Japan Markets ViewImpact of News on Stock Price Fluctuations and Investment Performance ― Stock Dividend News

Oct 31, 2023

Summary

- QUICK provides EDINET and TDnet in text format

QUICK provides data disclosed by companies via the EDINET and TDnet systems in text format by automatically analyzing the data and adding proprietary tags. - News of upward dividend forecast revision and stock performance

Following the news release, the stock price gradually rose toward the last cum-rights date. - News labeling rules and investment performance

News stories with a high probability of stock price increase toward the last cum-rights date were labeled as “high impact.” Desirable performance could be achieved by investment based on this label.

Introduction

F-index, a data analysis consulting service provider in Japan, has conducted a case study on the use of company disclosure bulletin data provided by QUICK for stock investment. In the previous article featuring news of clinical trial success/failure, we constructed a model of next-business-day stock price fluctuations. The model was developed by combining three types of information: news content, information about the stocks associated with the news, and market conditions. The results confirmed that investing based on the label information could achieve favorable performance. This article examines whether labeling dividend news would yield favorable investment performance.

News of Upward Dividend Forecast Revision and Stock Performance

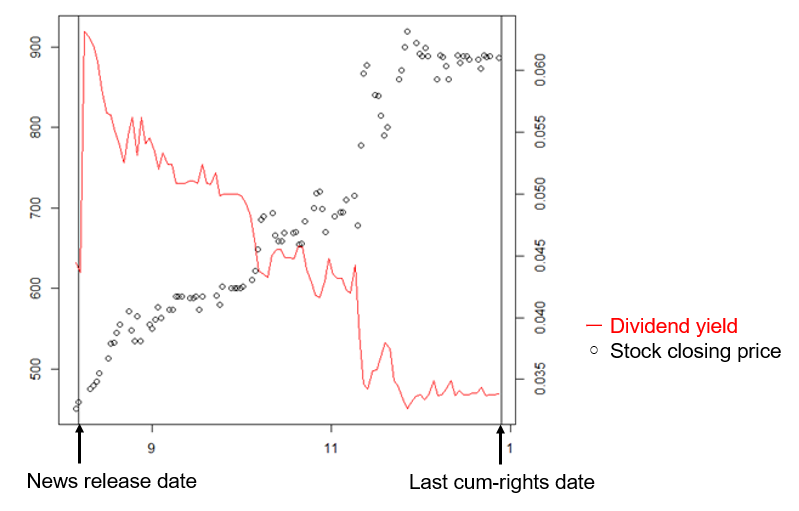

Upward dividend forecast revision will increase dividend yields and create investment incentives. It could lead to stock price appreciation toward the last cum-rights date. This may be because upward revisions can be interpreted as an indication that companies expect strong earnings if there is no change in their dividend payout ratio approach. Figure 1 shows the changes in the stock prices and dividend yields of HouseFreedom (8996) after a news release on August 7, 2020, about a dividend increase to 30 yen from the previous forecast of 20 yen.

Figure 1: Stock Prices and Dividend Yields after News Release on August 7, 2020, Regarding House Freedom’s Dividend Increase

Immediately after the news release, the dividend yield soared and then slowly declined toward the last cum-rights date. Meanwhile, the stock price rose moderately toward the last cum-rights date.

As shown above, news of dividend revisions can affect subsequent stock price fluctuations. In this article, we constructed a model of the probability of a stock price increase using the news about dividend revisions and labeled the news based on the results.

Scope News for Verification

This article covered the news on year-end dividends, which were extracted as follows.

- News release period: January 1, 2020, through June 30, 2023

- News extraction criteria;

- Criterion 1: A headline includes the term “dividend.”

- Criterion 2: The following relationship exists between the news release date and the closing dates.

- Half-year closing date < News release date < Full-year closing date

As a result of extracting news using the above criteria, 547 news stories were selected for verification.

Stock Trading Rules and the Stock Price Fluctuation Model

Depending on the news release time, we set the stock purchase price as follows.

- News release after market close: Opening price of the next business day of the news release

- News release before market open: Opening price of the news release date

- News release during trading hours: Closing price of the news release date

The stocks purchased were sold at the market close of the last cum-rights date.

We modeled the probability of returns exceeding 10% under the above settings. As explanatory variables for the model, we used information on dividend revisions (dividend revision amount, dividend yield, etc.) created by processing information embedded as tags in the news provided by QUICK.

News Labeling Rules and Investment Performance

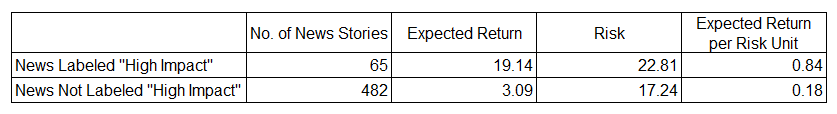

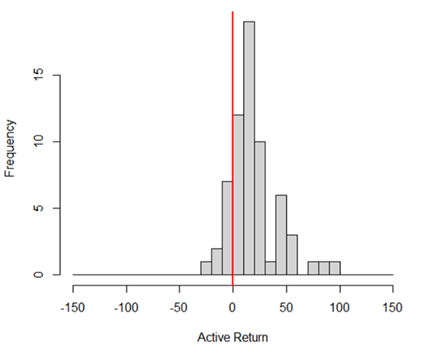

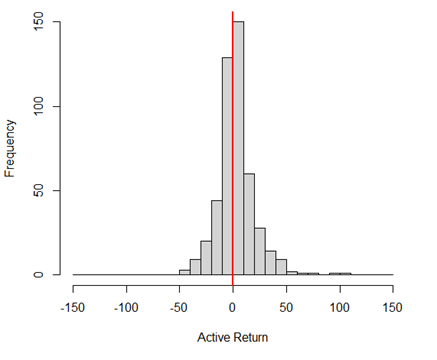

Based on the constructed model, we calculated the probability of a stock price increase, and assigned a “high impact” label to the news stories with the probability exceeding 50%. As a result, 65 news stories were assigned the label and recommended for investment, and 482 news stories were not assigned the label. For each labeling status, we calculated (1) expected return (mean of returns), (2) risk (standard deviation of returns), and (3) expected return per risk unit ((1) divided by (2)) as investment performance indicators, respectively. Table 1 summarizes the investment performance by label assignment status. Histograms of the respective returns are also plotted in Figures 2 and 3. The histogram (Figure 2) shows that the returns for the news stories labeled “high impact” are clearly on the positive side, indicating that positive returns can be expected for a significant number of stocks. On average, a return of nearly 20% can be expected. On the other hand, the expected return for the unlabeled news was 3.09%. However, the histogram (Figure 3) shows that the returns are evenly distributed around 0. In many cases, the returns are negative, indicating that unlabeled news are not appropriate for investment.

Table 1: Investment Performance by Stock Price Fluctuation Impact Labeling for Dividend News

Figure 2: Histogram of Returns for News Labeled “High Impact”

Figure 3: Histogram of Returns for News Not Labeled “High Impact”

Conclusion

In this article, we modeled the probability of a stock price increase toward the last cum-rights date focusing on dividend revision news, and assigned a “high impact” label to the news stories with a high probability of such an increase. The results show that desirable performance can be expected when investments are made based on the labeling results. Generally, it is difficult to handle news in text format. However, in this article, only the information embedded as tags in the news provided by QUICK were used for verification, allowing for automatic identification of news by machine processing.

Company Disclosure Materials (TDnet, EDINET) on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data011/