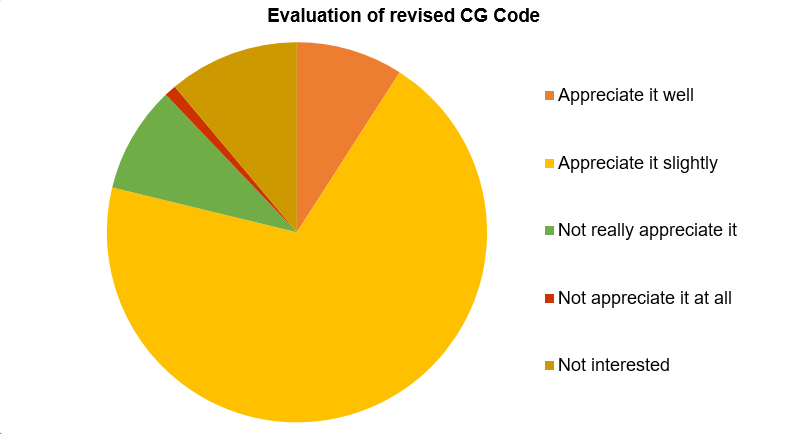

Japan Markets ViewAsked about the evaluation of the revised CG Code – QUICK Monthly Survey (Equity) in July 2021

Jul 13, 2021

The Financial Services Agency (FSA) and the Tokyo Stock Exchange (TSE) revised the Corporate Governance Code (CG Code) in June. Several new guidelines were lined up, including the appointment of at least one-third independent outside directors, the promotion of women, foreigners and others to management positions, and information disclosure in line with the framework of the Task Force on Climate-related Financial Disclosure (TCFD). The formulation of the CG Code is a pillar of the governance reforms that began as part of Abenomics. The key issue in the series of reforms is to enhance corporate value.

In the QUICK Monthly Survey (Equity) in July, we asked about their evaluation of the revised CG Code, just under 80% of market participants selected, “We appreciate it.” “Although the revision itself is not expected to bring about dramatic changes, the fact that the TSE requires listed companies to have a high level of corporate governance is a positive factor. To change the old structure, it needs outside pressure.” said one respondent.

To enhance corporate value, should we also listen to the proposals of activist shareholders? In the report investigating whether Toshiba’s annual shareholders’ meeting last July was conducted fairly, it drew attention that the company tried to prevent the proposal from activists together with the Ministry of Economy, Trade and Industry. 40% of the respondents selected that the problem would “negatively affect” the investment behavior of domestic and foreign investors in Japanese stocks, while 50% thought it would “remain unchanged.”

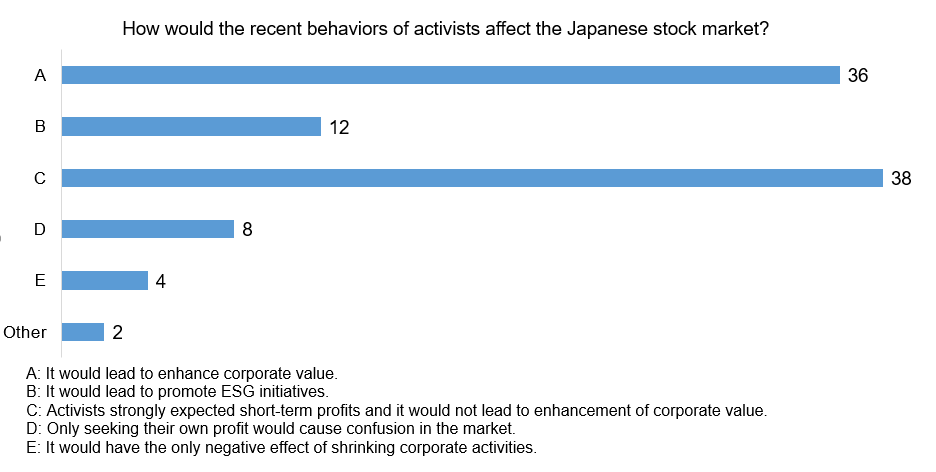

When asked about the impact of recent behaviors of activists on Japanese stock market, the pros and cons were antagonistic. 48% of the respondents selected, “It would lead to enhancement of corporate value and promotion of ESG initiatives.” On the other hand, 50% of respondents selected the one of the following options, “Activists strongly expected short-term profits and it would not lead to enhancement of corporate value,” “Only seeking their own profit would cause confusion in the market,” and “It would have the only negative effect of shrinking corporate activities.” Although more people are appreciating their behaviors than before, we still received feedback that “The purpose of activists was to maximize the value of the shares they hold, and that it should be understood that their arguments may conflict with the interests of other stakeholders.” (Bank)

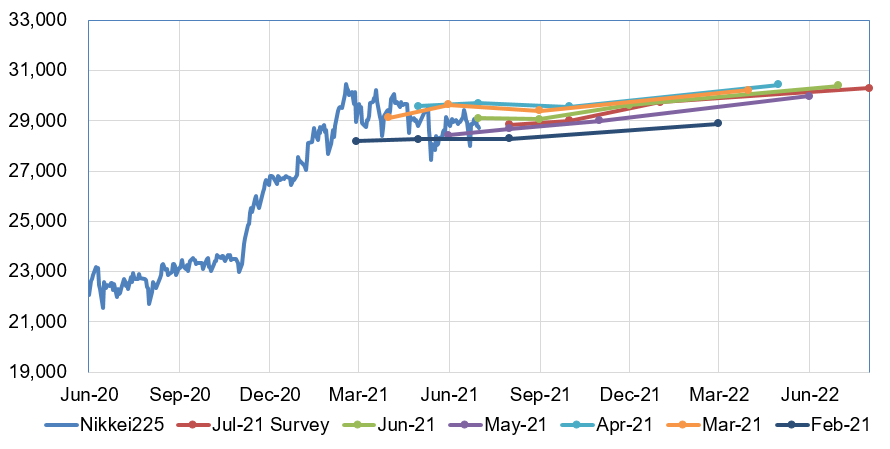

The forecast for the Nikkei 225 was corrected downward from the figures for June. The forecast for the end of July was 28,850, representing a drop of 245 from the previous survey.

The survey was conducted from June 29 to July 1, 2021, among 211 participants, including investment managers at domestic institutional investors. A total of 120 responded.

QUICK Monthly Survey on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data012/