Japan Markets ViewArrival of EV Era – Odawara’s (6149) Automatic Winding Machines Serving Worldwide Customers

Jul 20, 2023

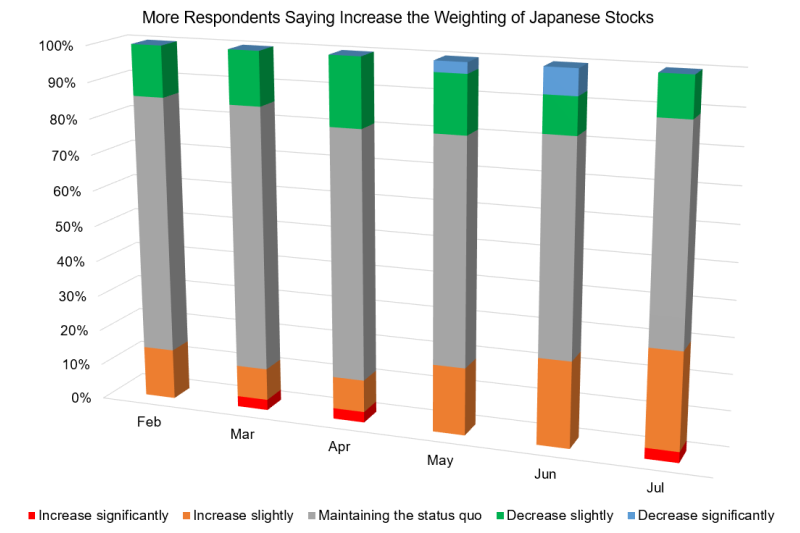

[QUICK Market Eyes] The QUICK Monthly Survey (Equity) in July revealed investors’ willingness to buy stocks at lower prices. In the question asking about their near-term investment stance, 30% of respondents answered that they would “Increase significantly” or “Increase slightly” their weighting of Japanese stocks, far exceeding the 11% who answered that they would “Decrease slightly” their weighting.

As for corporate earnings, recent retail companies’ results have been strong due to the reopening of the economy and successful price hikes, in line with the stock price rally to date. In the manufacturing sector, the stock price of YASKAWA Electric (6506) entered a correction phase after the earnings announcement. There is a strong sense that the market is running out of buying incentives. However, “the focus is on the recovery in earnings in the manufacturing sector, particularly in transportation equipment, in the April-June period, which will be in full swing from the latter half of July onward. If expectations of upswings increase due to a recovery in automobile production and a weakening yen, it will positively contribute to stock prices” (securities company). The search for buying opportunities is likely to intensify upon determining whether or not the Bank of Japan will revise its policy.

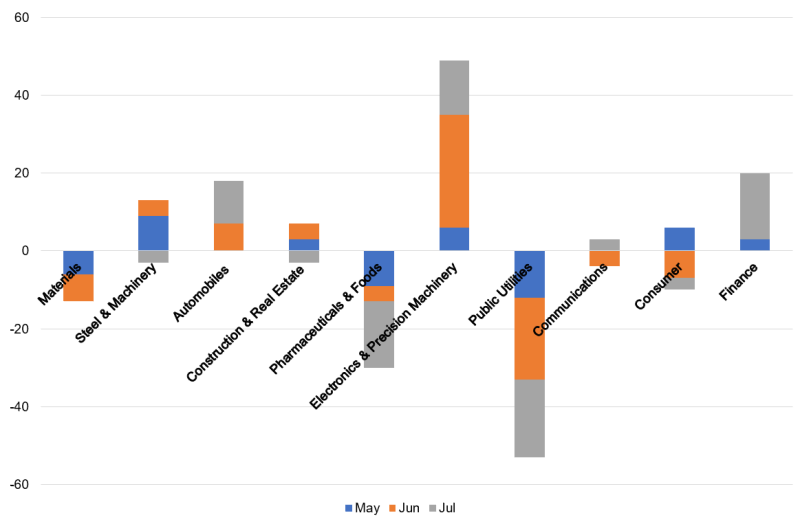

The Monthly Survey also asked respondents to indicate their investment stance for each sector. The balance between “overweight” and “underweight” was the largest for “Finance” at 17%, followed by “Electronics & Precision Machinery” at 14%, and “Automobiles” at 11%.

The recovery of capital investment in China is not as strong as market expectations, but new fields such as generative artificial intelligence (AI) and electric vehicles (EV) are starting up at an accelerating pace. The search for stocks with an eye toward potential earnings growth, not just short-term performance, is likely to intensify.

Attracts Attention for Automatic Winding Machines with Tesla as a Customer

In particular, companies with expanding commercial opportunities in EV-related fields are promising. One such company is Odawara Engineering (6149, Standard), which manufactures automatic winding machines to wind copper wire around motors. Since EVs are driven using electricity supplied to the motor, the winding machine plays an important role like the heart of the vehicle. Amid growing motor production volume fueled by the increasing EV popularity, the company’s strength lies in its ability to provide entire production systems, rather than just individual devices. Odawara Engineering enjoys the top market share in Japan as well as in the world, making it one of the leading global niche manufacturers.

The company’s annual securities report shows Hitachi Astemo, an auto parts subsidiary of Hitachi (6501), as a major business partner in recent years. Furthermore, the name of U.S. EV giant Tesla (TSLA) was found in the company’s annual securities report for the fiscal year ending December 31, 2018.

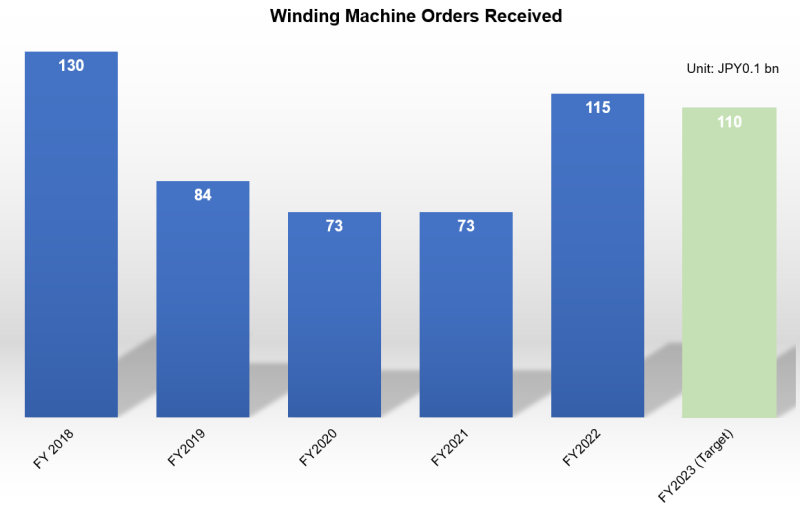

Currently, Odawara Engineering focuses on winding machines for vehicle drive motors. However, the process from inquiry, order receipt, delivery, and installation to the start of mass production often requires lead time that spans the fiscal year. Therefore, to raise sales levels, the company’s medium-term management plan sets an annual order volume target of JPY11 bn for this business from the fiscal year ending December 31, 2023, onward.

Given the intensifying competition as the market expands, this level is likely to be one of the factors in determining whether the business performance is booming or declining.

Looking at the recent stock price, the price-to-book ratio (P/B ratio) is below one. In order to raise valuations (investment evaluation), the company needs to stably receive orders for winding machines used in EVs and to formulate a growth scenario that includes production capacity expansion by leveraging its debt and other assets.

(Reported on July 12)

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/