Japan Markets ViewAccelerating Dissolution of Parent-Subsidiary Listings

Dec 22, 2023

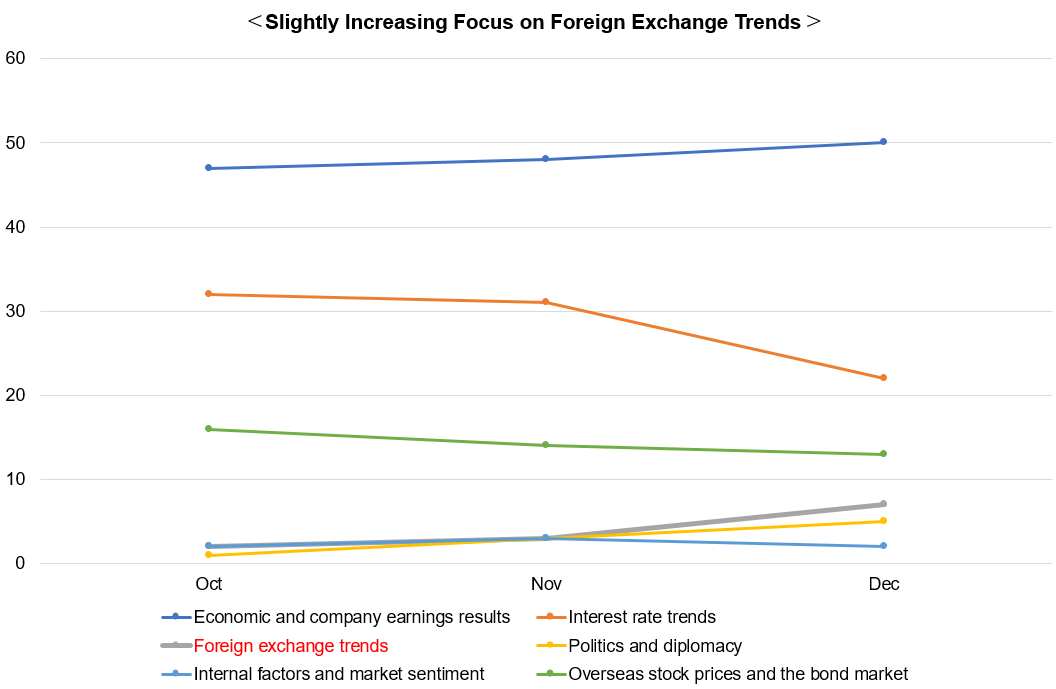

[QUICK Market Eyes] According to the QUICK Monthly Survey (Equity) in December, many expect the Nikkei 225 to be at the 33,000 (median) level at the end of December. Currently, the upward trend in stock prices is likely to be paused as the market is somewhat swung by the foreign exchange market over the Bank of Japan’s monetary policy revision. However, on an annual basis, the market is expected to maintain a rally for the first time in two years.

One of the reasons why the stock market has become more resilient as sentiment improves is that the U.S. economy is becoming less overheated, and investors are becoming more aware of expectations for policy shifts. While there is still uncertainty about a shift to lower interest rates, the rate hike phase has come to an end, and its impact on the stock market is diminishing.

Meanwhile, around the beginning of the new year, more attention is likely to be paid to developments of the Japanese policy authorities. If they revise the policy, Japanese stock market volatility will most likely increase once again through the exchange rates. Most of the assumed exchange rates for the current fiscal year are around 140 yen to the dollar. Toyota Motor (7203) has set the assumed exchange rate (average), which is the basis for its full-year forecast, at 141 yen to the dollar. The yen’s depreciation has helped to support the performance of Japanese companies amid the strong uncertainty over the volume-based outlook. Therefore, a somewhat cautious mood may emerge on the upside momentum.

