Japan Markets ViewAre Investors Buying Stocks in Anticipation of End to Deflation?

Oct 02, 2023

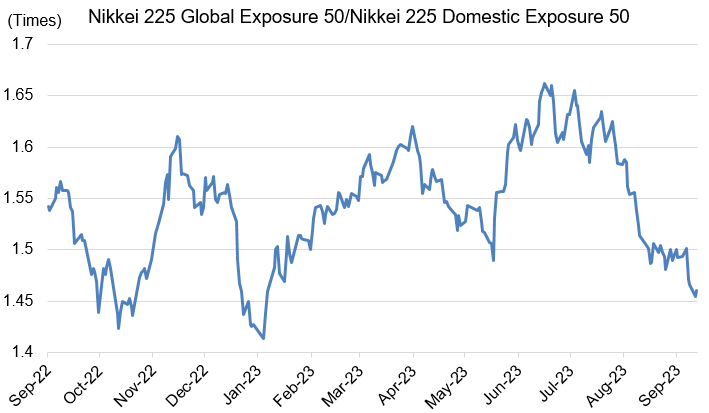

[QUICK Market Eyes] Japanese domestic demand stocks have been gaining momentum. On September 12, the multiple of the Nikkei 225 Global Exposure 50 Index divided by the Nikkei 225 Domestic Exposure 50 Index fell to the lowest level since January 6. This year’s strong foreign demand stocks trend driven by the artificial intelligence (AI) boom, especially in semiconductor-related stocks, is being swept away.

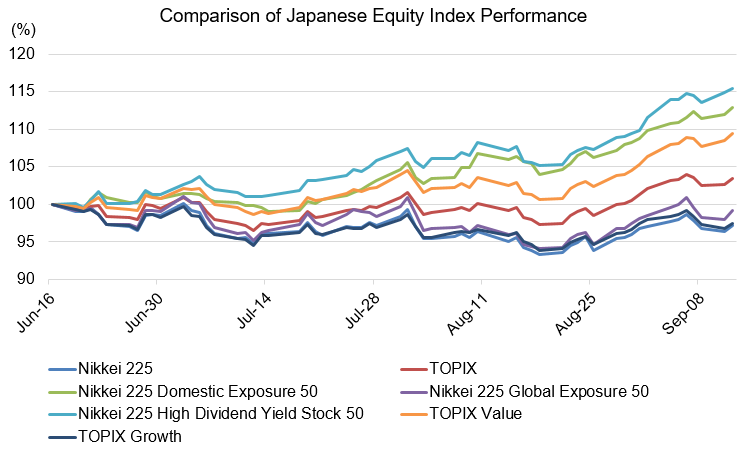

In terms of relative performance since the beginning of the year, the Nikkei 225 Domestic Exposure 50 Index underperformed the Nikkei 225 Global Exposure 50 Index by nearly 20 points at times. Recently, however, the spread has been narrowed to around minus 3.6 points. Since June 16, when the multiple of the Nikkei 225 Global Exposure 50 Index divided by the Nikkei 225 Domestic Exposure 50 Index was at its highest, the Nikkei 225 High Dividend Yield Stock 50 Index, Nikkei 225 Domestic Exposure 50 Index, and TOPIX Value have remained positive. On the other hand, the Nikkei 225 Global Exposure 50 Index and TOPIX Growth have been negative, clearly showing the difference in performance.

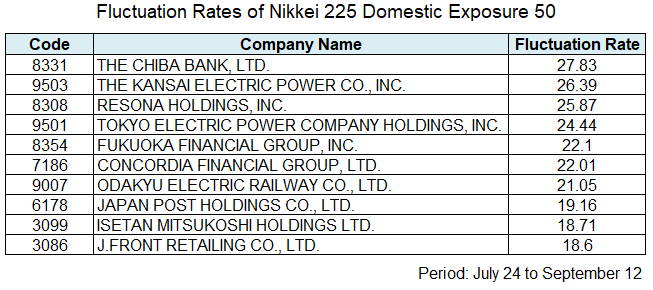

Looking at the fluctuation rates of the index constituents to the present from late July, when the dominance of domestic demand stocks over foreign demand stocks surged, the rising prices of bank stocks stand out among the Nikkei 225 Domestic Exposure 50 Index constituents. This rise appears to be driven by the decision of Bank of Japan (BOJ) at its July monetary policy meeting to take measures for flexibly managing yield curve control (YCC). It is also attributable to the rise in interest rates on the expectation of early normalization following the recent comments by BOJ Governor Ueda. In addition, the rally can be seen in electric power stocks and inbound (foreign visitors to Japan) related stocks, as expectations for improved performance have increased due to price hikes and a lull in oil prices.

