Japan Markets ViewTrend of Larger-Scale Share Buybacks Expected to Continue

Mar 16, 2023

[Nikkei QUICK News] In 2023, the nature of share buybacks by Japanese companies is gradually changing. The cumulative expenditure figure for share buybacks in February increased YoY, but the number of companies that announced such buybacks decreased. In addition, the acquisition limit per company has been expanding. The Tokyo Stock Exchange announced a policy to correct any price book-value ratio (PBR) of less than 1x. Against this backdrop, companies are becoming more aware of stock price measures. Many market participants anticipate that enthusiasm for large-scale share buybacks will continue.

In February, many Japanese companies announced their latest financial results. According to Tokai Tokyo Research Institute, the amount of share buybacks disclosed in February 2023 totaled JPY1.1261 trillion (including additional buybacks), an amount about JPY240 billion greater than the figure of JPY883.7 billion announced the previous year.

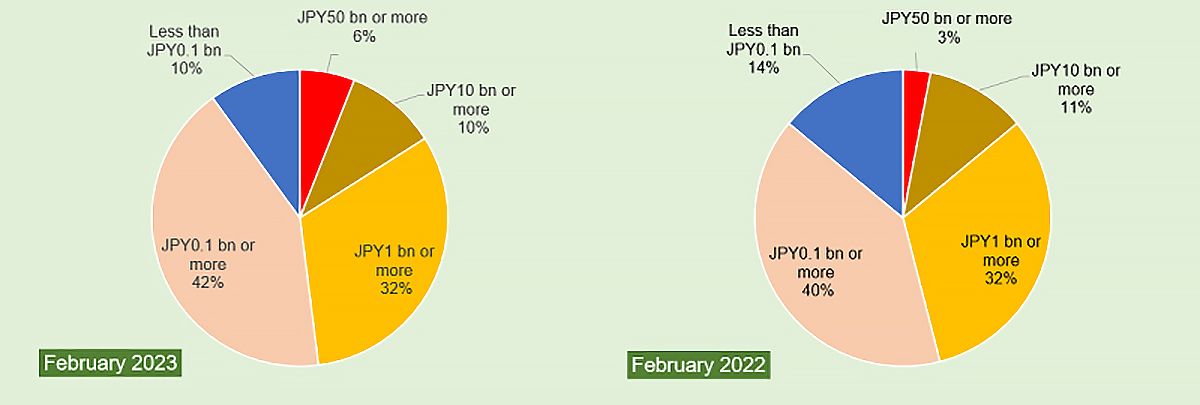

Notwithstanding the robust numbers above, when looking at the number of companies announcing buybacks, a different picture emerges. According to QUICK’s “Share Buyback Report,” 141 companies resolved to buy back their own stock in February 2023, down 25% from the 187 companies making such plans last year. The number of companies with acquisition limits to share buybacks of JPY50 billion or more increased to 8 (with 5 in the same month the previous year), while the number of companies with acquisition limits of less than JPY0.1 billion nearly halved to 14 (in contrast to the count of 27 for February of 2022).

Seiichi Suzuki of Tokai Tokyo Research Institute pointed out, “In 2022, small-cap companies bought back their own shares due to the weakness in their stock prices. But recently, large companies in a better earnings environment have been buying back their own shares.” He theorizes that relatively small companies bought back their own shares last year to cope with weak stock prices in response to the U.S. long-term interest rate hikes.