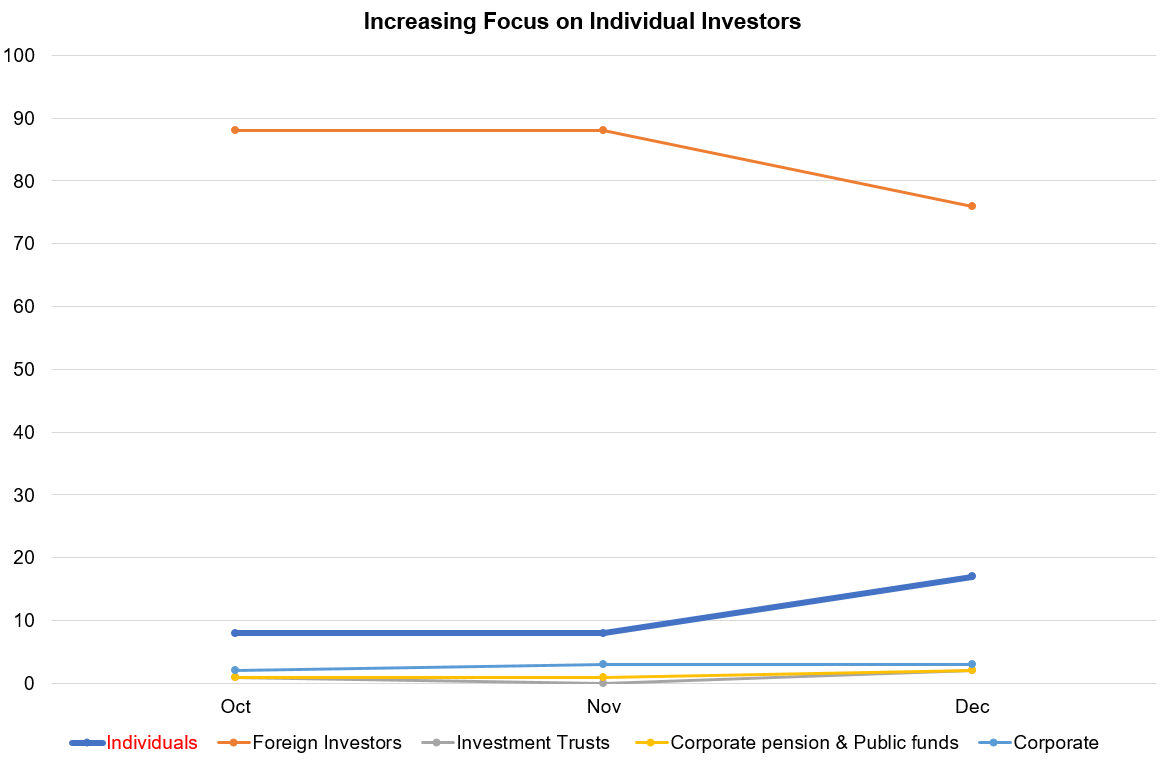

In 2024, the New Nippon Individual Savings Account (NISA) will be launched in Japan. Accelerating inflows of individual investors will be a positive factor on the supply-demand side. The December survey also revealed that individual investors have been gradually increasing their share of attention by investor type.

The New NISA is unique in that the system will be made permanent and that the “Growth Quota” and “Tsumitate Quota” can be used simultaneously. The Growth Quota with the annual investment limit of JPY2.4 mn allows for the trading of individual stocks. Lowering of investment unit prices is also underway at companies. Stocks familiar to shareholders, such as those with shareholder benefits, may draw attention.