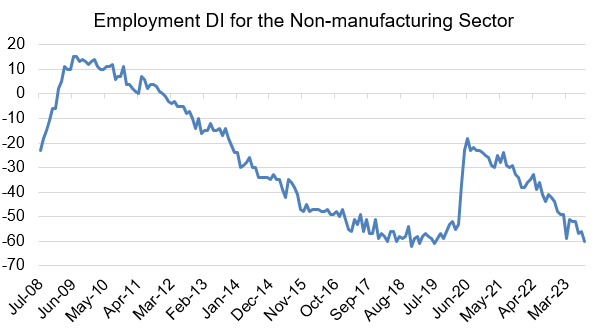

Meanwhile, there are concerns that labor shortages and rising raw material costs due to the weak yen could have a negative impact on the Japanese domestic demand stocks’ performance. According to “QUICK Short-Term Economic Survey (QUICK Tankan)” for September conducted by QUICK, the employment diffusion index (DI) in the non-manufacturing sector deteriorated to -60 from the previous month (-56), marking the lowest level in four years and two months since July 2019. This indicates a growing sentiment toward labor shortages. It is also below the average (-28.5) since July 2008, when the monthly survey of this DI started, and the -1σ level (-52). In the manufacturing sector, the sentiment toward labor shortages is strong, but not as strong as in the non-manufacturing sector.

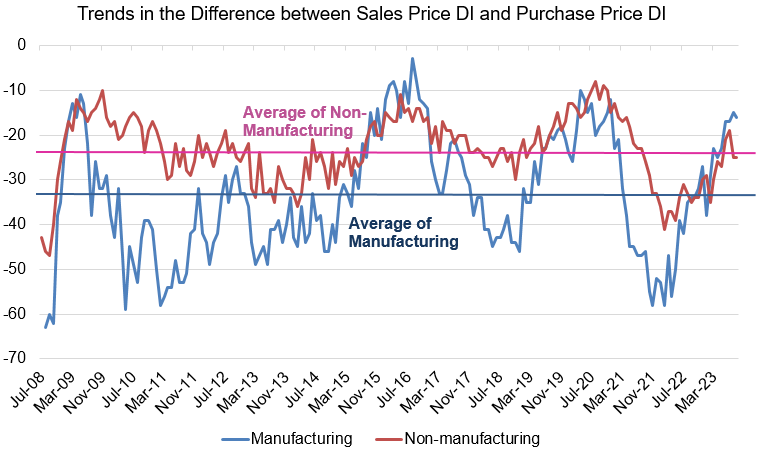

The difference between the sales price DI and the purchase price DI is improving in both the manufacturing and non-manufacturing sectors. Still, the improvement is greater in the manufacturing sector. The impact of labor shortages could weigh heavily on the performance of the non-manufacturing sector.

Regarding the current Japanese stock market, one fund manager commented, “Investors’ buying of stocks in anticipation of an end to deflation may be pushing the Japanese stock prices higher,” while acknowledging that labor shortages may be a headwind for domestic demand stocks, which are mostly in the service sector. It suggests that investors are buying Japanese domestic demand and value stocks to a certain extent in anticipation of performance improvements, such as higher sales, and higher interest rates, along with moderate inflation. The relatively low productivity in the service industry is undeniable. However, based on the example of hotels with room rates rising more rapidly than occupancy rate improvement, wage hikes will help improve labor shortages. Given the large disparity in service prices between Japan and other countries, there is ample room for future performance improvement in the process of appropriate pricing to fill the gap.

(Reported on September 15)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/