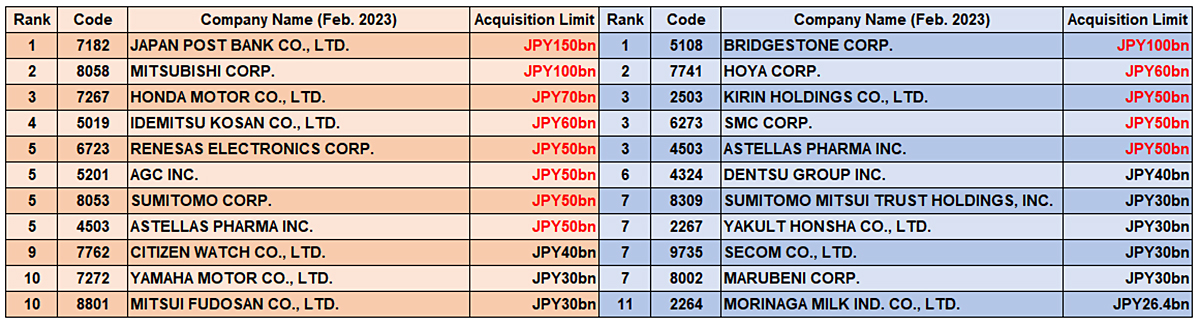

In 2023, share buybacks by large companies that are likely to record their highest profits ever are particularly conspicuous. One notable sector that typifies the trend is that of trading companies, currently benefiting from rising market conditions. Mitsubishi Corporation (8058), Sumitomo Corporation (8053), and ITOCHU Corporation (8001) all decided on large-scale share buybacks in February this year. Shingo Ide, chief equity strategist at NLI Research Institute, has commented on the wider general lineup of major corporations all embracing the same strategy as the trading companies. He notes, “Large businesses are probably using buybacks as signals to investors that they are making appropriate capital investments.”

Meanwhile, Collabos Corporation (3908) and NexTone Inc. (7094), which are classified as members of the Growth Market by the current financial taxonomy, were among the many smaller names resolving to buy back their own shares in February 2022. However, in 2023, both have yet to declare the same decisions they announced early last year. Although it is necessary to consider market restructuring and changes in a number of listed companies of every market, the proportion of Growth Market stocks that have announced share buybacks has been smaller than that of all other categories of companies listed on the TSE.

Regarding the downward trend in the number of companies announcing share buybacks, Kenji Abe, chief strategist at Daiwa Securities, observed that “caution amid the global economic slowdown remains strong.” He also pointed out, “There is a lingering concern about companies increasing the amount of liquidity on hand.” Mr. Abe expressed fears that a reduction in support for the Japanese stock market would become a negative factor.

Turning to the outlook for share buybacks, many market participants are focusing on companies with PBR figures of less than 1x. At a meeting to discuss improvements in market restructuring, it was proposed that listed companies with PBR numbers consistently below 1x be requested to disclose improvement measures.

Share buybacks by companies with low PBR would increase book value per share (BPS) if the decrease in the number of shares outstanding were to be greater than the decrease in book value. Therefore, strategies based on such understandings could serve to lower PBR.

Regardless, since there is a strong market sentiment in favor of share buybacks, many companies, even those with PBR below 1x, are considering share buybacks in anticipation of a significant rise in stock prices.

Mr. Suzuki of Tokai Tokyo Research Institute said, “I would like to observe closely how many more companies will decide to buy back their own shares from April onward, when those with fiscal years ending in March will announce their financial results.”

(Reported on March 2)

QUICK Provides Share Buybacks Data via API

QUICK compiles proprietary data on historical share buyback collected from corporate disclosures and provides it on terminals as the “Share Buyback Report” as well as providing such data via API. The data includes publicly disclosed information such as date of board resolution, number of shares purchased, and method of purchase, as well as items such as progress rate calculated by QUICK. It can be used to forecast the timing of corporate share buybacks based on historical data spanning more than 20 years.

[Case Study]

- Equity Investment in Companies Implementing Share Buybacks

https://corporate.quick.co.jp/en/japanmarketsview/equity/equity-investment-in-companies-implementing-share-buybacks/ - Stock Investment Strategies Using Share Buyback Information

https://corporate.quick.co.jp/en/japanmarketsview/equity/stock-investment-strategies-using-share-buyback-information/

Share Buybacks Data on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data029/