Japan Markets ViewTokyo Olympics, limited Impact on Japan market – QUICK Monthly Survey (Equity) in June 2021

Jun 15, 2021

The Tokyo 2020 Olympic and Paralympic Games are less than 40 days away. While the Tokyo Metropolitan Government and the Government of Japan are preparing to hold the events, opinion polls conducted by media companies show that many people are opposed to the idea. How do market participants think the Olympics will affect the market?

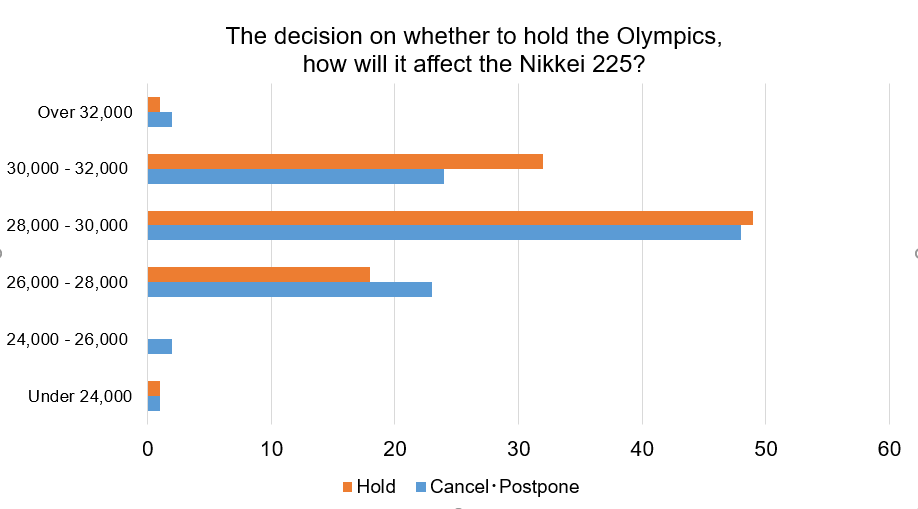

In the QUICK Monthly Survey (Equity) for June, we asked how the market participants would forecast Nikkei 225 at the end of September in the following two cases: when the Tokyo Olympics are held, and when they are cancelled or postponed. As a result, nearly 50% of respondents chose, “The Nikkei 225 will be in the range of 28,000 to 30,000 in either case.” Currently, the Nikkei 225 is moving back and forth around 29,000. Most of the respondents seem to think that the stock prices will remain almost flat regardless of whether the Olympics are held.

32% of respondents chose “The Nikkei 225 will exceed 30,000.” if the Olympics are held, while 26% chose the same answer if the Olympics are canceled or postponed. A fair number of respondents believe that stock prices will rise if the events are held. “The market is already expecting a bearish trend in a view of the Tokyo Olympics. Dispelling the uncertainty about holding the events is a slight positive factor,” said a respondent.

On the other hand, 19% of respondents chose “The Nikkei 225 will fall below 28,000.” if the Olympics are held. 26% of them chose the same answer in the case the events are canceled or postponed. The risk to the market is the further infection of COVID-19 after the Olympics, and “The holding, cancellation or postponement of the Olympics itself does not affect the market.” (Asset Management)

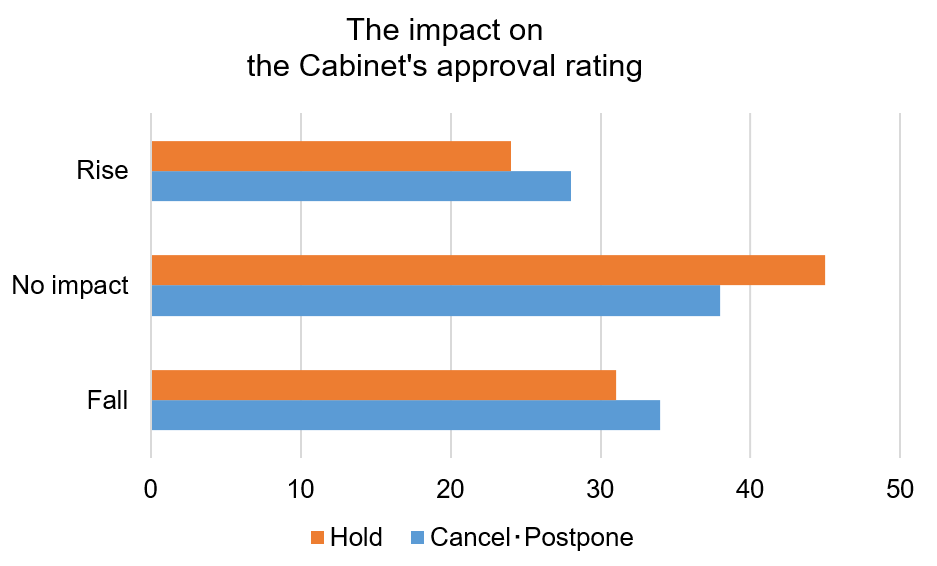

The impact on the approval rating for the Cabinet is also expected to be limited. About 40% of respondents chose “The approval rating for the cabinet would not be impacted.” regardless of whether the Olympics are held, canceled, or postponed. The general opinion is that “The vaccination progress does affect the approval rating, instead of the Olympics.” (Asset Management)

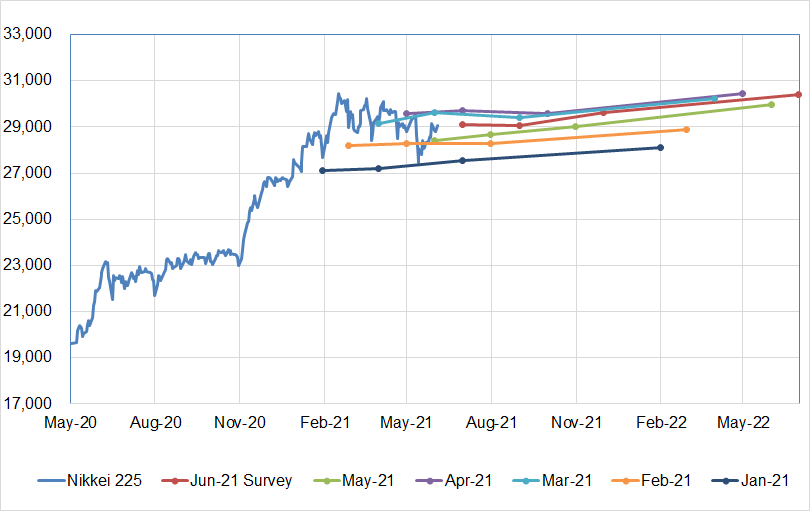

The forecast for the Nikkei 225 was corrected slightly upward as compared to that of May. The forecast for the end of June is 29,095, an increase of 665 from the previous survey.

The survey was conducted among 211 participants, including investment managers at domestic institutional investors, and 123 responded. The survey was conducted during June 1 – 3, 2021.

QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/