Japan Markets ViewCompanies Proactively Investing in Human Resources Enjoy Good Reputations – Eyes Are on Human Capital Disclosure

Oct 12, 2022

[QUICK Market Eyes] The foundation is now being established for the disclosure of “human capital,” in which the knowledge and skills of employees are considered the capital of a company. It is assumed that this is aimed at encouraging investment in human resources, which are inferior to that in Europe and the U.S., both of which are leading the way in this area. On the global stage, human capital is already an important source of investment information. Companies in Japan that are proactively investing in human resources seem to enjoy a good reputation in the marketplace. It is now being questioned whether Japanese companies can demonstrate a human resource strategy based on their business strategy, rather than just taking localized actions or disclosing information in a formal manner.

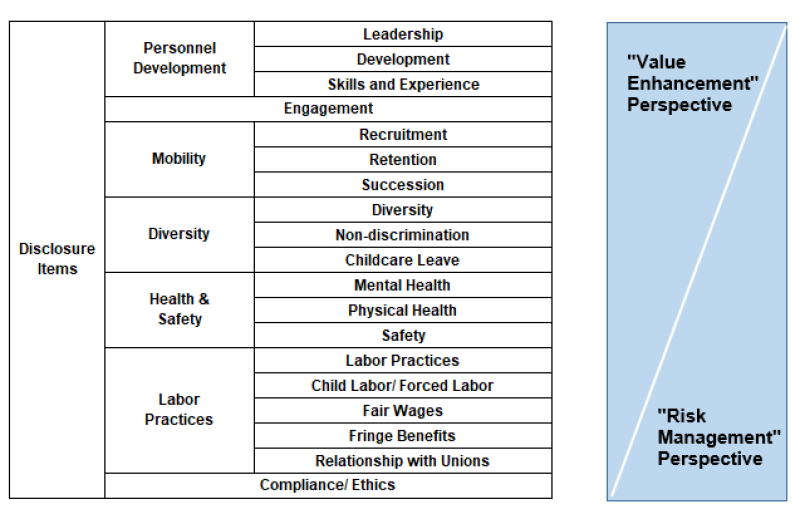

The environment to promote “investment in human resources” is beginning to take shape. In late August, the Japanese government released the “Human Capital Management Consortium” to share advanced case studies on human capital management practices such as re-skilling (relearning) and support for side or dual employment, and the “Human Capital Visualization Guidelines.” The former, with the Ministry of Economy, Trade and Industry and the Financial Services Agency as observers, promotes case sharing, discussions toward inter-company cooperation, and studies on effective information disclosure. The latter is the final report of the Study Group on Visualization of Non-Financial Information, which had been held at the Cabinet Secretariat since February. The report presents 19 items in seven areas recommended for companies to disclose, including “leadership,” “skills and experience,” “recruitment,” and “diversity.” It is the result of comparative analysis focusing on relevant leading organizations and systems in the U.S. and Europe, including the Securities and Exchange Commission (SEC) and the International Sustainability Standards Board (ISSB) in the U.S.

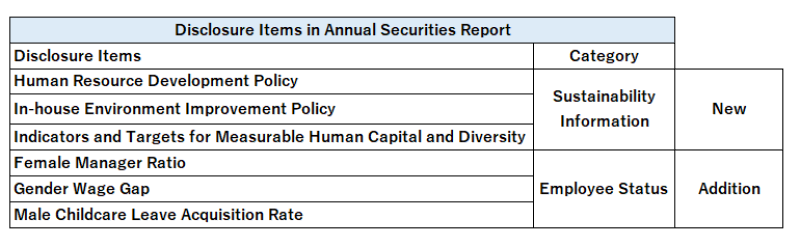

Japan, which has traditionally emphasized on-the-job training (OJT), has the lowest private-sector investment in human resources as a percentage of gross domestic product (GDP) among developed countries. The Japanese government, which sees this as having an indirect impact on the country’s sluggish economic growth, is likely aiming to promote investment in human resources by encouraging information disclosure to the capital markets. “Investment in human resources” is a management approach that views the company’s human resources and the knowledge and skills they possess as capital that serves as a source of value creation. The objective of this investment is to maximize the value of human resources, thereby increasing corporate value over the medium to long term. Digital transformation (DX) has gained momentum in the wake of COVID-19. Such rapidly changing digital field, for example, is considered an area that cannot be fully addressed by on-the-job training. It has been proposed that as early as 2023, companies will be required to include certain human capital information, such as the ratio of female managers and the wage gap between men and women, in their annual securities reports; and that they will be required to proactively include information on their “human resources development policy” and “in-house environment development policy” in their reports.

