Japan Markets ViewDaifuku (6383), Trusted Also by UNIQLO, Grows on Two Strengths

Sep 22, 2023

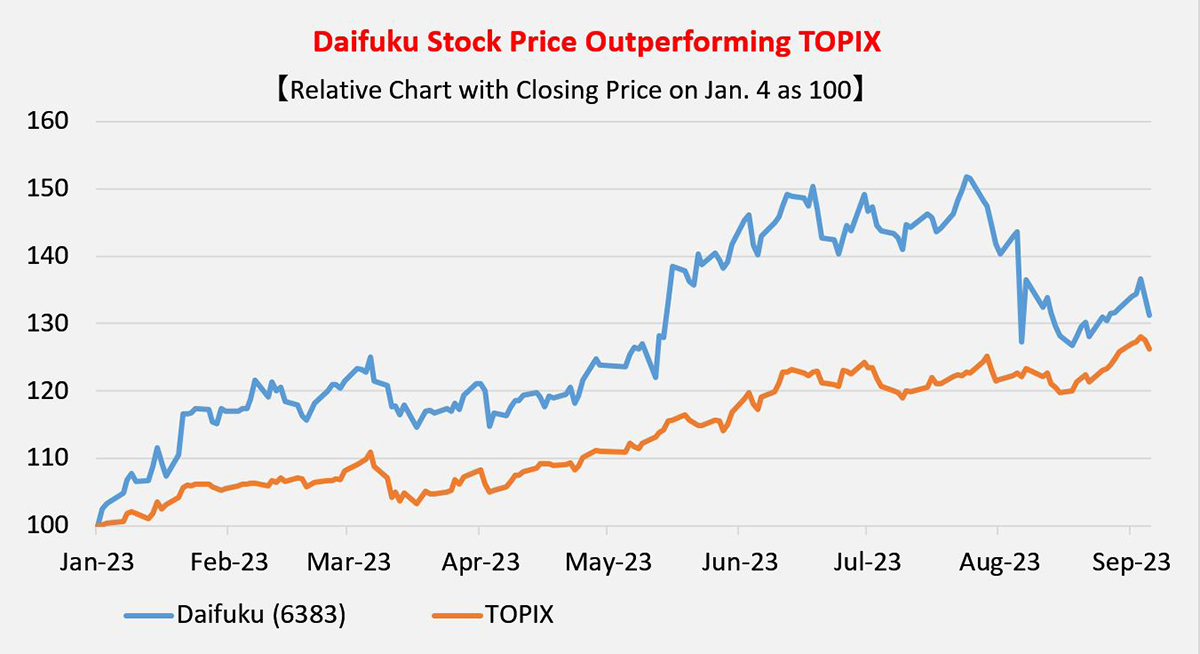

[QUICK Market Eyes] The stock price of Daifuku (6383), a company involved in logistics warehouse automation, has been on an upward trend this year. Its performance since the beginning of the year has outperformed the Tokyo Stock Price Index (TOPIX).

The company expects a profit decline in the fiscal year ending March 31, 2024, due to prolonged inflation. However, stable growth over the medium term appears to contribute to market confidence. Behind the stability of growth are two strengths: “not limiting the industries to handle (carry anything)” and “thorough after-sales service.”

Strength 1: “Not Limiting the Industries to Handle”

Daifuku has been involved in logistics warehouse automation and the world’s largest material handling equipment manufacturer for nine consecutive years (as of 2022, the most recent year available). The company’s stock price rose sharply in 2020 during the COVID-19 pandemic, and logistics was a major factor driving this rise.

The COVID-19 pandemic fueled growing demand for e-commerce (EC) and revealed labor shortages in the logistics industry. As a result, growth expectations for Daifuku, which handles warehouse automation, increased. Tadashi Yanai, Chairperson, President & CEO of Fast Retailing (9983), which operates UNIQLO, expressed tremendous confidence in Daifuku at a press conference when the company partnered with Daifuku in 2018, saying, “Daifuku is the most reliable company in the world in this field, and the only one that can work with us until the very end.”

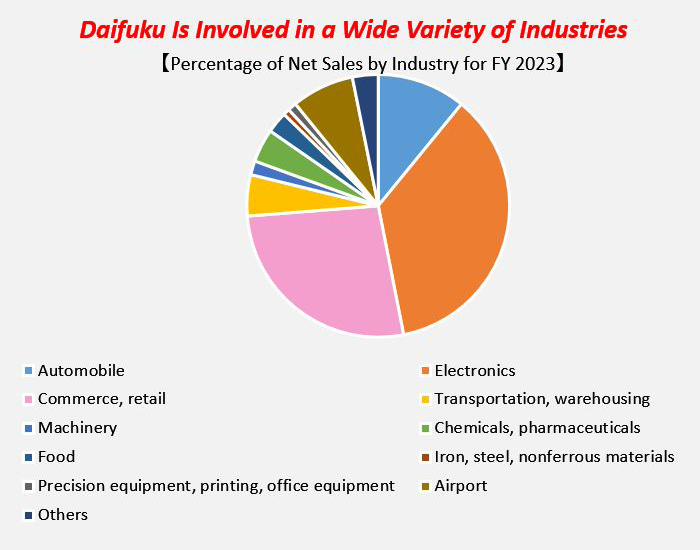

Daifuku’s true strength lies in the fact that it does not limit the industries it handles. In addition to logistics warehouse automation, Daifuku has also realized transportation efficiency in various industries by capturing the needs of the times, such as semiconductor and automobile production lines, airport baggage handling systems, etc. The company’s stable growth is underpinned by its stance of not relying on any particular industry.

