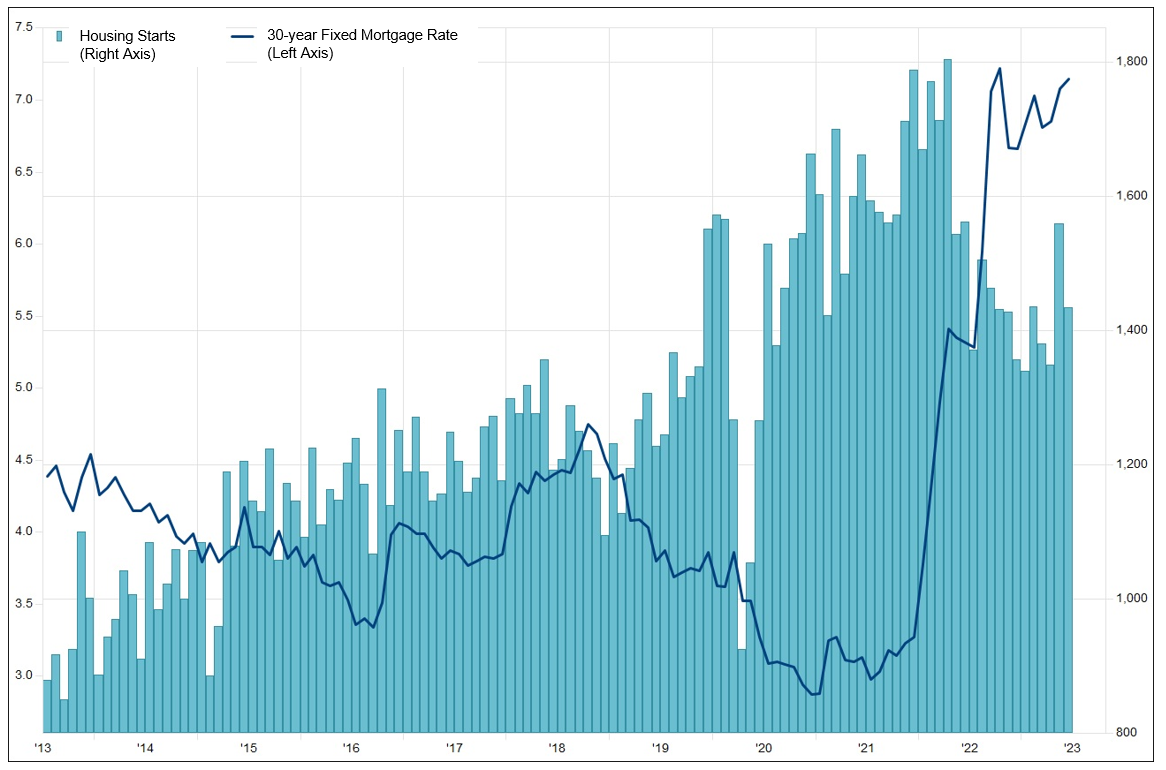

Although U.S. mortgage rates remain high at around 7%, the U.S. housing market is showing signs of bottoming out. Housing starts in May made a rapid recovery, up 16% from the previous month to 1,559,000 units (revised figures). Although June saw an 8% month-on-month decline to 1,434,000 units in reaction to the previous month, the recovery trend may continue. One of the reasons for this is the lack of existing home inventory in the U.S.

Existing homes account for 80 – 90% of the U.S. housing market. The number of properties decreased due to declining demand for resale by owners who took out loans during the low-interest-rate years. As a result, demand for new properties has increased, and construction starts have unexpectedly increased.

Housing Starts and Mortgage Rates in the U.S.

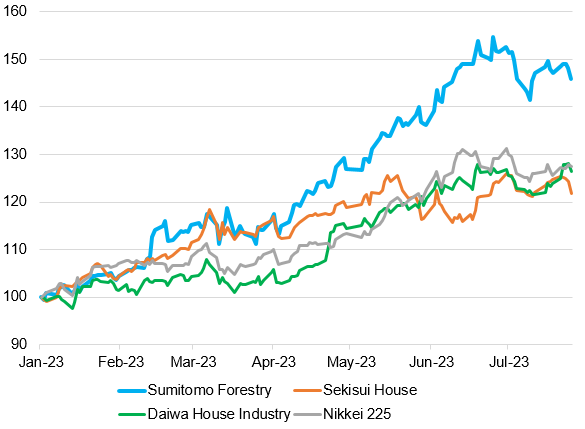

The ratio of sales to the U.S. market of the three major Japanese homebuilders is approximately 10% for Sekisui House (1928) and Daiwa House Industry (1925) respectively, while for Sumitomo Forestry, it is around 40%. Sumitomo Forestry is involved in the overseas housing sales business, mainly in the U.S. and Australia.

The difference is clearly reflected also in the stock prices. Comparing the stock price performance of the three homebuilders since the beginning of the year, the stock price appreciation of Sumitomo Forestry, which has already built its foundation in the U.S., stands out.

Relative Chart of Sumitomo Forestry

Sumitomo Forestry projects a 4% decline YoY in consolidated net sales to JPY1,598 bn and a 29% YoY drop in net profit to JPY77 bn for the fiscal year ending December 31, 2023. The company expects a decrease in both sales and profit. However, the declining profit margin may be reduced due to its recovery in the number of units sold in the U.S. In the January-March 2023 period, the number of units ordered exceeded the company’s initial forecast, and the company is on track to achieve its full-year sales target of 9,000 units. Lower lumber prices are also likely to contribute to higher profits.

The prospect of suspended U.S. interest rate hikes is also providing a tailwind. The June increase in the U.S. Consumer Price Index (CPI) came in below market expectations at 3.0% YoY and was widely perceived as a sign of slowing inflation. Although the Federal Open Market Committee (FOMC) decided to raise interest rates by 0.25% on July 26, some in the market expect the FOMC to suspend rate hikes at some time in the future. If the mortgage rate hike subsides, it will facilitate an improvement in housing market conditions.

Sumitomo Forestry has set a sales target of 23,000 units in 2030 and continues to focus on building a sales structure. The company intends to capture the wave of the market upturn by capitalizing on its strength in home sales to the U.S. market.

(Reported July 24, partially revised)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/