Japan Markets ViewQUICK Tankan clearly shows companies are facing severe situations

Jun 09, 2021

Japanese companies are struggling as far as earnings are concerned. “QUICK Short-Term Economic Survey (QUICK Tankan)” for May, announced on May 19, showed that companies saw the index for purchase prices reaching its highest level, for the first time in twenty-one months. On the other hand, the index for selling prices continues to be sluggish. As the domestic economy cools down with the re-emergence of COVID-19, many companies are unable to completely pass on the increased raw material prices to the selling prices.

Rising international commodity prices

In QUICK Tankan of listed companies, the index for all industries (excluding finance) was 26 for May, the highest since August 2019. The index is calculated by subtracting the percentage of companies that chose their purchase prices ‘decline’ from ‘rise’. The indices for both manufacturing and non-manufacturing rose since the previous month. Particularly, the manufacturing index reached 42, the highest since December 2018.

While purchase prices are rising, selling prices are in the doldrums. The index, calculated by subtracting the percentage of companies that selected a ‘decline’ from ‘rise’ in selling prices, was -2 for all industries. Selling prices have been declining for the past 15 months. Although the negative range has narrowed from the previous month, the percentage of companies that reported a decline in the selling prices is still high. Both the manufacturing and non-manufacturing industries remain negative, with many industries unable to pass on rising purchasing costs to the selling prices of their products and services.

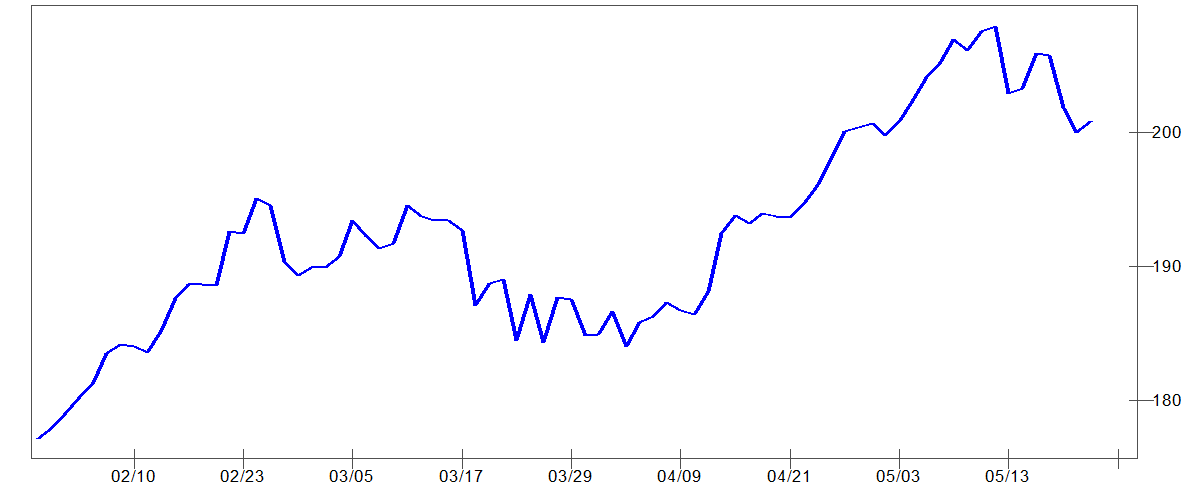

One of the reasons pushing up the purchase prices is the surge in international commodity prices. The Refinitiv/CoreCommodity CRB Index, showing the overall price movements of international commodities, reached 207.96 on May 12, the highest in five years and 10 months from July 2015. With the progress in COVID-19 vaccination, manufacturers around the world regained the momentum in production that resulted in a recovery of demand for raw materials and fuels. Prices of crude oil, copper, and other non-ferrous metals saw a noticeable increase too. Toshihiro Nagahama from the Dai-ichi Life Research Institute says, “One of the factors is that the money that has been swamped by the monetary easing of central banks is heading to the commodity market.”

Barriers in raising B2C selling prices

The prices of goods in the B2B trade are rising, reflecting the surge in the international commodity prices. The Producer Price Index rose by 3.6% YoY in April, the highest growth rate since September 2014, while the Consumer Price Index (CPI) for all items less fresh food has been negative for eight consecutive months until March, and deflationary pressure is gradually increasing. In Japan, domestic demand has been sluggish, partly due to delays in vaccination. Koya Miyamae from SMBC Nikko Securities said that many companies were able to raise prices in B2B transactions, but were not comfortable raising prices for consumers.

