Japan Markets ViewDrugstores’ Stock Prices Rising with Expanding Food Sales and Attracting Thrifty Consumers

Oct 24, 2023

[QUICK Market Eyes] Inflation is clearly putting pressure on household finances. While companies have been aggressively raising prices to improve their earnings, consumers appear to be “fed up” with the price hikes. Against this backdrop, drugstores have been expanding their business performance by capturing thrifty consumers. As a result, the stocks in this sector have become the focus of selective buying in the stock market.

Clearly Deteriorating Household Circumstances

The Bank of Japan’s “Opinion Survey on the General Public’s Views and Behavior” released on October 13 showed that the Household Circumstances D.I. deteriorated for the eighth consecutive quarter. This index is calculated by subtracting the percentage of respondents who answered that their household circumstances “Have become worse off” from the percentage of those who responded “Have become better off” compared to one year ago.

Of those who answered that the price levels “Have gone up” compared to a year ago, 85% said that the price increase was “Rather unfavorable.” In response to a question about major factor(s) when choosing goods and services on which to spend for the year ahead, the number of respondents who answered “Low price” increased for the second consecutive quarter to 60%.

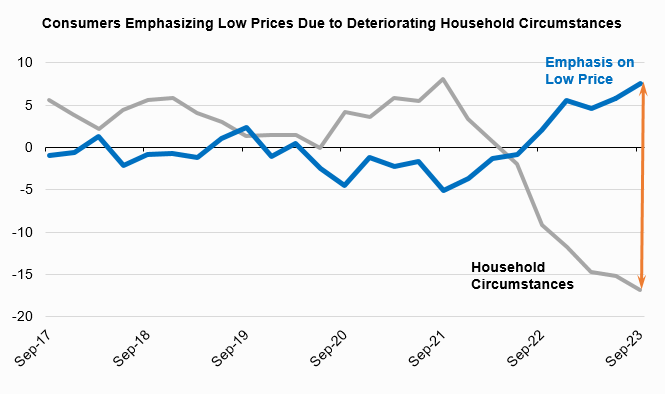

The chart below shows the deviations from the sample period average for the Household Circumstances D.I. and for the percentage of respondents who emphasize low prices of products, respectively. The chart suggests that consumers tend to prefer low-priced products as their household circumstances worsen.

* Compiled by QUICK based on the Bank of Japan’s “Opinion Survey on the General Public’s Views and Behavior”

(Note) The Household Circumstances D.I. indicates the value obtained by subtracting the percentage of respondents saying that household circumstances “Have become worse off” from those selected “Have become better off” compared to one year ago. Emphasis on low price indicates the percentage of respondents who answered “Low price” as a major factor when choosing goods and services for the year ahead. The chart shows the respective deviations from the average for the sample period (September 2017 to September 2023).

Drugstores Expanding Food Sales

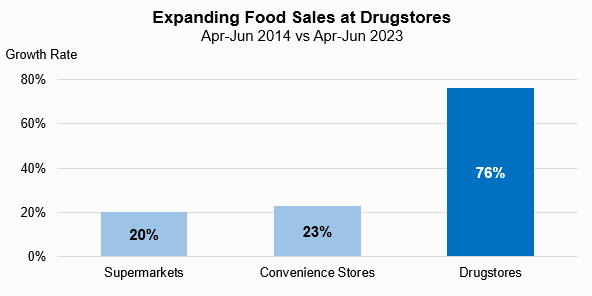

An increasing number of consumers are buying groceries at drugstores amid a rising trend toward thrifty shopping. Drugstores are able to sell food products at lower prices than convenience stores, thanks to the profits they earn mainly from pharmaceuticals. According to the Ministry of Economy, Trade and Industry’s Current Survey of Commerce, sales of goods by drugstores in the April-June period of 2023 was JPY2.0565 tn, up nearly 80% from the same period of 2014, when the statistics were first published. The driving force was food products, which expanded 2.3 times.

