Japan Markets ViewExecutive Incentive Compensation and ESG Performance

Apr 21, 2022

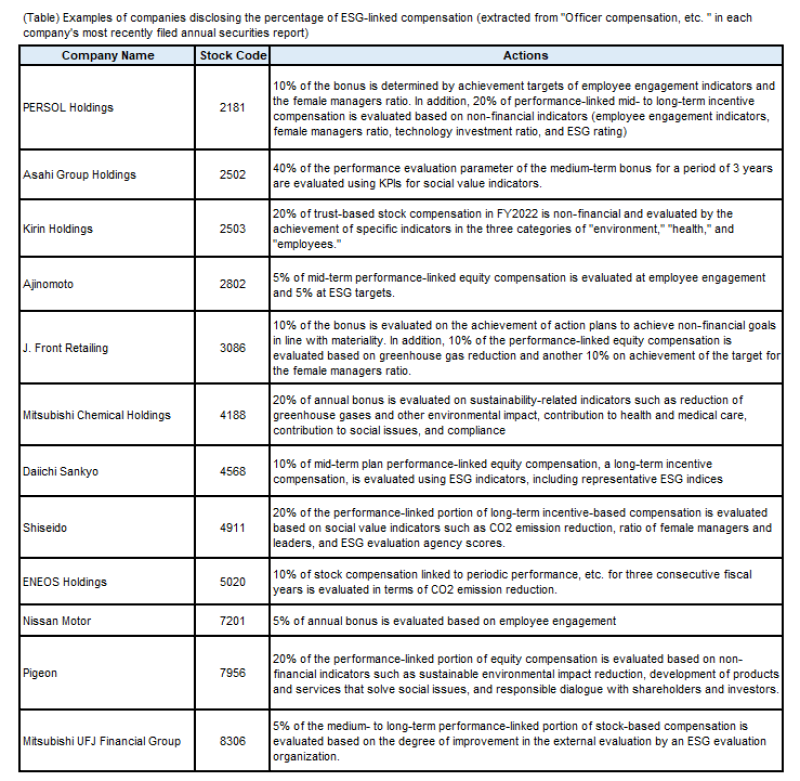

[Taigi Endo, QUICK ESG Research Center] More and more companies are engaged in sustainability issues from the perspective of increasing corporate value. One of the criteria for estimating the commitment level is “incentive compensation,” in which executive compensation is linked to indicators that take ESG (environmental, social, and corporate governance) factors into account. We have collected examples of Japanese companies that disclose the percentage of ESG considerations in their compensation.

French food giant Danone is known for its ESG-conscious management. According to the company’s presentation materials, 20% of the CEO’s annual variable compensation is based on achieving indicators related to social, societal and/or environmental issues.

How about Japanese companies? Using the news in the Nikkei Online Edition and the “Collection of Good Examples of Descriptive Information Disclosure” published by the Financial Services Agency, we examined the “Officer compensation, etc.” in the most recently submitted annual securities reports of the 12 named companies.

Note that we did not examine all companies submitting annual securities reports and did not confirm how the compensation was actually paid. It is also unclear what ratio of the companies specifying the percentage of ESG-linked compensation account for among those submitting reports, but a list of the 12 companies would be helpful to understand the overall situation.

Looking at the 12 companies in the table, we notice that some companies link “sustainability indicators” to short-term incentives such as annual bonuses as well as medium- and long-term incentives. As for KPIs, evaluations by the female managers ratio, greenhouse gas reduction, and ESG evaluation organizations stand out.

KPIs for performance-linked compensation are mostly financial-related indicators such as sales, profits, and profit margins. ESG-related compensation is a small proportion of executives’ total compensation, including fixed salaries. However, outside parties may perceive these incentives as a positive message to solve ESG issues.

Japan’s Corporate Governance Code (CG Code) was revised in June 2021 and referred to the formulation and supervision of basic policies on sustainability from the perspective of medium- to long-term corporate value enhancement by the board of directors. Before the revision, there was an opinion that the compensation for management “should include incentives such that it reflects mid- to long-term business results and potential risks, as well as promotes healthy entrepreneurship.” The revised version additionally refers to incentives related to sustainability.

The CG Code has encouraged a number of listed companies to establish committees on sustainability. More and more companies may introduce compensation systems that use sustainability indicators as KPIs in line with this trend.

On the other hand, many investors may be expecting increased dividends and other return measures. From stakeholders, including shareholders, to gain understanding of ESG-linked incentive compensation, it is essential to explain that it is consistent with the company’s objectives and business strategy and will enhance corporate value. Detailed disclosure of information, including verification of results after introduction, is important.

[Reference] Nikkei Veritas has started a series of articles entitled “Sustainable Investment: The Latest Trends in Sustainable Investment,” which analyzes and reports on the latest trends in sustainable investment based on a survey conducted by QUICK ESG Research Center. The April 17 issue, the first issue of this series, features “Recent Trends in Executive Compensation and Sustainability Factors,” which is organized by extracting passages that refer to executive compensation from the perspectives of international norms, corporate governance codes in Japan, the U.S., and the U.K., and other internal and external guidelines. This paper is related to that article.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/