Japan Markets ViewWhat is the Report of Large Volume Holding? (2) – Explanation on the Impact on Stock Prices!

Sep 07, 2022

[QUICK Money World] The previous article discussed the definition of the Report of Large Volume Holding, the background of the system, those who are subject to the report, the rules for submission of the report, etc. This article provides an explanation of the impact of the Report of Large Volume Holding on stock prices.

Is There a Relationship between the Report of Large Volume Holding and Stock Prices?

What relationship can be seen between the Report of Large Volume Holding and stock prices? If the Report of Large Volume Holding indicates that a leading domestic and foreign institutional investor or a prominent investor holds 5% or more of the shares of a listed company, or if the Change Report states that an investor who used to hold 5% or more of the shares has “increased its shareholding ratio,” it is likely to have a positive effect on the company’s stock price.

The purpose of shareholding is indicated in the Report of Large Volume Holding, and “net investment” or “holding for management based on a discretionary investment contract” are often stated as the purpose of institutional investors. This is nothing more than that institutional investors hold the company’s shares on the assumption that future price appreciation can be expected as a result of fundamental analysis, which measures the intrinsic value of the company based on its financial condition and performance. In other words, the stock has been thoroughly analyzed by professional investors, who have endorsed the stock as the one with the potential for future price appreciation. This will encourage other investors, such as individual investors, to buy the stock, and the stock price is more likely to rise.

Let’s take a look at the case of a consulting firm, BayCurrent Consulting (6532, BayCurrent).

BayCurrent went public in September 2016. Currently, many of the company’s domestic and foreign institutional investors are subject to the 5% rule and have filed the Report of Large Volume Holding. Among them, the most notable in terms of the size of their holdings is the large shareholding by Capital Research and Management Company, an asset management company under the U.S. Capital Group, which is one of the world’s largest asset management companies, and its joint holders (hereinafter “U.S. Capital Research”).

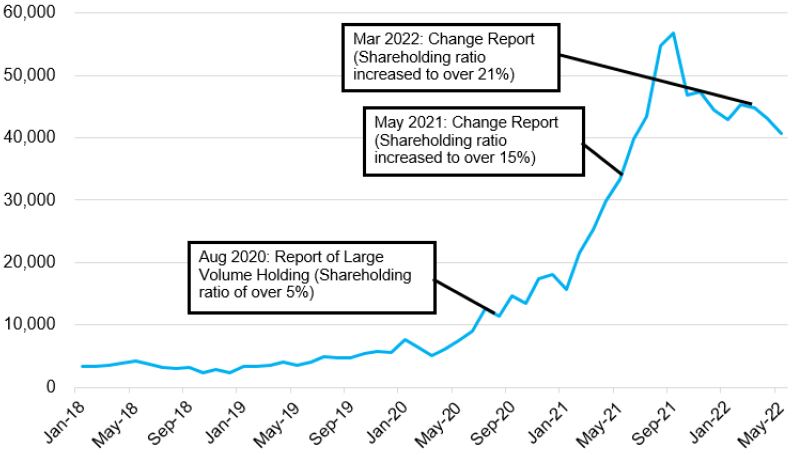

U.S. Capital Research submitted a Report of Large Volume Holding for BayCurrent shares (holding 5% or more of the shares) for the first time in August 2020. Since then, its holding ratio has basically continued to increase, and exceeded 20% in March 2022. The stock price of BayCurrent, which was in the 11,000-yen level at the end of August 2020, started to rise in line with the additional purchases by U.S. Capital Research, and temporarily reached the 49,000-yen level in 2022 as the company’s performance steadily expanded.

Large Holding of BayCurrent Shares by U.S. Capital Research and Stock Price Movement

As seen in the above case, if institutional investors substantially increase the ratio of shareholdings, it is likely to be a major positive factor in terms of the supply-demand balance of the stock. However, it should be noted that institutional investors may also reduce their holdings (sell) for profit-taking after the stock price rises significantly.This will, in turn, be perceived as a negative factor for the stock price.

Investors are obliged to submit a Change Report “when their shareholding ratio increases or decreases by 1% or more.” If it is revealed that the shareholding ratio has decreased by 1% or more, it is possible that institutional investors who had been buying the stock may see little room for further appreciation in the stock price and start to sell the stock for profit-taking and may continue selling a large number of shares afterwards. Furthermore, in the event of a decrease in the holding ratio of a large investor, it is possible that the investor is selling the stock due to concerns that company is having some problems with its performance or other issues. If the behavior of large investors turns around, it would be better to check if there is any material concern in the company.

Additionally, there are cases in which a securities company submits a Report of Large Volume Holding with “securing inventory” or “loan transaction” as the purpose of holding, or a Change Report. This could be a case where shares purchased by the securities company are lent to investors and sold short. Short selling can be a factor that puts downward pressure on the stock price (and conversely puts upward pressure on the stock price when it is time to buy it back). Do not fail to check the purpose of holding when a securities company submits a Report of Large Volume Holding or a Change Report.

Pay Attention to the Top Management’s Shareholdings

The top management of companies classified as small- and mid-cap stocks is often a major shareholder holding a large number of shares. Attention should also be paid when the Report of Large Volume Holding reveals that the top management has reduced its shareholding ratio. If the top management leading a company sells its shares, investors may be wary that there is something wrong with the company’s management, which may lead to an unexpected decline in the stock price.

The case of BroadBand Security (4398), a security services company, is one of the examples where stock prices have fluctuated wildly due to such speculation. On May 20, 2020, then president and representative director submitted a Change Report, which revealed that his shareholding ratio had decreased by more than 1%. In response to this, on the next business day (May 21, 2020), the stock price plunged more than 13% at one point. The top management’s sale of its own shares triggered a rush of selling by investors who became increasingly wary of the situation.

BroadBand Security then issued a release on May 25, 2020, stating that the president and representative director had submitted a written oath to the effect that he would not sell or lend any of his shares for the next two years. Then, the company’s stock price took a sudden turn and rose sharply on the same day, at one point increasing by more than 20%.

As mentioned so far, the Report of Large Volume Holding is a material factor whose impact on the target company’s stock price can never be ignored. In particular, it is advisable to check thoroughly who submitted a Report of Large Volume Holding or a Change Report, content of the report, whether there is any increase or decrease in the shareholding ratio, the purpose of shareholding, etc., and use them as one of the decision-making elements to foresee the company’s management situation and stock price trends.

Summary

The Report of Large Volume Holding is a type of document that shall be submitted by a shareholder within 5 days, excluding Saturdays, Sundays, and holidays, when having acquired 5% or more of the outstanding shares or increased/decreased the holding ratio by 1% or more after the acquisition of 5% or more. Those holding 5% or more of the outstanding shares are usually large investors, called “professional investors,” such as domestic and foreign institutional investors, and changes in the shareholding ratios of these investors affect stock prices as a fluctuation factor.

Provision by QUICK via API

To view the contents of Reports of Large Volume Holding, it is basically necessary to use EDINET, an electronic disclosure system managed by the FSA. QUICK’s Corporate Disclosure Bulletin Service analyzes the contents disclosed on EDINET and provides them via API as tag information such as stock code, company name, percentage of holding, etc. The data is maintained in such a way as to facilitate incorporation into the system and can be used for data analysis.

Company Disclosure Materials (TDnet, EDINET) on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data011/