Japan Markets ViewWhich Stocks are Expected to Increase Dividends?

Nov 02, 2022

[QUICK Market Eyes] Amid the July-September 2022 earnings announcement season, expectations are rising for dividend increases by companies with strong earnings performance. This is because Japanese companies may continue to strengthen shareholder returns due to the dissolution of cross shareholdings and an increase in shareholder proposals. According to data compiled by QUICK, the total number of companies that have bought back their own shares in 2022 since the beginning of the year has reached 853 as of October 24. The number of companies that announced share buybacks in 2021 was 743.

In its Strategy Report dated October 21, Daiwa Securities compiled forecasts for ordinary income and total dividends of major listed companies for FY2022. As a result, the company forecasted a 15% increase in ordinary income and an 8% increase in total dividends compared to the previous year. With the recent accelerated depreciation of the yen, the trend toward higher profits and higher dividends in FY2022 remains unchanged. In fact, many companies have announced dividend increases in their interim financial results. The report also noted that if a company’s expected dividend payout ratio, calculated based on the QUICK Consensus, is below its five-year average, the company is very likely to increase the dividend.

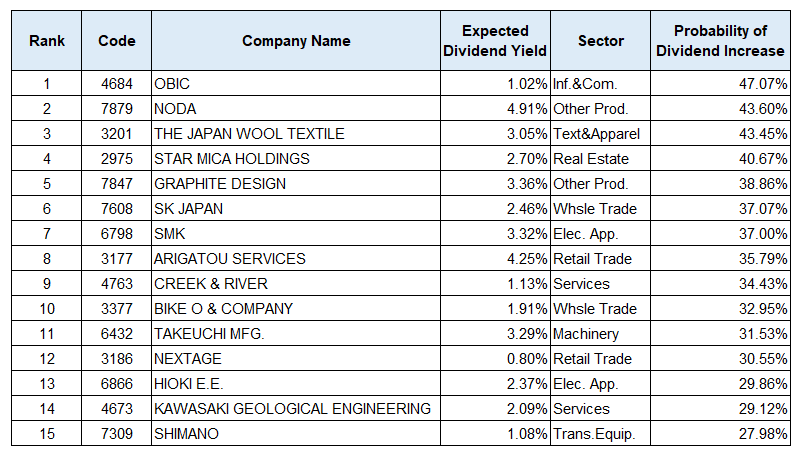

To examine the trend of stocks with high expectations for dividend increases, a ranking of the top 15 stocks with the highest probability of paying a larger dividend was compiled for stocks that have updated their dividend forecast data in the past month. QUICK’s “Prediction of Dividend Forecast Revision,” was used for the ranking. It is an analysis tool that uses machine learning to predict the probability of a year-end dividend revision based on quarterly financial results and dividend revisions over the past 10 years. This tool models and calculates the trend of variables of individual stocks, such as the actual earnings results, cash flow, quarterly progress rate, and other financial results, before the actual increase (decrease) of dividends. Then, the tool predicts the probability of revising the dividend forecast from announcing the quarterly earnings to the next ones.

Domestic demand-oriented sectors such as Other Products, Retail Trade, and Wholesale Trade were ranked high in the ranking of prediction probabilities for dividend increases. These companies are steadily expanding their business performance amid inflation, a weakening yen, etc. NODA (7879, Standard), ranked second, manufactures housing construction materials and plywood. The company’s plywood business has been driving growth in recent years.

BIKE O & COMPANY (3377, Standard), ranked 10th, has been enjoying a boom in outdoor activities and rising prices for used motorcycles, which are underpinning its performance. For foreign demand-oriented sectors, TAKEUCHI MFG. (6432, Prime), a manufacturer of mini excavators and other products, ranked 11th. The company is steadily capturing demand for infrastructure development in Europe, the U.S., etc. For electrical measuring equipment manufacturer HIOKI E.E. (6866, Prime), ranked 13th, demand for measurements on battery production lines for electric vehicles (EVs) is providing a tailwind.

(Reported on October 25)

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/