Japan Markets ViewTIS Increased Its Sales and Profit Significantly on Rising Demand for Cashless Payments

Sep 01, 2021

Cashless payments are entering a new phase. On August 19, PayPay, the largest provider of QR code payments, announced that it would charge small and medium-sized companies a payment system fee, which had previously been free in order to attract stores.

More businesses adopting the system due to COVID-19

The new PayPay fee rate is 1.6% to 1.98%, lower than the average credit card fee of 3% to 5% and QR code payment fee of 2% to 3%. At one time, there were dozens of cashless payment services in the market, and the competition was fierce with high-priced campaigns, etc. However, the excessive high-priced campaigns have been criticized as too much, and recently the competition has calmed down. In the meantime, the number of businesses adopting cashless payment services is steadily increasing due to the need for contactless and speedy payment in the COVID-19 pandemic.

Low adoption rate in BtoB

According to the latest “Cashless Payment Survey” compiled by the Cashless Payment Promotion Office of the Ministry of Economy, Trade and Industry, 70% of the 1,189 businesses in Japan that responded to the survey have adopted cashless payments. By industry, the restaurant, retail, and tourism sectors have made progress in going cashless, while the service, primary industry, manufacturing, construction, and wholesale sectors have made little progress.

Although the cashless ratio rises as the BtoC ratio rises, the adoption rate tends to be low in BtoB. In addition, although the cashless adoption rate increases in the unit price range of JPY1,000 to less than JPY10,000 per customer, the adoption rate tends to be low among businesses with a high unit price per customer. This is partly because of the fact that the benefits of simplified settlement and marketing effects outweigh the payment fees for businesses with low profit per customer.

80% of the respondents answered that the maximum fee rate for the adoption of cashless payment should be up to 2%. As PayPay has introduced the system payment fee, other service providers are expected to follow suit, and the trend will be closely watched.

TIS Inc. increased its sales and profit significantly

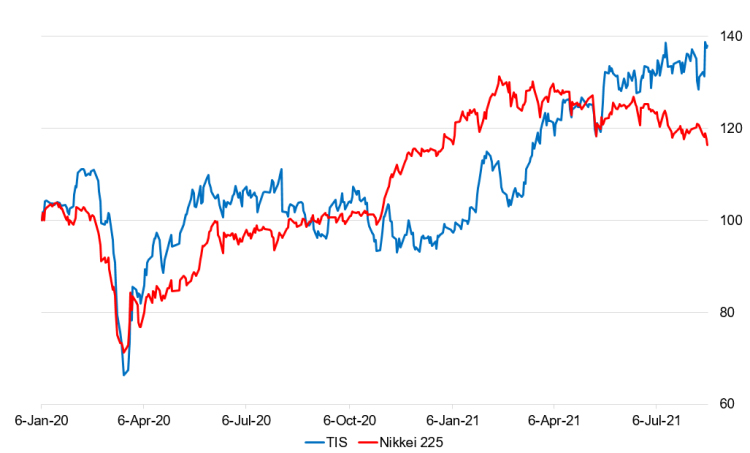

With the spread of cashless payments, companies that provide related platforms and systems are performing well. One such company is TIS (3626), an independent system integrator that specializes in credit cards. As of August 23, its stock price has been record-high since it was listed. The company provides system construction and related platform services for credit cards (deferred payment), debit cards (immediate payment), and prepaid cards (advance payment).

*Relative chart of TIS and Nikkei 225 with the beginning of the year 2020 as 100

According to the “Follow-up on the Growth Strategy” announced by the government in 2019, they aim to increase the ratio of cashless payments to 40% by 2025, when the Osaka Expo will be held, and to 80% in the future, the highest level in the world. With the spread of QR codes and touchless payments, the amount of credit card-based payments is expected to increase further.

TIS announced on August 5, 2021 that for the April-June period of 2021 (Q1), sales increased 13% YoY to JPY113.5bn and operating income increased 34% YoY to JPY10.2bn, a significant increase in both sales and profit. In addition to capturing demand for IT investment in settlement and marketing-related fields as digitalization progresses, the financial sector benefited from increased IT (information technology) investment by credit card-related customers. Orders for the quarter increased 16% to JPY88.7bn, and the order backlog increased 12% to JPY123.5bn, as software development increased due to the normalization of business activities from the COVID-19 pandemic.

In a report dated August 13, Mitsubishi UFJ Morgan Stanley Securities evaluated the company’s financial results for the April-June period of 2021 as positive. Looking ahead, they expect credit card SaaS (software as a service) to be released in the first half of 2023 and credit card integration projects, and have maintained an “overweight” rating on the company.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product//