Japan Markets ViewShift from Savings to Investment – New NISA to Start in January 2024

Nov 27, 2023

The New Nippon Individual Savings Account (NISA) will be launched in January 1, 2024. The New NISA is expected to encourage more people in Japan to start investing and to be involved in investment more proactively.

When individual investors invest in stocks, investment trusts, and other financial instruments, they are usually subject to a tax of approximately 20% on profits from the sale of these instruments and dividends received. However, the NISA system allows tax exemption within a certain range. While the investment under the current NISA is available until the end of 2023, the New NISA will be introduced in 2024 to drastically expand the current NISA and make the scheme permanent.

Table of Contents

Background of Launching the New NISA

In the Basic Policy on Economic and Fiscal Management and Reform approved by the Cabinet in June 2023, it is clearly stated that the government is working to accelerate the shift “from savings to investment” by “opening up household financial assets of JPY2,000 tn and realizing a ‘leading nation in asset management’ that contributes to sustainable growth. One of the specific measures to achieve this is the implementation of the “Doubling Asset-based Income Plan” formulated by the government’s “Council of New Form of Capitalism Realization” in November 2022. At the core of this policy is the drastic expansion and permanent establishment of NISA. The plan calls for doubling the total number of NISA accounts (General NISA and Tsumitate NISA) (from 17 million at the end of June 2022 to 34 million) and doubling the amount of NISA purchases (from JPY28 tn at the end of June 2022 to JPY56 tn) in five years.

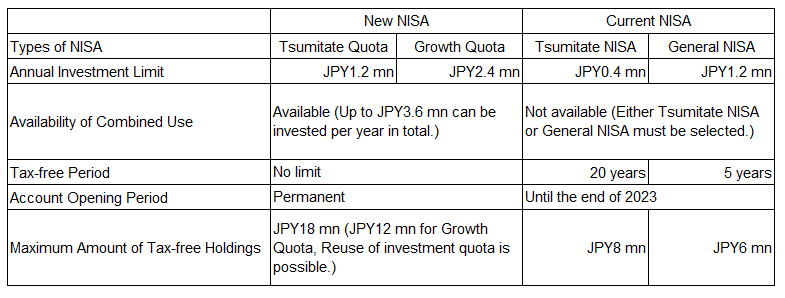

Key Points of the New NISA and Differences from the Current NISA

Tsumitate Quota:

It is the successor to the current “Tsumitate NISA,” and invests on a regular monthly basis in certain investment trusts suitable for long-term accumulation and diversification. Eligible instruments for investment are the same as those for the existing “Tsumitate NISA.”

Growth Quota:

It is the successor to the current General NISA. Eligible instruments for investment include the same as those for the Tsumitate Quota, as well as listed stocks and investment trusts including Exchange Traded Funds (ETFs) and Real Estate Investment Trusts (REITs) that are not eligible for the Tsumitate Quota.

Benefits of the New NISA

(1) Expansion of Investment Limits

Under the current system, the annual investment limits are JPY1.2 mn for the General NISA and JPY0.4 mn for the Tsumitate NISA. The New NISA consists of “Tsumitate Quota” and “Growth Quota” and has the annual investment limits of JPY1.2 mn for the former and JPY2.4 mn for the latter, a substantial expansion from the current system. In addition, the “Growth Quota” and “Tsumitate Quota” can be used simultaneously, allowing for investment of up to JPY3.6 mn per year.

(2) Unlimited Tax-free Period

Under the current NISA, the tax-free periods are 5 years for the General NISA and 20 years for the Tsumitate NISA. In the General NISA, rollover is possible. Rollover refers to transferring financial instruments held in the year following the end of the tax-free period to a new tax-free investment quota for the same year. However, in Tsumitate NISA, rollover is not possible, which means that the investment instruments must be either sold or transferred to a taxable account. On the other hand, the New NISA eliminates the limit on the tax-free period.

(3) Reuse of Investment Quota Becomes Possible

Under the current NISA, the investment quota cannot be reused even after selling the purchased financial instruments. In contrast, under the new NISA system, investors can hold assets up to JPY18 mn based on acquisition value. Thus, as long as the sum of assets held in the Tsumitate Quota and the Growth Quota does not exceed JPY3.6 mn per year, the investment quota equivalent to the acquisition cost of the instruments sold can be used again for new investments in the following year or later.

Notes on the New NISA

(1) Treatment of Losses

As with the current NISA, losses in a NISA account and gains in a taxable account in the same year cannot be aggregated. In addition, losses in a taxable account can be carried over for up to three years and added to profits in the same year, but this is not possible in a NISA account.

Meanwhile, under the current NISA, if there is an unrealized loss at the end of the tax-free period, the acquisition price will be the market value at the time of transfer to the taxable account. Therefore, even if the asset subsequently recovers to its original level, the amount of the recovery would be taxed. However, with the New NISA, the tax-free period became indefinite, eliminating this kind of problem.

(2) Growth Quota with Narrower Instruments Range Compared to General NISA

Since the New NISA is designed for continuous asset building through long-term holdings of financial instruments, the following products are not eligible for the new scheme.

- Securities to be delisted (stocks of companies that are scheduled to be delisted) and securities under supervision (stocks of companies that are at risk of being delisted)

- Investment trusts with monthly distributions, etc.

- Certain investment trusts, etc., using derivatives transactions

- Investment trusts with a trust period of less than 20 years, etc.

Treatment of the Current NISA

Accounts opened under the current NISA will remain, but new investments will be allowed only until the end of 2023.

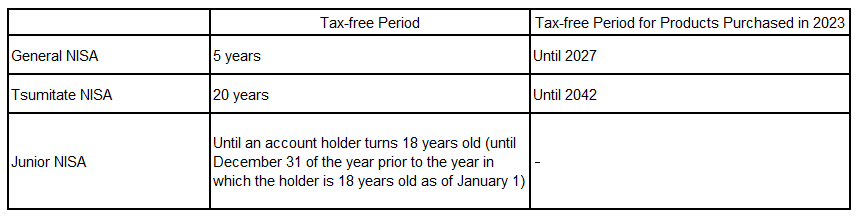

(1) Tax-free Period

Dividends and gains from the sale of the assets are exempt from taxation until the periods shown in the table below, but the assets should be sold upon completion of the tax-free period or transferred to a taxable account for investment.

Junior NISA is a system under which custodial parents or grandparents manage and operate the accounts of their children and grandchildren under the age of 17. If the money invested is withdrawn before turning 18 (until December 31 of the year prior to the year in which the person is 18 years old as of January 1) unless due to a disaster or other unavoidable reason, it, together with past gains, will be taxed at that time and the Junior NISA account will be abolished. However, after 2024, the Junior NISA system will no longer exist, and tax-free withdrawals will be possible at any time. In this case, again, the Junior NISA account will be abolished.

(2) Transfer to the New NISA Accounts and New Account Opening

Instruments held in the current NISA accounts cannot be transferred to the New NISA accounts. However, in order to avoid complicated procedures for the new system, if you have either a Tsumitate NISA or General NISA account under the current system, a New NISA account (i.e., Tsumitate Quota and Growth Quota) will be automatically set up at the same financial institution when the new system is launched. It is possible to change the financial institution where the account is opened. However, since a single person can only hold one account, it is necessary to close the account at the financial institution before the change and open an account at a different financial institution after the change.

So far, this article outlined the New NISA system. An unlimited tax-free period and increased investment limits will allow individual investors to invest more assets with the benefit of tax exemption for a longer period of time.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/