Japan Markets ViewReview of IPO Initial Prices and Trading Trends for 2023

Dec 15, 2023

[QUICK Market Eyes] The end-of-year rush of initial public offerings (IPOs) has become an annual tradition, with 15 IPOs scheduled for December 2023. This year, however, IPOs are less concentrated at the end of the year than in previous years, with the peak in June when 18 companies went public.

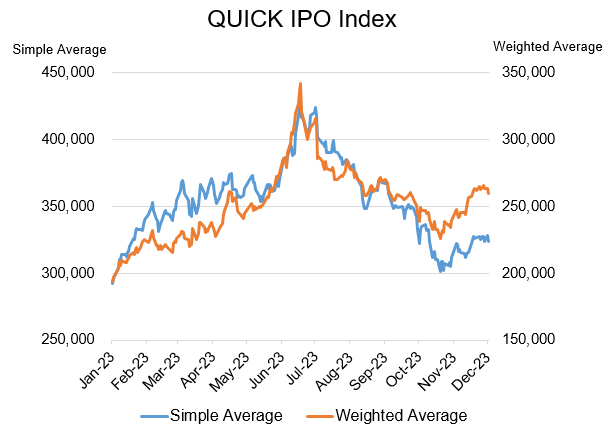

Behind the backdrop are the rising long-term interest rates in the U.S. and the sluggish market environment for emerging small-cap stocks due to market rallies led by large-cap shareholders. The QUICK IPO Index (weighted average), which shows the price movements of stocks that went public over the past year, also peaked at the end of June over the past year.

The TSE Growth Market 250 Index (previously known as TSE Mothers Index) has been declining on a monthly basis for the past five consecutive years. This is partly due to deteriorating supply-demand conditions resulting from redemption selling in preparation for IPOs in December. However, the recent declines in interest rates in Japan and the U.S. have halted the decline of the TSE Growth Market 250 Index from the October lows.

IPO Market Trends in 2023 with 96 Companies Newly Listed

The number of IPOs in 2023, excluding TOKYO PRO Market (TPM), totaled 96 as of December 1, 2023. This number was second only to the 125 IPOs in 2021, the largest number in the past decade. In addition, due to improvements in the market environment, including a better macroeconomic environment and a rise in the Nikkei 225, there were six large IPOs with a market capitalization of over JPY100 bn, the same level of IPOs as in 2021.

Of the 82 companies newly listed by December 4, the initial prices of 66 companies were the same as or exceeded their IPO prices, while those of 16 companies were lower than their IPO prices. Investors became more cautious about emerging small-cap stocks, mainly those listed on the TSE Growth Market, due to rising interest rates in Japan and the U.S. and deteriorating supply-demand balance.

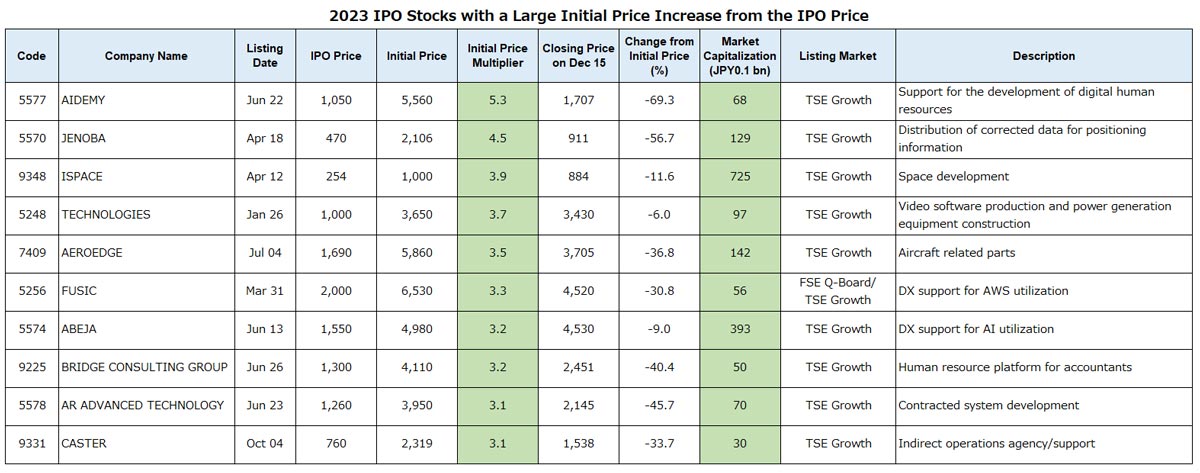

In ranking stocks whose initial prices rose significantly from their IPO prices, AIDEMY (5577, Growth), a company supporting the digital human resource development newly listed in June, came in first place in the increase rate. The initial price jumped 5.3 times from the IPO price. In third place was ISPACE (9348, Growth), a space development venture that made headlines in April when a research vessel attempted to land on the moon. The initial price rose sharply to 3.9 times its IPO price.