In Japan, a state of emergency was declared for the third time in April due to the re-emergence of COVID-19. The preliminary real Gross Domestic Product (GDP) for the January-March period announced on May 18 showed that personal spending, which accounts for more than half of GDP, declined by 1.4% QoQ. It is the first decline since the previous three quarters, indicating the unwillingness of consumers to spend.

Mr. Nagahama from the Dai-ichi Life Economic Research Institute pointed out that the economic disparity has become evident between Japan and countries where vaccination is underway. He added that “Domestic companies have experienced a prolonged deflationary recession. Hence, they have become overly cautious about passing on costs. Even if business confidence improves as vaccination progresses, they will not be able to easily pass on the increased costs.”

What is QUICK Tankan?

The official name is QUICK Short-term Economic Survey. It is an economic indicator of business confidence concerning Japanese listed companies and is surveyed and published by QUICK. BOJ Tankan is a survey of business confidence conducted by the Bank of Japan. Among the survey, the DI for large companies and manufacturing attracts a great deal of interest in the market. BOJ Tankan is published quarterly, while QUICK Tankan is published monthly. As the latest QUICK Tankan results are published about two weeks before BOJ Tankan, they are used as a leading indicator of BOJ Tankan. The survey asks the respondents to evaluate the current and future business conditions by selecting an option from ‘Good’, ‘Not so good’, and ‘Bad’. The results are announced as Diffusion Index (DI) by the industries of manufacturing and non-manufacturing. For example, the current DI for business conditions is calculated by subtracting the percentage of companies that answered ‘Bad’ from the percentage of companies that answered ‘Good’ based on the data of the past three months. In addition to business confidence, the survey also examines the level of stock prices of the companies, the yen exchange rate, and the outlook for future commodity prices.

