Japan Markets ViewWhat Would Happen to BOJ-Owned ETFs? To Be Used to Form a “Sovereign Wealth Fund?”

Mar 27, 2024

[QUICK Market Eyes] The Bank of Japan (BOJ) decided to lift its large-scale monetary easing policy at the Monetary Policy Meeting held until March 19. The BOJ decided to discontinue purchases of exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs). The BOJ’s policy was unprecedented in the world, with the central bank assuming risk. While some criticize this policy for causing distortions in the market, others point out that it has contributed to the Japanese stock rally in terms of supply and demand. The focus going forward will be on exit strategies. There is a proposal in the market to set up a “sovereign wealth fund” utilizing the BOJ-owned ETFs.

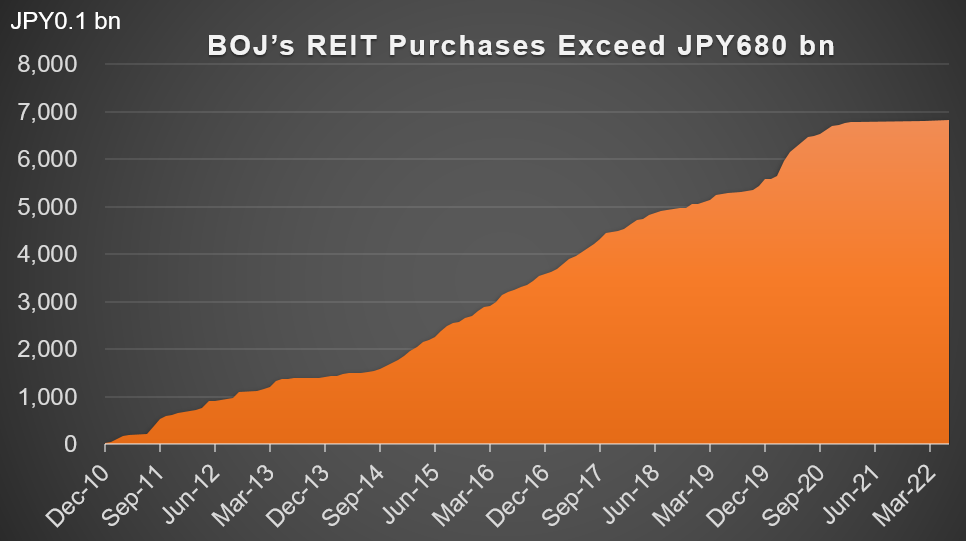

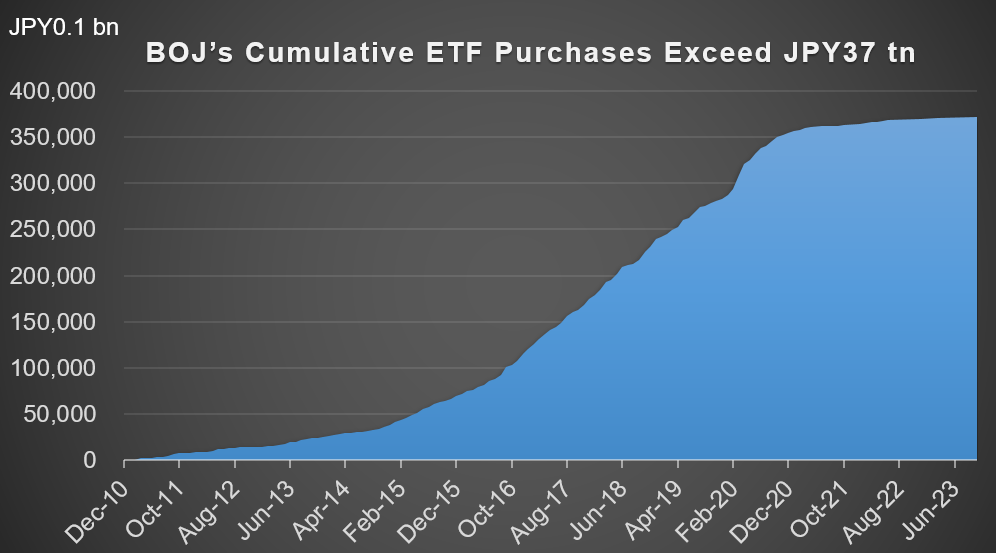

The BOJ began purchasing ETFs and REITs in 2010 when Masaaki Shirakawa was the Governor. The BOJ increased its purchases of ETFs as part of the extraordinary monetary easing policy set forth by Governor Haruhiko Kuroda, who took office in 2013. The cumulative amount of ETF purchases, calculated by QUICK based on publicly available data from the BOJ, totaled JPY37.1549 tn. According to estimates by NLI Research Institute, the market value of BOJ’s ETF holdings as of the end of February was JPY71.3 tn, and the unrealized gains amounted to JPY34 tn. EFT distributions are also expected to exceed JPY1 tn per year.

The BOJ’s ETF purchases had a specific pattern of regularity: when the Tokyo Stock Price Index (TOPIX) fell to a certain level in the morning, the BOJ would buy ETFs in the afternoon. Although not directly acknowledged by the BOJ, this regularity has been referred to as the “2% rule” recently. When TOPIX fell by 2% in the morning, the BOJ tended to buy ETFs in the afternoon. However, on the morning of March 11, even though the TOPIX fell by more than 2%, the BOJ did not buy ETFs, increasing speculation that the BOJ would modify its policy.

The BOJ’s unorthodox policy of purchasing ETFs has both pros and cons. One negative is the side effect of distorting stock price formation and market functioning. Another point of criticism is that the BOJ’s continued purchases have indirectly increased its holdings of certain stocks. On the other hand, Masamichi Adachi, chief Japan economist for UBS, expressed his view saying, “We need to consider what Japan would have been like without the BOJ’s ETF purchases. It was positive that the BOJ took as many easing measures as possible.”