* Compiled by QUICK based on the Ministry of Economy, Trade and Industry’s ”Current Survey of Commerce”

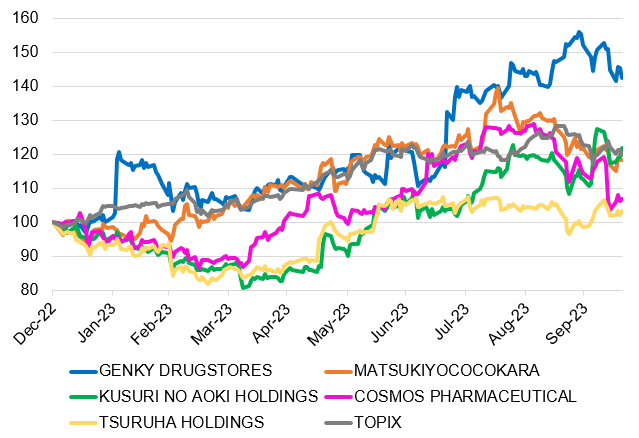

We calculated the stock price fluctuation rates since the beginning of the year for drugstore stocks listed on the Tokyo Stock Exchange Prime Market, and charted the top five stocks. The top-ranked stock in terms of price fluctuation rate was Genky DrugStores (9267), with an increase of nearly 50%. Genky DrugStores’ strong performance is attributable to its food-oriented business model, with food products accounting for 60% of its sales, compared to 10-30% at most drugstores. The company’s strength lies in its ability to sell fresh produce, boxed lunches, and prepared food, all of which require time-consuming production and management.

Genky DrugStores started its business as a small drugstore in the Hokuriku region. In 2017, the company launched the sale of fresh produce, rapidly expanding its business performance. Since 2019, the company has been strengthening its Everyday Low Price (EDLP) strategy. Taking advantage of its strength in discounting, the company achieves low-cost management by operating its own store development, food production, and logistics. The convenience of being able to buy groceries in addition to pharmaceuticals and cosmetics has given Genky DrugStores a competitive edge amid intensifying competition to open new drugstores. For the fiscal year ending June 2024, the company projects a 4% increase in consolidated operating income over the previous year.

Trend to Increase the Food Sales Mix

It is also worth noting that drugstore companies are currently raising the sales mix of food products. KUSURI NO AOKI HOLDINGS (3549) plans to renovate 250 stores in the fiscal year ending May 2024, and to start selling fruits, vegetables, and meat at 90% of all stores. The company’s June-August 2023 financial results, announced on October 3, were well received by the market, as the renovation of existing stores, with a focus on introducing food products, contributed to the company’s profit growth.

WELCIA HOLDINGS (3141), the largest drugstore operator in Japan, plans to increase the sales mix of food products from the current 20% to 30% of its total sales by the fiscal year ending February 2026. The company intends to work with its parent company, the AEON Group, to increase the number of drugstores complexed with supermarkets and expand its fresh produce and other product lineup.

Cosmos Pharmaceutical (3349) also sells food on the strength of low prices. However, in its earnings announcement for the June-August period of 2023, the company’s gross profit margin declined as a result of increased discounting. The market reacted by selling the company’s stock due to insufficient profit levels. Compared with pharmaceuticals, raising the food product ratio too much will make securing gross profit margins harder. The key will be how much companies can cut costs and use the savings as a source of discounting.

Raising food prices under inflation has continued, but households can no longer stand this trend. Tatsuhiko Nakanobu, an economist at Mizuho Research & Technologies, points out, “The rapid price hikes (after 2022) seem to have offset households’ excess savings built up during the COVID-19 pandemic.” The risk of losing customers is higher than ever due to consumers’ deteriorating household circumstances. It is likely that consumers will increasingly prefer drugstores as a one-stop shopping destination that offers better deals than supermarkets and convenience stores.

(Reported on October 20)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/