QUICK Tankan on Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data024/

QUICK Tankan correlates with BOJ Tankan and helps to forecast the results

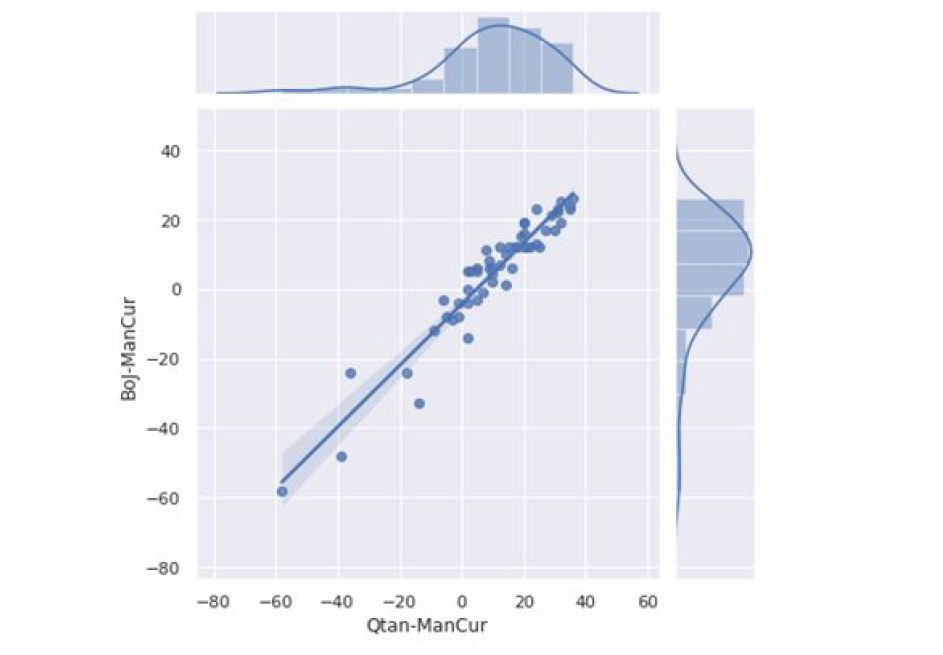

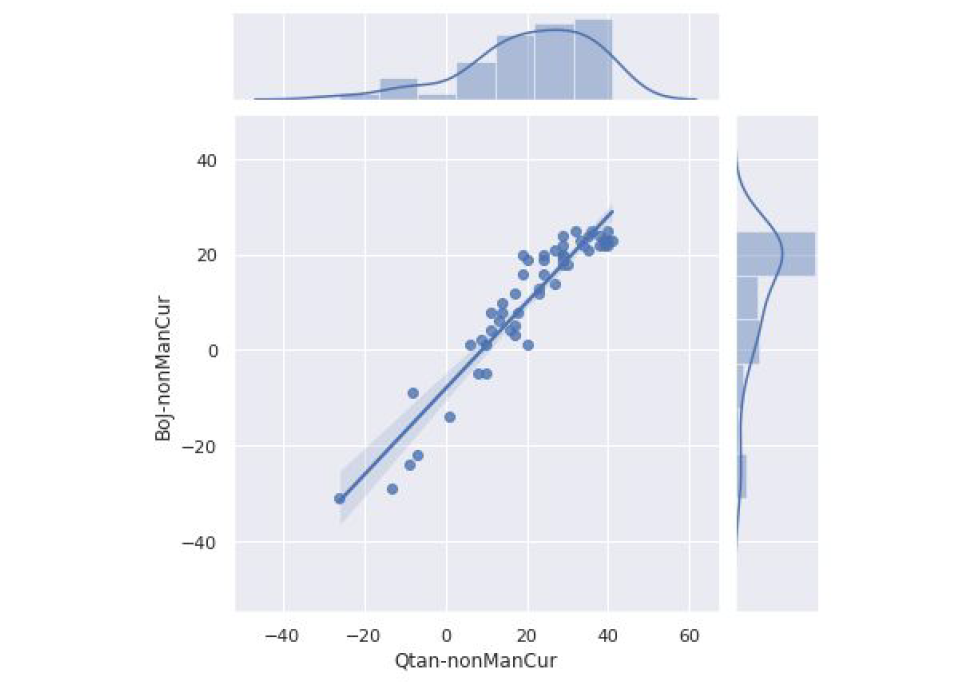

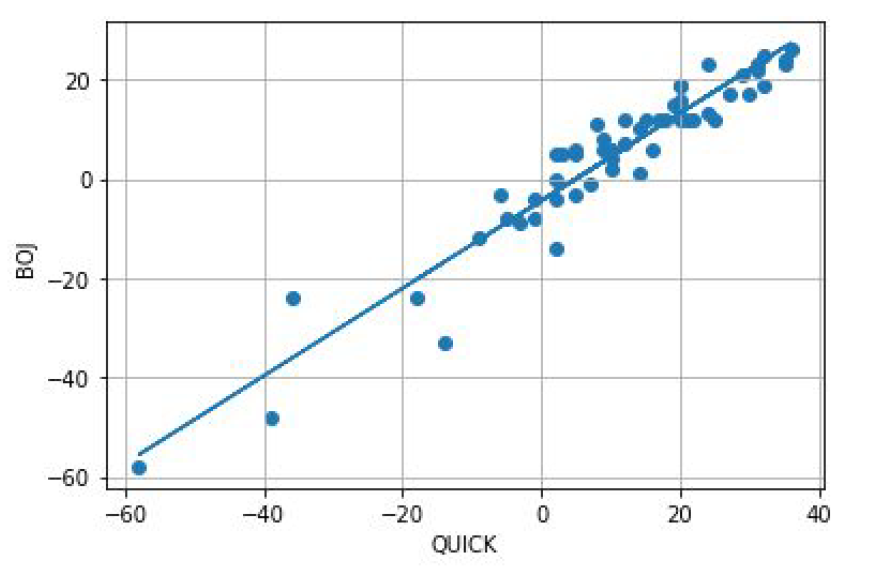

QUICK Corp. observed a strong correlation between the business confidence diffusion index (DI) published by QUICK Tankan as well as by Bank of Japan (BOJ) Tankan, with the correlation coefficients for both manufacturing and non-manufacturing DIs exceeding 0.9.

①QUICK Tankan DI for manufacturing (current, horizontal axis) and BOJ Tankan DI for manufacturing (large companies/current, vertical axis)

②QUICK Tankan DI for non-manufacturing (current, horizontal axis) and BOJ Tankan DI for non-manufacturing (large companies/current, vertical axis)

What if we use QUICK Tankan to forecast the results of BOJ Tankan? We used the Single Regression Model to analyze the data from December 2006 to March 2020 and derived the following equation for finding the correlation between QUICK Tankan DI and BOJ Tankan DI by respectively plotting them on X and Y axes.

Y=0.8821X-4.411

QUICK Tankan DI in June 2020 for manufacturing, published on 15 June, was -32. Substituting this value in the above equation gives us the value -35.52. The actual BOJ Tankan DI in June 2020 for manufacturing, announced subsequently on 1 July, was -34, a value quite close to -35.52.

The coefficient of determination of the above equation was 0.91. It ranges between 0 and 1, and a value closer to 1 indicates higher reliability of the variables used in the equation.