Japan Markets ViewTSE Second Section stocks with market cap over JPY10bn rather than new Prime Market exclusion candidates?

Apr 27, 2021

Less than a year remains until the TSE’s market restructuring. The current five market segments which are First Section, Second Section, Mothers, and JASDAQ (Standard and Growth) will be reclassified into three market segments: Prime Market, Standard Market and Growth Market. The new market starts from April 4, 2022.

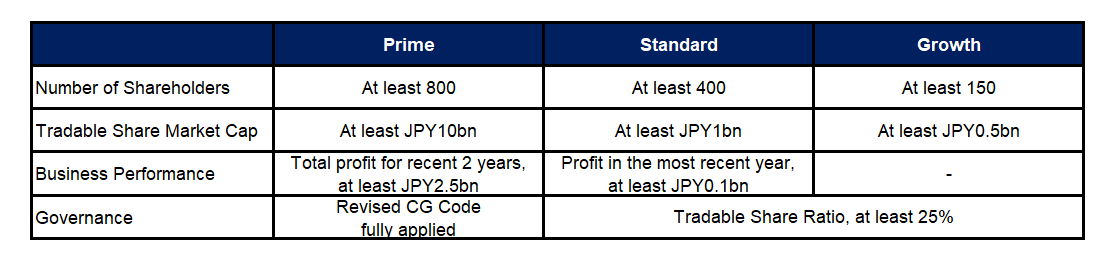

■ Prime Market, Standard Market and Growth Market

The background to the market restructuring arises from the fact that even after the Tokyo Stock Exchange and Osaka Securities Exchange merged in 2013 to form the Japan Exchange Group, they maintained their previous market structures. The current TOPIX consists of more than 2,000 companies listed on the First Section of the market and all of their stocks.

In October 2018, TSE established the “Advisory Group to Review the TSE Cash Equity Market Structure,” stating that “Potential improvements are seen around the structure of the cash equity markets and related listing rules.”

In December 2018, TSE released the Consultation Paper “Review of TSE Cash Equity Market Structure” and gathered public comments until the end of January 2019, stating that “We consider the ways to motivate listed companies to maintain and enhance their corporate value more proactively, and to gain greater support from diverse investors, both domestic and international. It is important from the perspective of contributing to the sustainable development of capital markets and eventually the development of the Japanese economy.”

Subsequently, in December 2020, TSE released the “Development of Listing Rules for Cash Equity Market Restructuring (second set of revisions),” which made it clear that that the market would be reclassified into three market segments from April 2022: Prime Market, Standard Market and Growth Market.

The main rules for each market are as follows.

