Japan Markets ViewEfficient Investment Strategies Using QUICK Consensus

Dec 01, 2022

QUICK Consensus, offered by the financial information provider QUICK, is a proprietary aggregation of company earnings forecasts and stock price ratings forecasted by analysts at securities and research firms. It enjoys extensive coverage in Japan and is recognized as the most well-known and reliable consensus.

It has been found that QUICK Consensus can be used to capture stock price movements with high accuracy. The Revision Index (“RI”), calculated using QUICK Consensus, is likely to help develop effective investment strategies.

Calculating the RI Using QUICK Consensus

First, we calculated the RI using QUICK Consensus. Generally, RIs are used as indices of earnings forecast revisions made by securities analysts. A larger positive value indicates a growing momentum of upward revisions, while a larger negative value shows the opposite – a growing momentum of downward revisions. This index captures the direction of change in business performance and is used to judge business confidence. In this report, we established portfolios by industry and verified whether investment returns could be obtained using the relevant RI.

Industry-specific RIs are often compiled employing large categories, such as TOPIX sector indices. However, increased accuracy can be expected by narrowing the target to companies in similar business categories. We extracted a group of such companies based on the attributes of the businesses in question and the indicators they disclose.

The industries analyzed for this report were drugstores (17 stocks), system development (14 stocks), housing-related (12 stocks), and restaurants (or izakaya, a type of casual Japanese bar; 15 stocks). A classification more narrowly focused than TOPIX Sector Indices was used based on reports by sector analysts.

Investment Decisions Based on the RI

Next, we performed a back-test to verify the actual investment results using the RI calculated based on QUICK Consensus. Using the RI compiled for each industry at the end of each month, we formulated investment strategies to determine which stocks to buy. We decided the stocks should be bought if the RI rose, and conversely, that they should not be bought if the RI fell. The stocks purchased were held until the end of the following month, after which the position was again determined based on the updated RI.