However, a comparison of the most recent stock prices of these top 10 stocks with their initial prices shows that the prices of all 10 stocks were lower than their initial prices. Most of them are small-cap stocks with a market capitalization of less than JPY20 bn. The stock price movements in the secondaries were weak due to the lack of expected capital inflows from institutional investors.

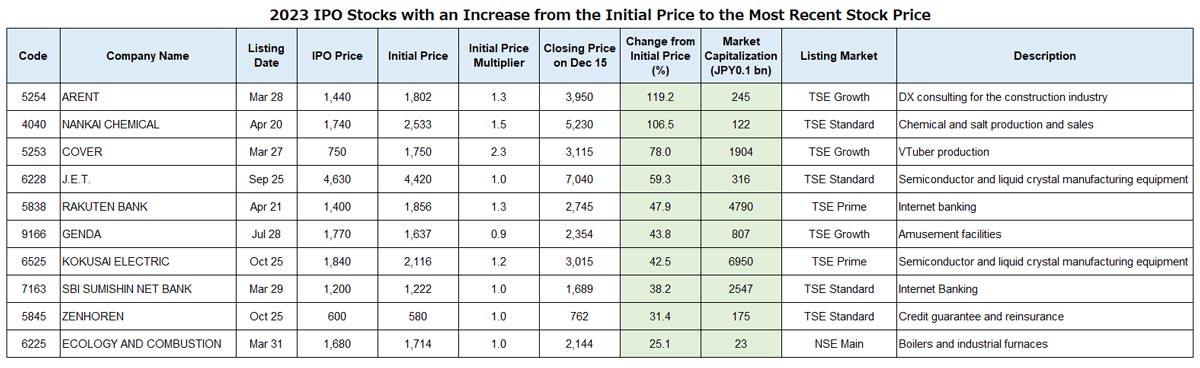

On the other hand, comparing the fluctuation rates of stocks with an increase from the initial price to the most recent price shows that many mid- and large-cap stocks on the Prime Market and undervalued stocks were ranked in the top 10. The top gainer was Arent (5254, Growth), a consulting firm specializing in digital transformation (DX) for the construction industry, with its stock price rising 2.2 times from its initial price. As the construction industry needs to comply with overtime caps, there is growing interest in improving productivity through DX, creating a highly profitable and high-growth business environment.

Nankai Chemical (4040, Standard), the second highest gainer, manufacturing caustic soda and hydrochloric acid, also maintains its stock price in a record high range since its listing. The company’s efforts to raise prices and curb costs are proving successful, and its projected price-to-earnings ratio (P/E ratio) is in the range of 10, making the company’s stock price undervalued.

Other large deals, including Cover (5253, Growth), a V-tuber production company, Rakuten Bank (5838), an Internet bank, and SBI Sumishin Net Bank (7163, Standard), were also recognized for their growth potential, performance, and affordability, and their stock prices have all risen above their initial prices.

Similarly, the stock price has bee rising for KOKUSAI ELECTRIC (6525), the largest deal since SoftBank (9434) in 2018. The company is involved in semiconductor deposition equipment, and its shares have been bought on expectations that the semiconductor market has bottomed out. In a report dated November 27, Nomura Securities analyst Atsushi Yoshioka newly set the “Buy” investment rating on the company’s stock and set the target price at 3,840 yen.

In the report, he noted that the performance of memory manufacturers, which account for a high percentage of the company’s sales, has bottomed out. Moreover, he shared his view that the company would enjoy strong Chinese demand, including for power semiconductors, and that it is likely to attract attention from a short-term perspective as well.

It is also worth watching the initial price multiples for IPOs in December and the subsequent stock price movements. The aforementioned trends make it difficult to expect continuous price increases due to the supply-demand balance for small-cap stocks. However, even if the initial price multiple is low, the continued capital inflows into the secondary market, focusing on growth potential and undervaluation, will lead to a virtuous capital cycle.

On December 6, Institute for Q-shu Pioneers of Space (iQPS, 5595) was newly listed on the TSE Growth Market. The company develops and manufactures small Synthetic Aperture Radar (SAR) satellites that enable detailed observation of the earth’s surface day and night and in all weather conditions. Demand for earth observation data from satellites is increasing in the security field.The deal of iQPS is the second IPO of a space development venture this year, following the IPO of ispace in April. iQPS started with a strong bid and hit an initial price of 860 yen, 2.2 times the IPO price of 390 yen. However, the stock price fluctuated roughly, with the closing price at 710 yen, 150 yen lower than the initial price, which was at the lower end of the price limit (the limit-down level).

(Reported on December 6, partially revised)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/