Japan Markets ViewHigh-dividend Stock Rally Continues, Driven by NISA

Feb 14, 2024

[QUICK Market Eyes] High-dividend stocks have shown steady performance, driven by the New Nippon Individual Savings Account (New NISA*) launched in January 2024. The indices of high-dividend stocks continue to perform strongly, outperforming the Tokyo Stock Price Index (TOPIX). Capital inflow from individual investors who “want to receive high dividends tax-free” is likely to continue for some time.

* An overview of the New NISA system is described here.

Steady Performance of High-Dividend Stocks Fueled by New NISA, Temporarily Suspending Investment Trust Sales

“High-dividend stocks are popular in the New NISA,” pointed out by Akira Warita, President and CEO of Matsui Securities (8628), Shigeru Osugi, Managing Executive Officer of Okasan Securities Group (8609), and executives from other securities companies who held a financial results briefing at the end of January. They said that Japan Tobacco (JT, 2914) is particularly popular.

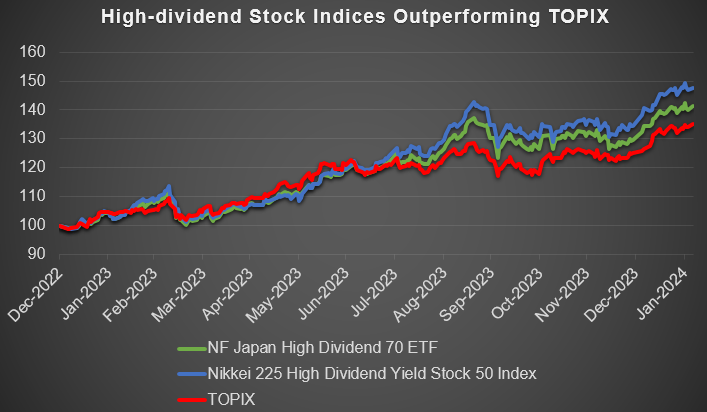

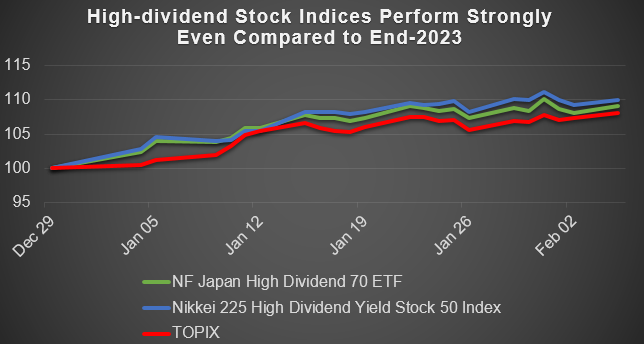

The indices of high-dividend stocks continue to outperform TOPIX. The underlying index of the NEXT FUNDS Nikkei 225 High Dividend Yield Stock 50 Index Exchange Traded Fund (NF Nikkei High Dividend Yield 50 ETF, 1489), an exchange traded fund (ETF) with a large market capitalization, has risen 47% since the end of December 2022. This outperforms TOPIX (up 35%) and the Nikkei 225 (up 39%) over the same period. Even with a base date set at the end of December 2023, the high-dividend stocks show a strong performance.

Relative comparison with the index at the end of December 2022 as 100

Relative comparison with the index at the end of December 2023 as 100

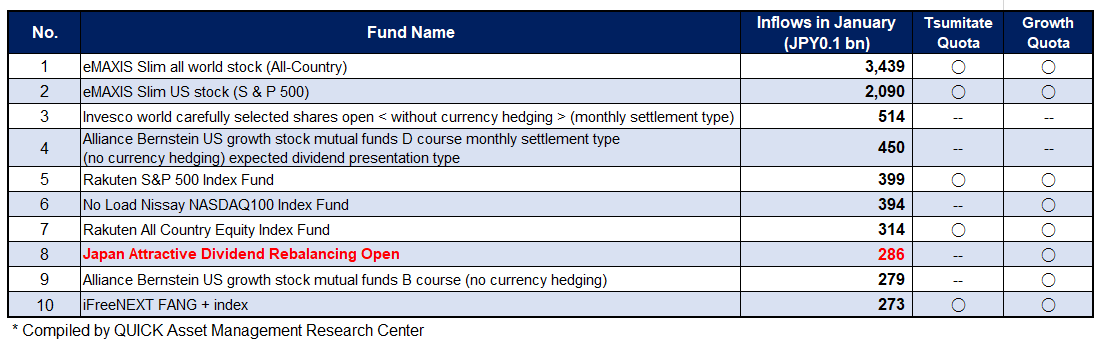

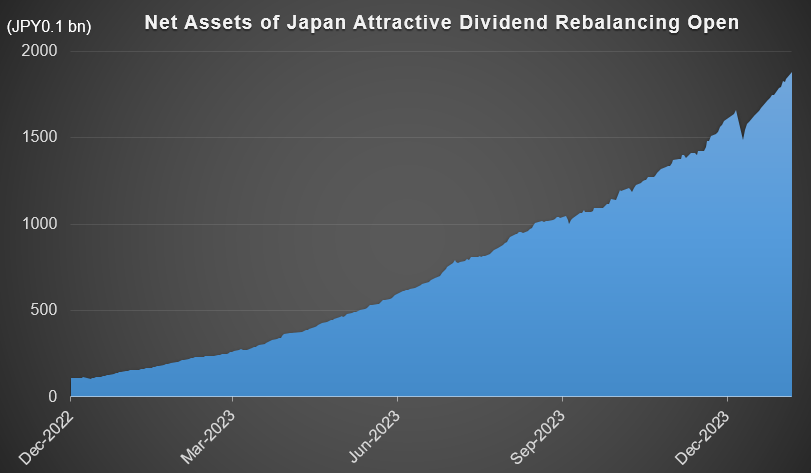

Capital is also flowing into high-dividend stocks through investment trusts. According to QUICK Asset Management Research Center, “Japan Attractive Dividend Rebalancing Open,” managed by SBI Okasan Asset Management, ranked in the top eight in January in terms of capital inflow. The fund is the only domestic equity fund among the top 10 in the January capital inflow rankings, which are dominated by All-Country Index and S&P Index funds.

The fund boasts nearly 20 years of investment experience and invests in approximately 70 constituents of the Nikkei 500 Index in order of expected dividend yield. SBI Okasan Asset Management announced on January 31 that it would temporarily suspend sales of this fund, with February 7 as the last day to accept applications. By suspending sales, the company intends to maintain the net asset size within an appropriate operational range in light of the recent capital inflow and the liquidity of the investments.

An online securities representative also revealed, “Among the information content provided to investors, high-dividend related views are increasing.” Another online securities company noted, “Since the launch of the New NISA, capital inflow into high-dividend stocks has increased spontaneously, though securities companies have not recommended such stocks.” The high-dividend stocks that are well-known even among novice investors may continue to see a gradual capital inflow.

The high level of NISA account applications continues, particularly at online securities companies. At a press conference on January 26, Mr. Warita explained, “We estimate the number of accounts opened in January have reached 14,000 (by January 26). We have received nearly 20,000 applications, but the procedures for opening accounts have been delayed.” A market source commented, “At some online securities companies, opening a NISA account may take three to four weeks from the time of application.”

It has only been about a month since the New NISA was launched, and an investor base is expected to see a modest expansion. Capital inflow into high-dividend stocks will continue to increase given new individual investors’ desire for “value for money” by receiving high dividends tax-free.

(Reported on February 7)

QUICK Licensed News on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data016/