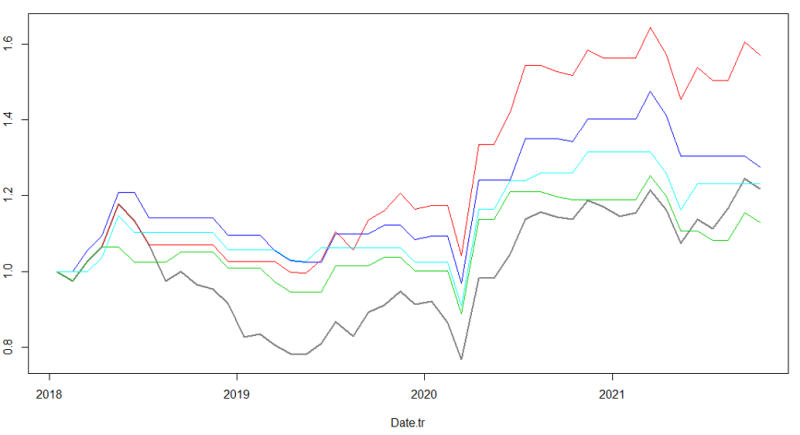

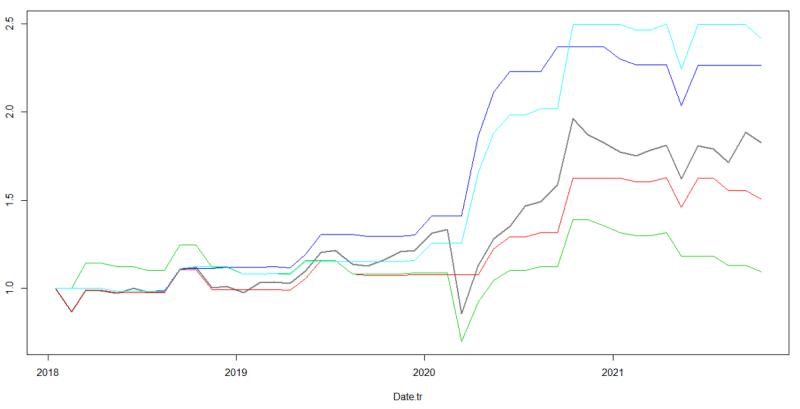

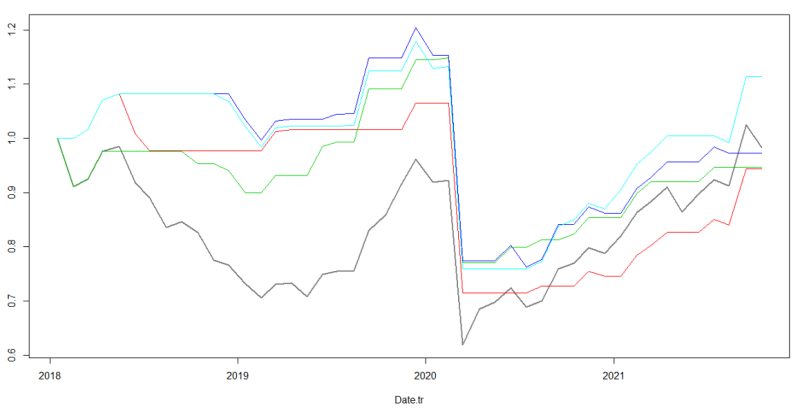

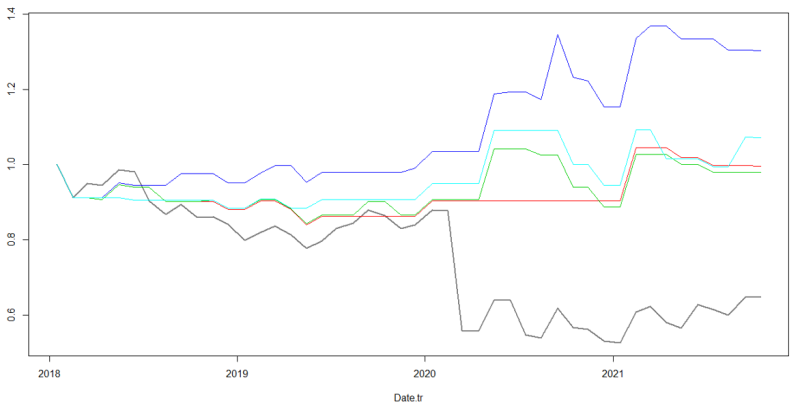

The following charts show the performances of each industry sector from January 2018 to October 2021, with the RI used as the investment decision factor.

Drugstores

System development

Housing-related

Restaurants (Izakaya)

*Black line (Benchmark): When investments were made regardless of the RI

*Red line (RI): When stocks were purchased if the end-of-month RI was positive, but not purchased if the end-of-month RI was negative

*Green line (D1): When stocks were purchased if the end-of-month RI increased from the end of the previous month; otherwise, stocks were not purchased

*Blue line (D2): When stocks were purchased if the end-of-month RI was higher than at the end of the previous two months; otherwise, stocks were not purchased

*Light blue line (D3): When stocks were purchased if the end-of-month RI was higher than at the end of the previous three months; otherwise, stocks were not purchased

“RI” shows the performance when the RI at the end of the current month was used as-is for investment decisions. “D1,” “D2” and “D3” represent the performances when the RI was used for investment decisions by comparing the historical RI with the RI at the end of the current month. D1, D2 and D3 differ in terms of the periods of data compared.

The results indicate that drugstores had the best performance in the RI category, while system development and housing-related had an outstanding performance in D3, and restaurants (izakaya) in D2. All of these outperformed their benchmarks. This suggests that making investment decisions using the RI, which is calculated based on QUICK Consensus, ensures effective investment management.

During this validation period, the selections for all industries generated greater returns when the RI was used. When focused on specific industries, the RI can provide an investment strategy that aims for returns outperforming the benchmark. This demonstrates the effectiveness of QUICK Consensus as an extremely useful investment tool for identifying industry trends.

QUICK provides data on various companies through its data platform, QUICK Data Factory. QUICK Consensus, which aggregates a number of different analyst forecasts for sales, EPS, ROE, EBITA, etc., covers historical data from 2005.

QUICK Consensus on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data009/