Japan Markets ViewNew TOPIX dominates price movement, attracting funds in a virtuous cycle

Feb 09, 2022

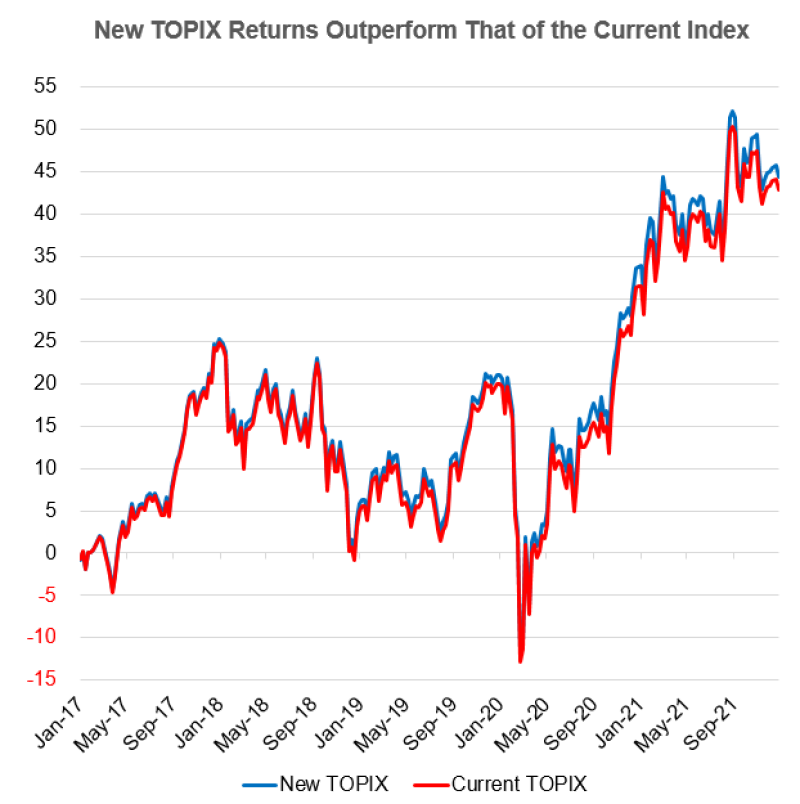

The Tokyo Stock Exchange (TSE) narrows down the constituent stocks of the Tokyo Stock Price Index (TOPIX). A feature of the new TOPIX is that it excludes stocks with low liquidity based on the tradable shares market capitalization. QUICK and Nikkei Veritas made a retrospective calculation using a new group of stocks as a prototype, and found that the cumulative return over the past five years exceeded the current TOPIX by 1.59%. If the performance of the indexes improves, it could be a catalyst for attracting new investment funds from around the world.

The current TOPIX consists of all stocks listed on the TSE 1st Section. Recently, index investment, which aims to achieve the same price movement as the index, has become mainstream, facilitating a uniform inflow of funds into all stocks on the TSE 1st Section. As of January 20, there were 2,184 companies on the TSE 1st Section, and they are a mixed bag in terms of corporate size, financial strength, and business performance.

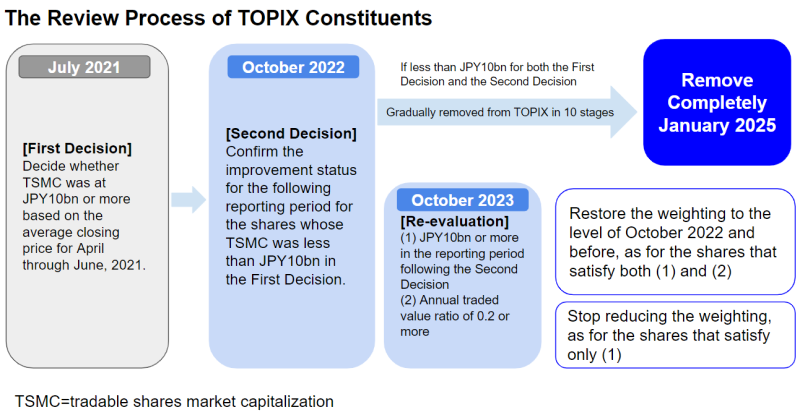

With the TSE’s market structure review, the TSE 1st Section will be reborn as “Prime Market” with stricter standards from April. In line with this, the TSE has also taken steps to reform TOPIX. A new criterion was established to select stocks with a tradable share market capitalization of JPY10bn or more, and stocks with low liquidity will be phased out of the composition.

QUICK created a group of stocks (1,498 stocks) on the TSE 1st Section, excluding stocks with a tradable share market capitalization of less than JPY10bn as of January 14. Assuming that these are the constituents of the new TOPIX, past price movements were calculated and compared to the current TOPIX. The cumulative weekly return for the five years through January 14 was 42.81% for the current TOPIX, while new TOPIX outperformed the current TOPIX at 44.40%.

It was only in the first month of the comparison that the current TOPIX exceeded the new TOPIX in cumulative returns. Stocks with stagnant corporate value growth and limited liquidity were excluded, making it easier for the index to reflect the growth of mainstay companies, which is believed to have led to improved performance.

The largest difference in cumulative returns over the period, 2.50%, was in the second week of February 2021. This was the period when stock prices rose, mainly for major stocks, against the backdrop of improved business performance of large companies. The TOPIX and Nikkei 225 reached their highest levels in almost 30 years.

In terms of price movements, the increase in the impact (weight) of each stock on the index due to the decrease in the number of stocks is also noteworthy. For example, Toyota Motor (7203), which has the largest weighting by stock, had a weighting of 3.84% in the current TOPIX as of the end of November 2021, but under the new standards, its weighting is estimated to be 5.21%. TSE has set the upper limit of the composition ratio at 10% to prevent the stock price movements of mainstay stocks from excessively influencing the index.

TSE plans to change its constituent stocks and switch to the new standards by January 2025. If the performance of the new TOPIX, which has become lighter due to the reduction in the number of constituent stocks, improves, it will be an opportunity to attract new funds for index investment. If a virtuous cycle is realized, which will further improve the price movement of the index, there is a high possibility that the return will be better than the estimate from the past five years. The success or failure of the TOPIX reform is likely to be a focal point that would influence the long-term price movements of the mainstay stocks in the Tokyo market.

For alternative data on Japanese stocks

https://corporate.quick.co.jp/data-factory/en/product/