Japan Markets View“Automobiles” – A Sector to Be Overweighted

Aug 18, 2022

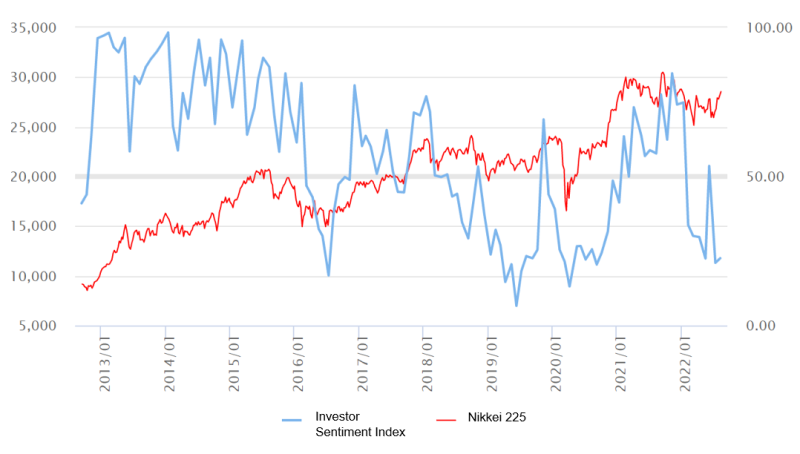

The Nikkei 225 surpassed the 28,000 milestone, which had been repeatedly hit back, on a closing basis on August 5, and recovered to its highest level in two months since June 9. However, there still remain challenges, such as calming inflation and avoiding entering a recession, making it difficult to expect a steady Nikkei 225 growth. According to QUICK Monthly Survey (Equity) in August, the Nikkei 225 is likely to remain lackluster. Under such circumstances, it is encouraging to see an increasing number of market participants taking a bullish view on the automobile sector.

In the Monthly Survey in August, the Nikkei 225 is only forecasted at 27,562 at the end of August and at 28,300 six months ahead at the end of January 2023 (based on the simple average of 119 respondents). The respondents expect the market to remain in a range centered around 26,000-28,000.

In the same survey, when institutional investors in Japan were asked about the allocation ratio of Japanese stocks in the funds under their management, 85% of all respondents selected “Maintain the status quo” showing their strong wait-and-see attitude.

The QUICK Investor Sentiment Index for August came in at 22.58, still below 50, which is the dividing line between bullish and bearish judgments. This indicates that investors are not still unable to take a bullish stance. While major companies are in the midst of announcing their earnings results, only individual investors’ selective buying of stocks with favorable earnings can be confirmed, which is not enough to boost the entire market.

Some market participants said, “The impact of monetary tightening policy of the Central Banks in Europe and the U.S. on economic trends is a focus of attention, and there is also a concern about whether the pace of consumption recovery will slow down due to high prices in Japan. In the near term, the market is likely to remain lackluster.” (Bank)

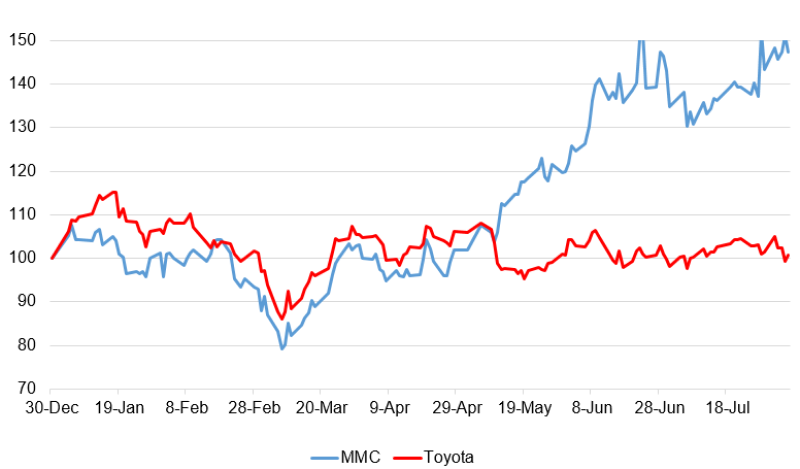

Yet, there is a brighter sign. The Monthly Survey asked institutional investors in Japan about the sectors to overweight, and “Automobiles” returned to the top for the first time in seven months at 21%. This suggests that the Nikkei 225 may be boosted by buying on dips of shares in companies such as Toyota Motor (7203, Toyota), which is a major contributor to the Nikkei 225.

