Japan Markets ViewNikke (3201) Undergoes Transforming Taking Advantage of Cash-Rich Balance Sheet

Mar 09, 2023

[QUICK Market Eyes] The Tokyo Stock Price Index (TOPIX) rose 4% in January, but was almost flat month-over-month in February. U.S. high-tech stocks had been bought based on the optimistic view that U.S. interest rate hikes would be halted early. However, the scenario may need to be revised following the release of the Federal Open Market Committee (FOMC) meeting minutes on February 22. Meanwhile in Japan, there is a strong sense of caution that the Bank of Japan will revise its policy at the monetary policy meeting in March. Amidst growing uncertainties, we focused on cash-rich companies with solid balance sheets, which are deemed resilient to adversity.

Cash-rich means having a lot of funds available to spend, such as highly liquid cash and deposits, more than interest-bearing debt. Cash-rich companies are considered to demonstrate strength in a turbulent market, as their strong balance sheets underpin their stock prices. They are also anticipated to use their cash reserves to buy back their own shares and increase dividends. On the other hand, these companies are sometimes criticized for merely hoarding funds and not using them to grow their businesses. In addition, cash-rich companies with undervalued stock prices tend to be targets of mergers and acquisitions (M&A). If the acquisition is successful, the cash on hand can be used for the acquisition price.

QUICK discloses a list of cash-rich stocks every month. We looked at companies with fiscal years ending in November for the survey in February when most of their financial results became available. Among the Prime Market stocks on the Tokyo Stock Exchange (TSE), The Japan Wool Textile Co., Ltd. (Nikke, 3201), a major wool textile company, ranked in the high cash-rich stocks list. The company has JPY37.5 bn in cash on hand, which is more than its JPY19.3 bn in interest-bearing debt. Therefore, net cash, which is cash on hand minus interest-bearing debt, is JPY18.2 bn.

However, Nikke can easily be an acquisition target because it is a cash-rich company. The “EBITDA multiple,” which indicates how many times the company’s enterprise value (EV), calculated using net cash or market capitalization (JPY75.8 bn as of the end of January) is EBITDA, is about 3 times. It is much lower than the simple average of all Prime Market stocks on TSE of 10 times. It may be possible to recoup the acquisition cost in a few years.

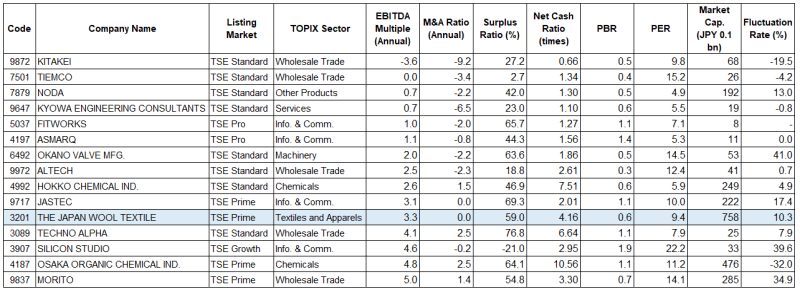

Cash-Rich Stocks Screening Results, All Stocks with Fiscal Year Ended November 30, 2022

*Data as of the end of January 2023 in descending order of EBITDA multiples (annual)

Possibly in light of this situation, Nikke has been making more effective use of its capital in recent years, through launching product sales for the e-commerce market, embarking on the childcare business, etc. The textile & clothing materials business, which has been carried on from the company’s original textile business, accounts for 28% of sales. On the other hand, the “Human and Future Development Business,” involving childcare services, accounts for 33% of sales, demonstrating the growth of new business sectors in the company’s portfolio.

Nikke also handles semiconductor-related and automotive materials, which drove the company’s performance in the previous fiscal year. In the e-commerce business, the company acquired Thanko, inc., which excels in the development of unique products such as “Kotatsu to wear” (Kotatsu is a traditional Japanese leg warmer with a coverlet”), as a subsidiary. Currently, the company is considering six to seven M&A deals, and is expected to expand further into new business segments.

According to the corporate plan, the company expects sales and operating income increases for the third consecutive year in the fiscal year ending November 2023. Operating income for the current fiscal year is expected to increase 3% YoY to JPY 11.0bn, a record high following the previous fiscal year. In addition to an anticipated recovery in the e-commerce business, growth in the automobile industry is also expected to contribute to the company’s strong performance.

Nikke’s stock price has fallen 1% from the beginning of the year through February 21, underperforming the TOPIX (up 4%) and lagging. Forecast PER is in the 9x range, and PBR is 0.6x, below 1x. The company plans to pay an annual dividend of 30 yen per share for the current fiscal year, giving it a dividend yield of more than 3% calculated based on the current stock price. Few analysts seem to cover Nikke, and not many seem to know much about Nikke now as it changes while leveraging its hard-earned capital.

(Reported on February 24)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/