The background behind the development of such an environment includes the proliferation of ESG (Environmental, Social, and Governance) disclosure standards, and the situation in which the importance of human capital is recognized within companies, but the data is not fully utilized. Government Pension Investment Fund (GPIF) has been conducting an ESG assessment correlation analysis among ESG assessment firms since 2017. The analysis shows that the correlation of S-indicators among Japanese firms in particular has remained low. The proliferation of ESG standards has led to confusion in information disclosure by companies. This has made investors unable to compare ESG evaluations based on the same standards. According to KPMG Japan’s Chief Financial Officer (CFO) Survey 2021, human capital ranked first as a sustainability issue that affects corporate value. On the other hand, the survey also identified “selection of indicators to be monitored and target setting” as a challenge in reporting sustainability information.

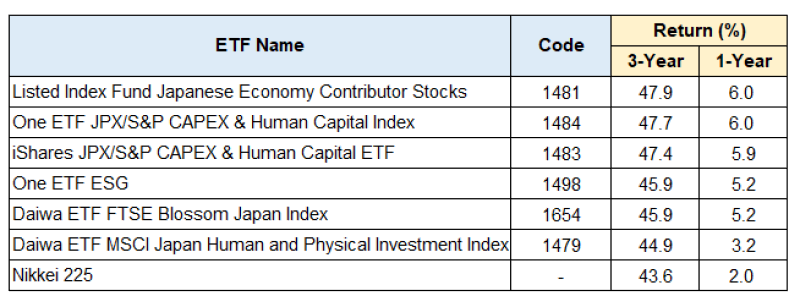

According to a survey on human capital released by Recruit Co., Ltd. in December 2021, only about 15% of companies publicly disclose information on their human capital. Under the circumstances where further expansion is expected, companies that are proactive in investing in human resources are highly evaluated by the market in ESG investment. The Asset Management Research Center of QUICK Corp. has ranked the three-year returns of all 11 ESG-related Japanese equity Exchange Traded Funds (ETFs) that have been under management for three years or longer. As a result, the top three ETFs were products that aim to link to the JPX/S&P CAPEX & HUMAN CAPITAL INDEX, which is related to capex and investment in human resources. The top six products exceeded both the 3-year and 1-year returns of the Nikkei 225 including dividends.

*Data as of the end of August, 2022

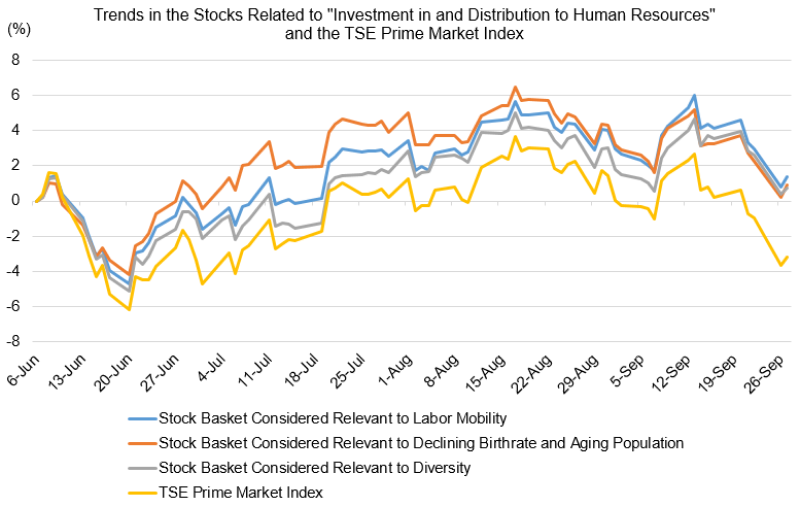

Stocks related to “investment in and distribution to human resources” also outperform the TSE Prime Index. In a report dated September 19, Mitsubishi UFJ Morgan Stanley Securities extracted relevant stocks from the terms used in Chapter 1 Growth Strategy Action Plan in the Follow-Up, where specific measures are mentioned, in the “Follow-Up of the Grand Design and Action Plan for a New Form of Capitalism” approved by the Cabinet on June 7. The extracted stocks were collectively indexed.

*The period starts on June 6 and ends on September 27.

The market is questioning whether Japanese companies can present strategic information on skills required now and in the future, and how these skills can be linked to corporate growth, in combination with management strategies, rather than just taking localized actions and disclosing information in a formal manner.

(Reported on September 29)

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/