One of the reasons for the interest in the automobile sector is the earnings boost driven by a weaker yen. In fact, on August 4, Toyota revised upward its consolidated net income forecast (based on International Financial Reporting Standards) for the fiscal year ending March 31, 2023, to JPY2.36 tn, a 17% decrease YoY, from the previous forecast of JPY2.26 tn. The fact that the group’s global sales volume remains unchanged at 10.7 million units from the previous forecast, despite continued production cutbacks due to supply constraints, is also likely to be a supportive factor.

On August 8, it was reported that Mazda Motor (7261) appeared to have posted a consolidated operating loss for the April-June period of 2022. However, the stock price rebounded after the morning’s low to finish 1.7% higher. The market points out that the contribution of new cars can be expected from the second half of the fiscal year, and that a decline in the stock price would provide a good opportunity for buying on dips.

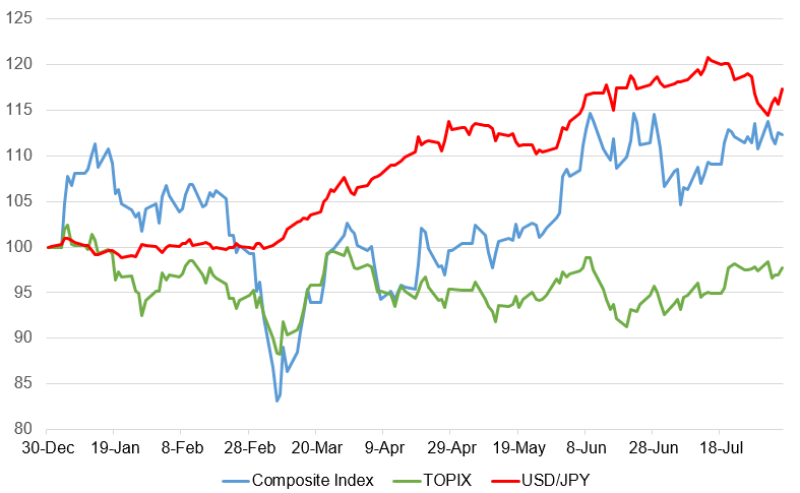

he composite index (blue line) of the seven major automobile makers has outperformed the TOPIX by 14% since the beginning of the year, factoring in a pickup in production due to the weaker yen and the normalization of supply constraints. Mitsubishi Motors (7211, MMC), in particular, rose nearly 50% driving the composite index.

* Composite index: Nissan Motor (15%), Toyota Motor (15%), Mitsubishi Motors (14%), Mazda Motor (14%), Honda Motor (14%), Suzuki Motor (14%), Subaru (14%)

MMC enjoys brisk sales of “eK X EV,” a light electric vehicle (EV), and has received orders for 5,400 units, exceeding the plan, in about two months from the end of May. The company’s performance is expected to recover rapidly benefiting from structural reforms and higher sales prices.

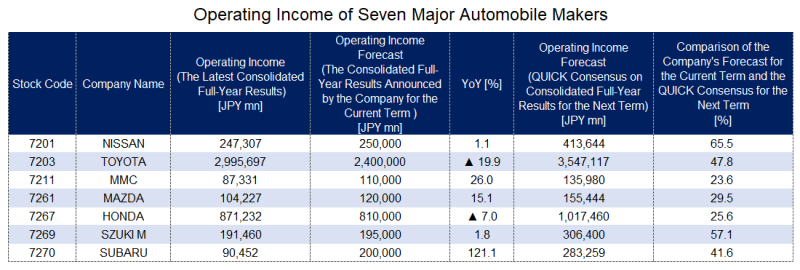

Regarding the seven major automobile makers’ forecasts for the current fiscal year, Toyota and Honda Motor (7267) are forecasting a decline in operating income. However, according to the QUICK Consensus forecast for the next fiscal year, which is the average of market expectations, all seven companies are expected to post large double-digit increases in profits. A slightly more forward-looking perspective may provide a clear picture of investment targets.

(Reported on August 9)

QUICK Investor Sentiment Index

Investor Sentiment Index is a proprietary index utilizing questionnaire data collected by QUICK Monthly Survey (Equity). The index is calculated based on the stance of funds’ Japanese stocks allocation ratios answered by institutional investors in Japan. The index value above 50 indicates that institutional investors in Japan are “Bullish” in their investment stance, while below 50 indicates that they are “Bearish.”

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/