■ Some stocks will be excluded from the TOPIX

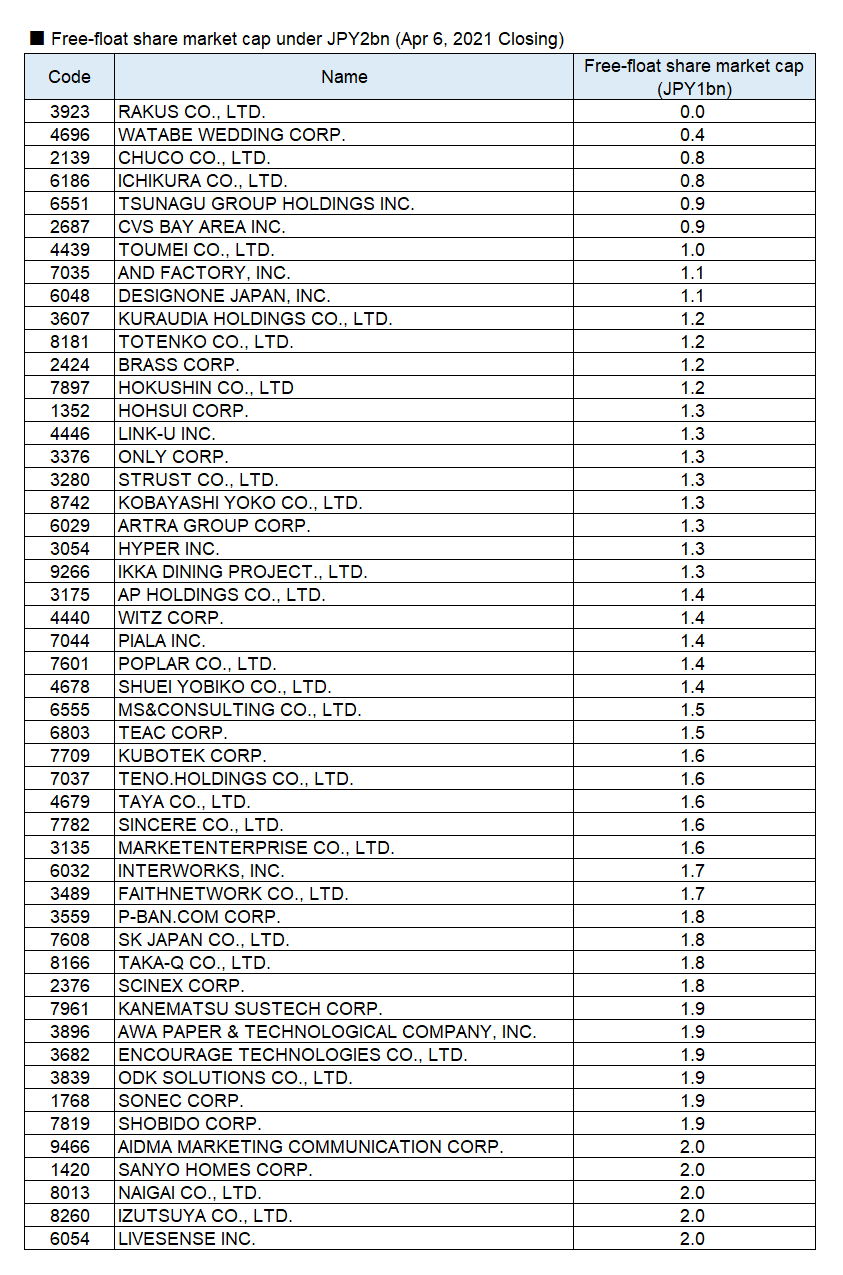

Stocks with a tradable share market capitalization of under JPY10bn will be designated as “Phased weighting reduction constituents” and their weightings will be gradually reduced from October 2022 to be finally excluded from TOPIX at the end of January 2025. The phased weighting reduction constituents are expected to be published on the fifth business day of October 2022.

Under the current rule, tradable shares are excluded if someone owns at least 10% of the listed shares. In the second set of revisions, given the extremely low liquidity in the market, shares held by “Domestic banks, insurance companies and business companies (other than financial institutions and financial instruments businesses)” (excluding those held purely for investment purpose), “Special stakeholders other than board members,” and “Shares that TSE deems inappropriate to include in” are excluded from tradable shares, even if they account for less than 10% of the total shares.

As of the close of April 6, there were 633 companies (according to FactSet) with a free-float share market capitalization of under JPY10bn.

SMBC Nikko Securities stated in its quantitative report in December 2020 that “Even at the current free-float weight ratio, most policy-holding stocks are already treated as fixed shares, and there are few stocks with the free-float weight ratio declining significantly.” The definition of “Tradable shares” is expected to be similar to the TOPIX definition of “Floating shares”. As of April 6, there were 629 companies listed on the TSE First Section with a free-float share market capitalization of under JPY10bn.

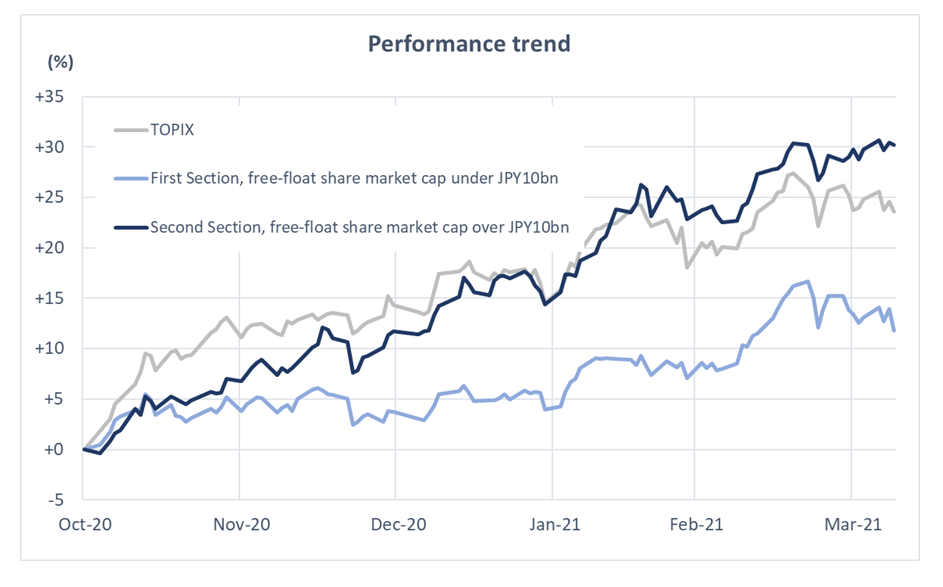

The graph below shows the performance of companies listed on the TSE First Section with a free-float share market capitalization of under JPY10bn (629 companies) and companies listed on the TSE Second Section with that of over JPY10bn, during the upward phase of the stock index since November 2020.

The performance of the group of the TSE First Section companies with a free-float share market capitalization under JPY10bn has been struggling. On the other hand, the group of the TSE Second Section companies with that over JPY10bn has outperformed the TOPIX.

In July 2021, the first decision will be made to confirm whether the tradable share market capitalization is at least JPY10bn based on June 30, 2021. The second decision will be conducted in October 2022 to check the status of improvement for the following fiscal year, even if the tradable share market capitalization is under JPY10bn in the first decision. Also, a re-evaluation will be done in October 2023 to determine whether to continue with the gradual decrease in phased weighting reduction constituents.

Depending on future events, the prices of the stocks which are on the borderline of the Prime Market adoption are expected to move significantly.

QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/