Japan Markets ViewWhat is the Report of Large Volume Holding? (1) – Explanation on Reporting Obligations and the 5% Rule!

Sep 07, 2022

[QUICK Money World] Stock prices fluctuate depending on various factors such as corporate earnings and economic trends, but it is the supply-demand balance of stocks that determines the ups and downs of stock prices. If there are many investors who want to buy, the stock price will rise, and if there are many investors who want to sell, the stock price will fall. One of the factors that affects the supply-demand balance is the “Report of Large Volume Holding.” This article outlines the Report of Large Volume Holding and explains in an easy-to-understand manner how to read and what to check in the report, as well as the relationship between the report and the stock prices.

What is the Report of Large Volume Holding?

The Report of Large Volume Holding is a type of document that shall be submitted and disclosed by a shareholder who has acquired 5% or more of the outstanding shares, etc. of a listed company. When the shareholding ratio of a listed company exceeds 5%, a Report of Large Volume Holding is required to be submitted to the Prime Minister (Local Finance Bureau) within five days, excluding Saturdays, Sundays, and holidays, from the date the ratio exceeds 5%. This system is commonly known as the “5% Rule.”

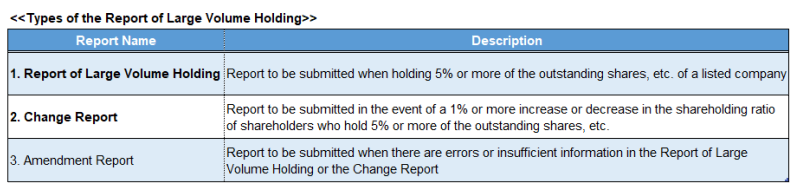

The Report of Large Volume Holding consists of three types: “Report of Large Volume Holding,” which shall be submitted when holding 5% or more of the outstanding shares; “Change Report,” to be submitted when the holding ratio increases or decreases by 1% or more after the date of becoming a large volume holder or when there is a change in material matters to be stated in the Report of Large Volume Holding; and “Amendment Report,” required to be submitted when there are errors or insufficient information in the Report of Large Volume Holding or the Change Report.

As explained earlier, the ups and downs of stock prices are determined by the supply-demand balance between investors who want to buy and those who want to sell. One of the factors that affect the supply-demand balance is the Report of Large Volume Holding. Of the three types of report, (1) Report of Large Volume Holding and (2) Change Report are particularly important.

What are the reasons for submitting a Report of Large Volume Holding?

A Report of Large Volume Holding (5% Rule report) is required to be submitted within five days, excluding Saturdays, Sundays, and holidays, from the date on which the applicable investor’s shareholding ratio exceeds 5%. As to the reasons for this, the Financial Services Agency (FSA)/Local Finance Bureau explains, “The purpose of the 5% Rule is to enhance the fairness and transparency of the market and to further ensure the protection of investors by disclosing to the public information on large shareholdings that can easily affect stock prices. Since the stock price often fluctuates wildly when a large volume of corporate stock is acquired, the 5% rule was institutionalized and made mandatory in order to prevent “the risk of unforeseen damage to ordinary investors who do not have sufficient information regarding this fact” (Local Finance Bureau).

Who are subjects to submitting a Report of Large Volume Holding?

Those who are required to submit a Report of Large Volume Holding are shareholders whose shareholding ratio in the number of shares issued exceeds 5%. Here, shareholders refer to the followings.

- ● Persons who own share certificates, etc. in their own name or in the name of others

- ● Persons who have the right to demand delivery of share certificates, etc. based on a sales or other contract

- ● Persons who have the purpose of controlling the business activities of the relevant issuer

- ● Persons who have the authority necessary to invest in share certificates, etc.

The 5% rule also applies not only to individual holders, but also to joint shareholders who agreed to jointly purchase shares and other securities. The same applies to married couples and parent-subsidiary or sibling companies with capital ties exceeding 50% (i.e., deemed joint holders).

How to submit a Report of Large Volume Holding?

A Report of Large Volume Holding is currently required to be submitted by those subject to the report (the 5% rule) via the Internet using “EDINET,” an electronic disclosure system managed by the FSA. It is no longer possible to submit a report in writing.

How much penalty will be imposed for failure to submit a Report of Large Volume Holding?

A Report of Large Volume Holding is required to be submitted within 5 days, excluding Saturdays, Sundays, and holidays, in cases of holding 5% or more of the outstanding shares or an increase or decrease of 1% or more in the shareholding ratio. In the event of failure to submit the report by the due date, the administrative monetary penalty will be imposed. The amount of the penalty is set at “1/100,000th of the total market value of the share certificates, etc. subject to the Report of Large Volume Holding” (FSA). There is also a system in place to impose additional penalties for repeated violations.

This article discussed the definition of the Report of Large Volume Holding, the background of the system, those who are subject to the report, and the rules for submission of the report. The next article will cover the impact of the Report of Large Volume Holding on stock prices.

Provision by QUICK via API

To view the contents of Reports of Large Volume Holding, it is basically necessary to use EDINET, an electronic disclosure system managed by the FSA, etc. QUICK’s Corporate Disclosure Bulletin Service analyzes the contents disclosed on EDINET and provides them via API as tag information such as stock code, company name, percentage of holding, etc. The data is maintained in such a way as to facilitate incorporation into the system and can be used for data analysis.

Company Disclosure Materials (TDnet, EDINET) on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data011/