The focus will now shift to measures to utilize ETFs purchased by the BOJ as well as exit strategies. There have been discussions in the market about the distribution of ETFs to the public. Overseas, the Hong Kong government purchased stocks in response to the Asian currency crisis. As an exit strategy, the government formed ETFs and transferred them to individuals and others at discounted prices. Some consider that this has helped foster individual investors. Shigeki Kushida, the BOJ’s ex-executive director under Governor Haruhiko Kuroda until 2017, contributed an article to the Securities Analysts Journal in 2017 on a Hong Kong-inspired exit plan, which attracted interest as one of the options.

However, there are currently many objections to a Hong Kong-style exit plan. One of the reasons is the cost required for the plan. Japan is moving on the path toward asset building under the slogan “from savings to investment.” However, many of the Japanese citizens still do not have securities accounts. There is concern that a Hong Kong-inspired exit plan will require enormous time and money to open accounts for all citizens, determine the allocation method, and process administrative tasks. In addition, some say that the financial literacy of the Japanese people is still in its infancy and that they are likely to sell the distributed ETFs immediately.

Shingo Ide, chief equity strategist at NLI Research Institute, proposes that “it would be a great idea to use a method similar to a sovereign wealth fund utilizing the BOJ-owned ETFs.” One example, he says, is modeled after a “university fund” format that has started in Japan in recent years.

Mr. Ide’s proposal is as follows. First, ETFs would be transferred to government-affiliated financial institutions, etc., to be converted into funds and exchanged for cash stocks so as not to adversely affect the supply-demand balance of stocks. Then, the voting rights policy would be presented. Finally, dialogue with companies and the exercise of voting rights would be conducted to promote corporate growth and governance, boosting the Japanese economy. Dividend income, for example, would be used to raise children and develop human resources.

The challenge with this proposal lies in the financial resources. Even if fiscal investment and loan programs (FILP) are used as the source of funds, as in the case of university funds, the fund size would be too large. Mr. Ide advocates transferring JPY10 tn each time, rather than the entire amount at one time. However, “There are many things that need to be agreed upon, such as FILP repayment plans,” he said. He expects it will take a long time because of the need for coordination among governments, the Ministry of Finance, the Financial Services Agency, and others, as well as the BOJ.

The BOJ announced the suspension of purchases of ETFs and other funds in the meeting statement. However, the BOJ has not yet indicated a final exit, including the sale of ETFs. Having taken a step toward normalization, the BOJ is expected to carefully explain how it will deal with ETFs.

(Reported on March 21)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/