Japan Markets ViewPremium Charge Rate Incurrence in the Japanese Stock Market

Mar 23, 2023

QUICK provides scores for the probability of incurring the Premium Charge Rates. F-index, a data analysis consulting service provider in Japan, has conducted a verification study using such data. The results of the study are summarized the status of the Premium Charge Rate incurrence and the performance and effectiveness of QUICK’s Premium Charge Rate Score.

Definition of the Premium Charge Rates

In Japan, there are two types of margin trading: negotiable margin trading, in which securities companies select issues eligible for trading; and standardized margin trading, in which Japan Exchange Group, Inc. (JPX) designates such issues. In standardized margin trading, securities companies can borrow stocks from Japan Securities Finance (JSF) if they are unable to procure them in-house. For instance when selling on margin increases, it may be difficult even for JSF to procure stocks. In such cases, JSF will procure stocks from institutional investors. The Premium Charge Rates are the fees incurred when procuring stocks from institutional investors, and are determined through bidding by institutional investors. The Premium Charge Rates are borne by investors selling stocks on margin.

Incurrence of the Premium Charge Rates

How often are the Premium Charge Rates incurred? First, this study examined the number of days that the Premium Charge Rates were generated during the one-year verification period from January 4, 2022 to December 30, 2022 (hereinafter, the “verification period”). The study covered 244 business days and 4,346 companies. Note that not all companies have 244 business days because some were newly listed or delisted in 2022.

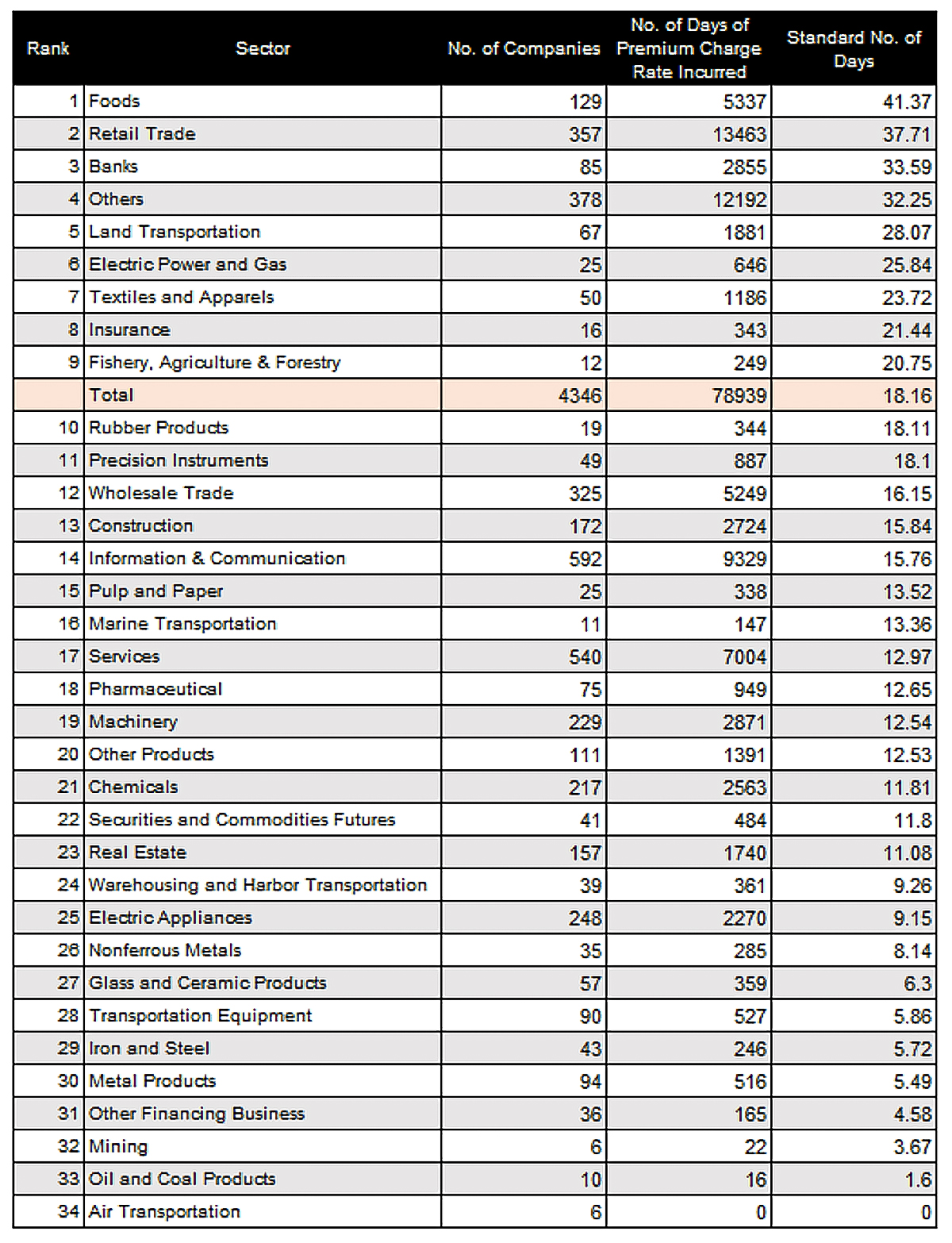

To see if there are any characteristics regarding the Premium Charge Rate incurrence, let us look at the number of days of incurrence for each TOPIX Sector Index (hereinafter, “sector”). Table 1 shows the number of days that Premium Charge Rates were generated during the verification period for each sector.

Table 1: Premium Charge Rates Incurred in 2022 (Number of companies indicates the number included in each sector)

The number of companies in Table 1 indicates the number included in the sector. The number of days of the Premium Charge Rate incurrence is the total number of business days on which the Premium Charge Rates were incurred for the companies in the sector. The standard number of days is the number of days of the Premium Charge Rate incurrence per company in the sector (i.e., the total number of days when the Premium Charge Rates were incurred divided by the number of companies). Table 1 also shows the order of sectors in which the Premium Charge Rate is most likely to be generated per company, sorted in descending order of the standard number of days. The total is the sum of all companies, and can be regarded as the market-wide level.

The study found that only 9 sectors exceeded the market-wide level, indicating that sectors prone to the Premium Charge Rate incurrence are unevenly distributed. Notably, in the top six sectors, the Premium Charge Rate incurrence had been observed for a period of more than 10% of one year. On the other hand, in the 14 sectors below the 21st place, the Premium Charge Rates had been observed for a period of less than 5% of one year (12.2 business days).

Margin Trading Restriction Data Provided by QUICK

QUICK provides the Premium Charge Rate Score, which predicts whether the Premium Charge Rate will be incurred on the next business day, based on the stock exchange guidelines and past occurrences. The next article will verify the accuracy of this score.

Margin Trading Restriction on QUICK Data Factory

https://corporate.quick.co.jp/data-factory/en/product/data020/