Japan Markets View[ESG Investment Survey 2022] (1) “Engagement” Ranked First among ESG Investment Methodologies

Jan 25, 2023

![[ESG Investment Survey 2022] (1) “Engagement” Ranked First among ESG Investment Methodologies](/wp-content/uploads/230125_img.png)

The ESG Research Center of the Enterprise Services Dept. at QUICK Corp. released “ESG Investment Survey 2022” on January 19. This is the fourth year the survey has been conducted. The purpose of the survey, which was taken during the period from August 22 to October 4, 2022, was to shed light on the actual status of ESG (Environmental, Social, and Governance) investment in Japanese equities by investors based in Japan. A total of 61 organizations (of which 13 are asset owners and 48 are asset managers) participated in the study. The aggregate results are presented in three articles, with the first issue covering ESG investment methodologies and promotional structures.

[Notable Points]

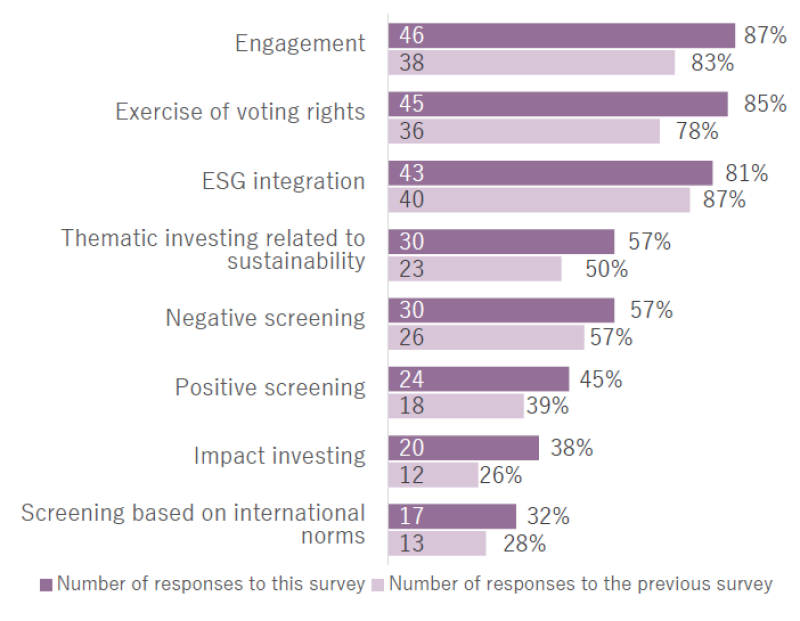

- The most common ESG investment methodology was “Engagement” (87% of valid responses; percentages to follow indicate the valid response rate for each question), followed by “Exercise of voting rights” (85%) and “ESG integration” (81%).

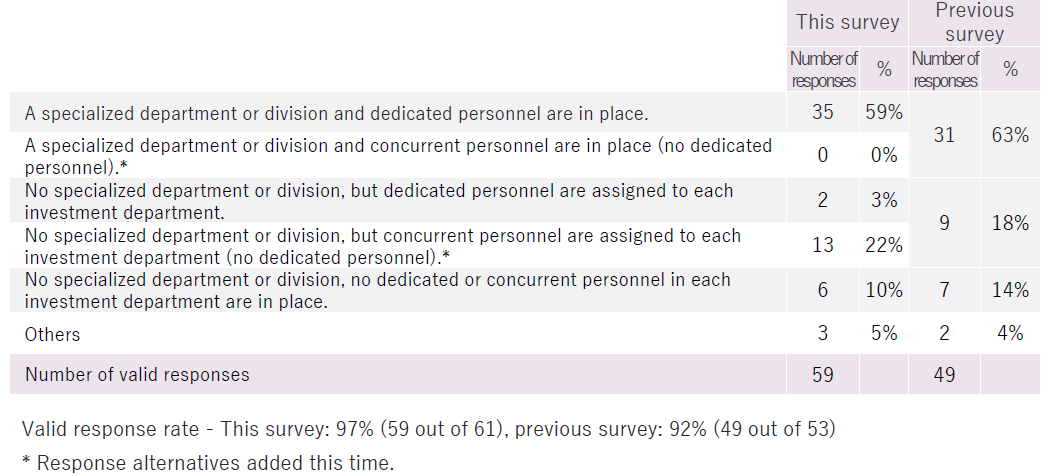

- Along with engagement activities, institutional investors are enhancing their structure to promote responsible investment through ESG research, etc. A total of 59% of respondents answered, “A specialized department or division and dedicated personnel are in place.”

Figure 1: ESG Investment Methodology

Please choose the ESG investment methodology that you implement, from among the following options. (Multiple answers allowed)

* Excerpt from “ESG Investment Survey 2022”

The most common investment methodology was “Engagement,” which involves direct dialogue with investee companies. This was followed by “Exercise of voting rights” at shareholder meetings, and “ESG integration,” which entails the incorporation of ESG factors into investment analysis and decision-making. In 2021, “ESG integration” topped the list, followed by “Engagement” and “Exercise of voting rights.” While these three methodologies continue to be widely used, “Engagement” and “Exercise of voting rights,” which allow shareholders to influence corporate behavior as investors, received very high response rates in the most recent survey.

“Engagement” is an investment approach that directly encourages investee companies to act with regard to ESG issues. The results reveal a proactive attitude of investors that extends beyond merely taking action within their organizations. Examples of their work in this area include integrating ESG factors into their investment decision-making process and excluding companies that derive revenues from certain unethical business practices.

Figure 2: Organizations and Human Resources to Support ESG Investment

Do you have any department or division dedicated to responsible investment, ESG research,engagement, etc.?

* Excerpt from “ESG Investment Survey 2022”

When asked about dedicated departments or divisions for responsible investment, ESG research, and engagement, approximately 60% of the respondents answered, “A specialized department or division and dedicated personnel are in place.” When companies with specialized or concurrently assigned personnel were included, the total was 50 organizations, exceeding 80% of the valid responses.

ESG issues cover a wide range of issues, from climate change, training and securing human resources, and diversity to human rights. There is an increasing need to have specialized departments and personnel that will promote engagement going beyond research and analysis. This survey asked separate questions about “specialized personnel” and “concurrent personnel,” but it can be said that generally, organizations and human resources supporting ESG investment are increasingly being put in place.

Continue to (2) “Climate Change” Being the Essential Theme of Engagement

[Outline of Survey]

QUICK ESG Investment Survey 2022

- 170 institutional investors based in Japan selected from the companies that have declared acceptance of the “Japanese Stewardship Code” or are signatories to the Principles for Responsible Investment (PRI)

- Number of respondents: 61 organizations (of which 13 are asset owners and 48 are asset managers)

- Survey period: August 22 to October 4, 2022

(Reported on January 19)