Akira Mizuno, an analyst at UBS Securities, said, “Daifuku has specific customers in the semiconductor and automobile industries, and thus, its performance is expected to follow the growth of those industries. The company also sees stable growth in its logistics business, and its overseas profitability is improving.”

In a past interview, Hiroshi Geshiro, President and CEO of Daifuku President, attributed the stable growth to the company’s capability of covering many industries without relying on industries in good shape at the time.

Strength 2: Thorough After-sales Service

Another strength of the company is its thorough after-sales service. It is the “core business” accounting for around 25% of sales. Mr. Geshiro emphasized, “The work is only half done when we have delivered the products. We manufacture most of our products in-house, allowing us to respond immediately to problems after delivery.” This has helped build trust with customers and has resulted in stable earnings, according to Mr. Geshiro.

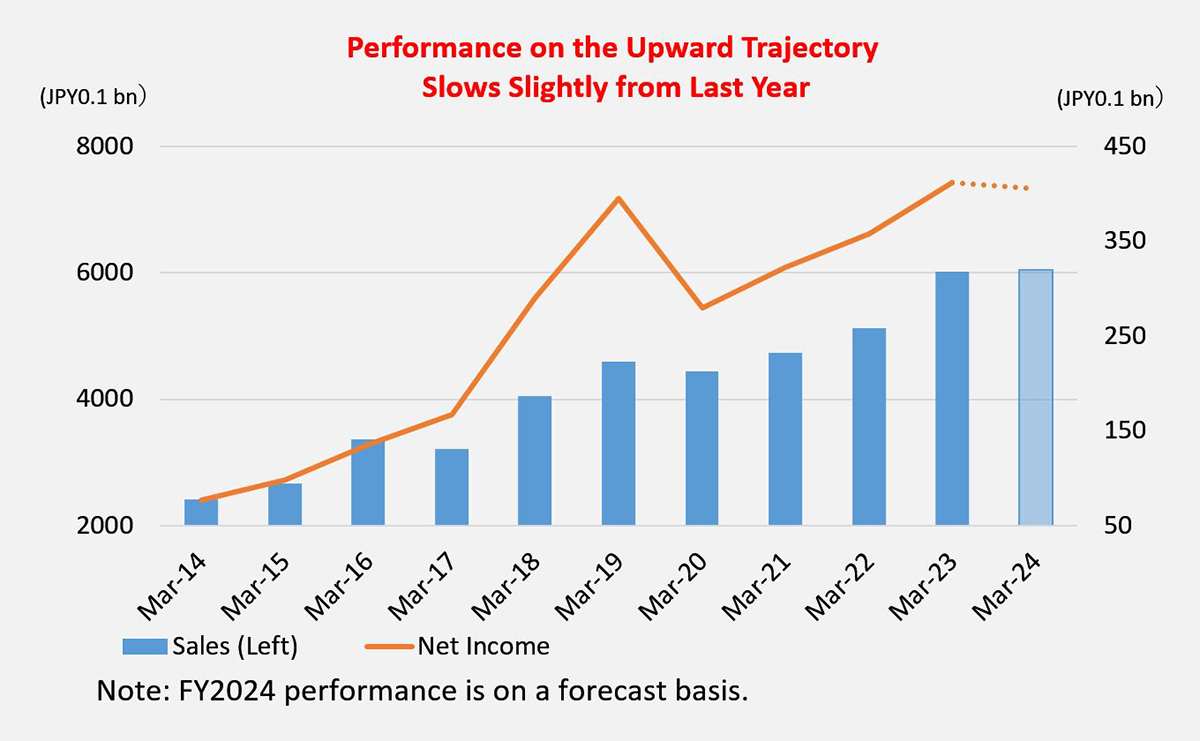

Stalled Earnings Expected for the Current Fiscal Year

However, growth is expected to stall in the fiscal year ending March 31, 2024. The company has been unable to fully pass on the rising costs of raw materials due to global inflation, resulting in a decrease in operating income for the first time in four fiscal years. Daifuku expects this impact to linger through the April-September 2023 period; and on August 8, revised downward its earnings forecast for the same period. The company described the difficult situation, saying, “It is hard for us to pass on prices to companies with which we have had a long-standing business relationship.

However, Daifuku expects improvement in the second half of the fiscal year ending March 31, 2024 (October 2023-March 2024) and has left its full-year forecast unchanged. The immediate focus will be on whether the company can return to its growth trajectory in the second half of the year and beyond. The market is becoming increasingly interested in whether Daifuku’s two fundamental strengths, “Policy of carrying anything” and “thorough after-sales service,” can accelerate the sustainable growth.

(Reported on September 14)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/