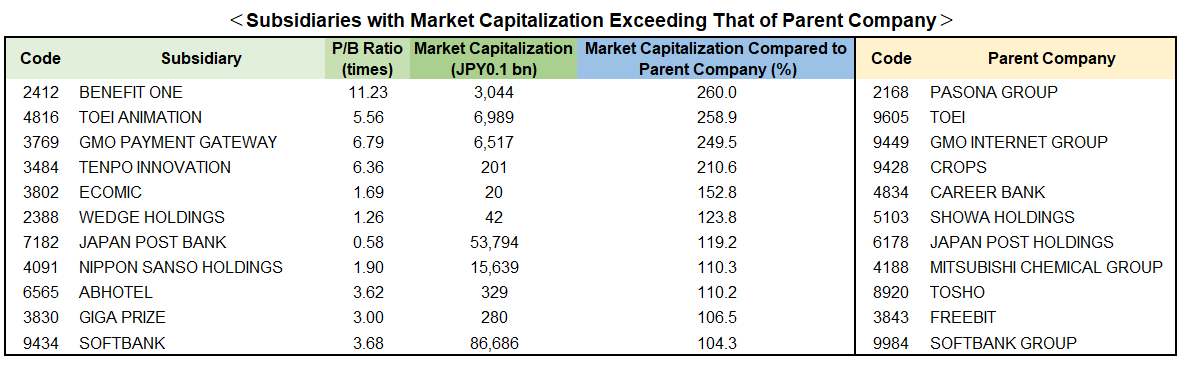

Another change underway is the TSE’s initiative to improve capital efficiency and corporate governance. Over the past year, companies have taken concrete actions such as strengthening shareholder returns and eliminating cross-shareholdings. The issue of parent-subsidiary listings, which has been viewed as problematic from the perspective of protecting minority shareholders’ interests, has also seen significant movement. This will be the focus of continued attention in 2024.

Symbolic of this is Benefit One (2412), which triggered a takeover battle between M3 (2413) and Dai-ichi Life Holdings (8750). For a long time, Benefit One and its parent company, Pasona Group (2168), have had an inverse relationship in terms of market capitalization. Pasona Group can use the proceeds from the sale of its stake in Benefit One for investment in its growth.

The dissolution of a parent-subsidiary listings can be achieved by making the subsidiary a wholly owned subsidiary, selling the shares, etc. In the case of a profitable subsidiary, making it a wholly owned subsidiary would also benefit the parent company in capturing minority shareholders’ interests that had been leaked to the outside the company. However, in cases where there is little business overlap or synergy, the funds obtained from selling the shares may be used for investment or return of profits. This would be especially beneficial in cases where the market capitalization is reversed between the parent and the subsidiary, as in the case of Bene One and Pasona Group, even considering the burden of the acquisition.

According to the QUICK survey, there are 11 parent-subsidiary relationships where the parent company has a smaller market capitalization than the subsidiary. Most notably, Toei Animation (4816, Standard) has a market capitalization of more than twice that of Toei (9605), its parent company.

*P/B ratios, market capitalization, and percentages are as of December 8.

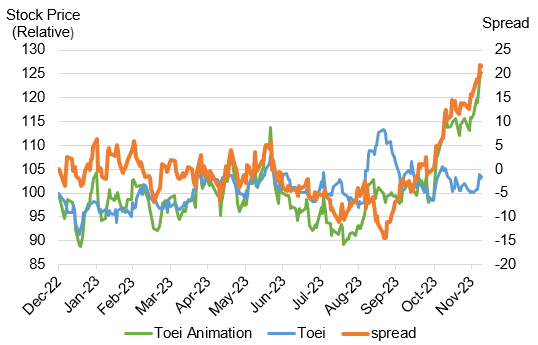

Toei Animation has high growth potential due to the expansion of popular anime copyrights. Market expectations are also high for the new animation “Dragon Ball DAIMA,” which is scheduled to begin airing in the fall of 2024. The company’s current stock price is in a record-high range. On the other hand, Toei Animation’s earnings contribution to Toei is significant. In the fiscal year ending March 31, 2023, Toei’s net income was JPY15 bn, while net income attributable to noncontrolling interests was JPY12 bn. Considering that most of the profit is attributable to minority shareholders of Toei Animation, making it a wholly-owned subsidiary will significantly boost Toei’s overall profit.

However, the financial burden of making Toei Animation a wholly-owned subsidiary is not small. Assuming that Toei acquires all the shares held by shareholders other than Toei, it will require approximately JPY460 bn, or about JPY500 bn, if the premium for tender offer (TOB) is taken into account. Toei’s total assets were JPY379.8 bn as of the end of March 2023. As the gap in market capitalization between the parent and the subsidiary companies widens, the hurdle becomes even higher.

The gap in stock prices between the parent company and the subsidiary has been widening recently.

Toei Animation also has a high ratio of corporate shareholders, reaching 80%. In addition, the company has high shareholdings by companies other than Toei. Toei Animation does not meet the listing standards of the Standard Market in terms of the ratio of tradable shares. The company encourages corporate shareholders to sell their shares in the company. A review of the capital policy is inevitable, including the release of shares held by Toei or its major shareholders other than Toei, such as TV Asahi, NAMCO BANDAI Holdings (7832), and Fuji Media Holdings (4676). Such speculation can be seen behind the rise in Toei Animation’s stock price.

(Reported on December 14)

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/